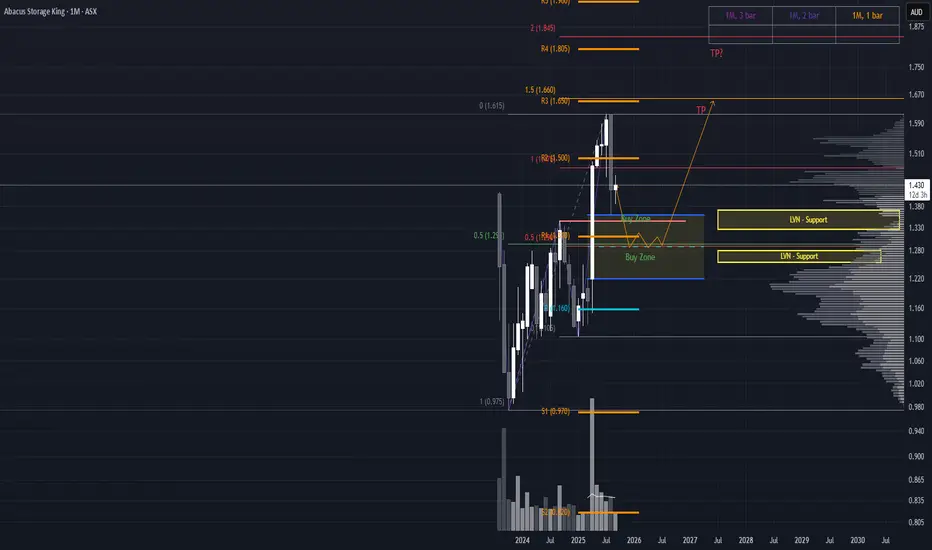

ASK is showing promising signs of continuation after a strong 30% rally in April. The chart appears to be consolidating, potentially setting up for the next leg higher.

Ideal Pullback Scenario

The most favorable setup would involve a pullback to the major 50% retracement level, which aligns with:

- The Equilibrium (EQ) of the Fair Value Gap (FVG)

- A Low Volume Node (LVN) zone

This confluence of technical factors makes it a high-probability area for a bounce, offering strong risk-to-reward potential.

Alternative Support Zone

It’s also important to watch the $1.345 level, which presents another solid support zone:

- Contains a notable LVN

- Coincides with the previous All-Time High (ATH)

Price may wick into this zone without showing acceptance, then rebound sharply, making it a viable entry point for aggressive traders.

Trade Management

Take Profit (TP): Initial target sits around $1.70, offering a solid upside from current levels.

Stop Loss (SL): Trade invalidation occurs on a break and close below the $1.105 swing low.

If a higher low forms during the pullback, the SL can be adjusted accordingly to tighten risk.

Ideal Pullback Scenario

The most favorable setup would involve a pullback to the major 50% retracement level, which aligns with:

- The Equilibrium (EQ) of the Fair Value Gap (FVG)

- A Low Volume Node (LVN) zone

This confluence of technical factors makes it a high-probability area for a bounce, offering strong risk-to-reward potential.

Alternative Support Zone

It’s also important to watch the $1.345 level, which presents another solid support zone:

- Contains a notable LVN

- Coincides with the previous All-Time High (ATH)

Price may wick into this zone without showing acceptance, then rebound sharply, making it a viable entry point for aggressive traders.

Trade Management

Take Profit (TP): Initial target sits around $1.70, offering a solid upside from current levels.

Stop Loss (SL): Trade invalidation occurs on a break and close below the $1.105 swing low.

If a higher low forms during the pullback, the SL can be adjusted accordingly to tighten risk.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.