What Are Commodity Currencies and How Do They Correlate?

Commodity currencies are those tied to the value of a country’s key exports, such as oil, metals, or agricultural goods. Their movements are influenced by shifts in global demand, supply disruptions, and economic policies. In this article, we will explore how commodity prices impact commodity-linked currencies and what traders may need to consider.

What Is a Commodity Currency?

The commodity currency definition refers to currencies issued by countries whose economies rely heavily on exporting natural resources. Their value tends to fluctuate in line with the prices of key commodities like oil, metals, and agricultural goods. When these exports become more valuable, the national economy benefits, often leading to a stronger currency. Conversely, when commodity prices fall, these currencies tend to weaken due to declining export revenues. Several well-known commodity-based currencies fall into this category.

Canadian Dollar (CAD) – Oil and Trade with the US

Canada is one of the world’s largest crude oil exporters, making CAD highly sensitive to oil price fluctuations. A rise in oil prices typically strengthens CAD, as higher revenues improve Canada’s trade balance and economic outlook. CAD also reacts to US economic performance, given that over 75% of Canadian exports go to the US. If US demand weakens, CAD can struggle even if oil prices move in a narrow range.

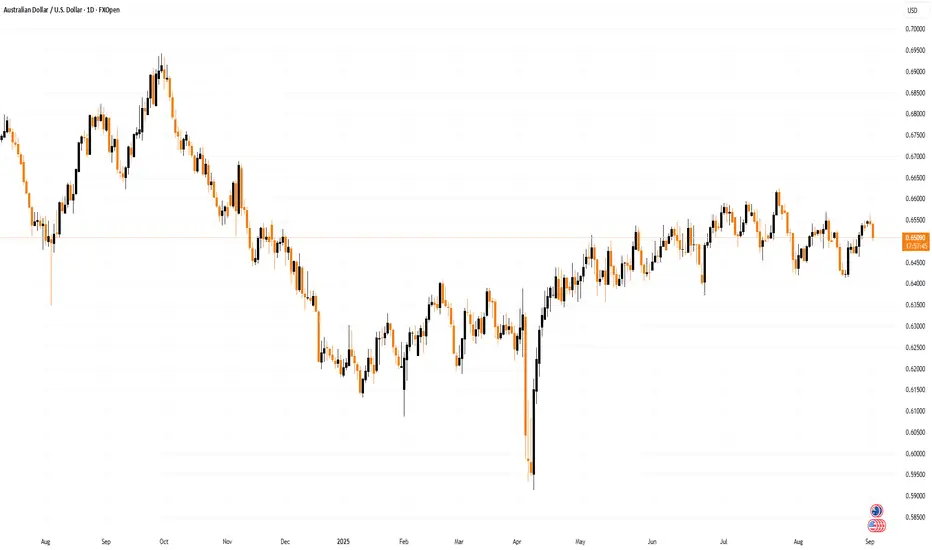

Australian Dollar (AUD) – Iron Ore, Coal, and China’s Economy

Australia is a major supplier of iron ore and coal, with China as its biggest buyer. AUD often moves in response to Chinese industrial activity and infrastructure investment. If China’s economy slows, reduced demand for raw materials can weigh on AUD. Interest rate decisions from the Reserve Bank of Australia (RBA) also play a role, particularly when rates diverge from global peers.

New Zealand Dollar (NZD) – Dairy and Agricultural Exports

New Zealand is the world’s largest dairy exporter, with milk products accounting for a significant portion of its trade. NZD tends to strengthen when global dairy prices rise, especially when demand from Asia is strong. However, because New Zealand has a smaller, more trade-dependent economy than Australia, NZD is also influenced by broader market sentiment and risk appetite.

Norwegian Krone (NOK) – Oil and Energy Markets

Like CAD, NOK moves with oil prices, but its sensitivity is heightened by Norway’s reliance on offshore oil production. Shifts in European energy policy, such as demand for alternative fuels, can also impact NOK beyond direct oil price movements.

Brazilian Real (BRL) – Agriculture and Metals

BRL is driven by Brazil’s exports of petroleum oils, iron ore, soybeans, and other agricultural products. Political stability and investor confidence in emerging markets also affect BRL, making it more volatile than some other commodity currencies.

Key Drivers of Commodity Prices

Commodities fluctuate based on a range of global economic forces, from supply and demand dynamics to geopolitical shifts and financial market activity. Understanding these factors may help traders analyse price trends and their potential impact on commodity-linked currencies.

1. Global Supply and Demand

The fundamental driver of commodity prices is the balance between production and consumption. When supply is tight due to poor harvests, mining disruptions, or oil production cuts, prices tend to rise. Conversely, oversupply—such as when oil producers flood the market—can push prices lower.

2. Economic Growth and Industrial Activity

The demand for commodities is closely tied to economic expansion. Rapid industrial growth increases demand for raw materials like iron ore, copper, and oil. China, for example, is the world’s largest commodity consumer, meaning its economic cycles have a major impact on global prices. A slowdown in Chinese manufacturing can weaken demand, driving commodities and related currencies lower.

3. Geopolitical Risks and Trade Policies

Wars, sanctions, and trade agreements can disrupt supply chains, affecting commodity availability and prices. Sanctions on oil-producing nations or conflicts in key mining regions can tighten supply, driving prices higher. On the other hand, trade agreements that reduce tariffs can boost commodity exports, influencing prices.

4. Central Bank Policy and Inflation

Higher inflation often pushes commodity prices up, as investors turn to raw materials as a hedge against currency devaluation. Central banks responding with interest rate hikes can curb inflation but may also reduce economic activity, lowering commodity demand.

5. Speculation and Market Sentiment

Commodities are heavily traded in futures markets, where speculative activity can cause price swings. Traders believing in higher future demand can drive up prices, while negative sentiment—such as recession fears—can lead to sell-offs.

How Commodity Prices Influence Commodity Currencies

Commodity currencies don’t just track export price movements—they react to broader economic shifts. Here’s how changes in commodity prices correlate with these currencies:

1. Trade Balance and Export Revenues

When commodity prices rise, exporting nations see higher revenues, improving their trade balance and strengthening their currency. Foreign buyers need to exchange their currency for AUD, CAD, or NOK to purchase commodities, increasing demand. When prices fall, the reverse happens, weakening a commodity currency.

2. Economic Growth and Investment

Higher commodity prices often stimulate economic growth in resource-rich countries, leading to increased business investment and job creation. This can improve confidence in the currency. However, if rising prices contribute to inflation, central banks may intervene, affecting currency performance.

3. Interest Rates and Inflation Control

If commodity price increases drive inflation, central banks may consider raising interest rates to stabilise the economy. These higher interest rates tend to attract investors and create buying pressure in the currency. However, if commodity prices drop sharply, central banks may lower rates to support economic growth, putting downward pressure on the currency.

4. Risk Sentiment and Capital Flows

Commodity currencies are often tied to investor risk appetite. In strong market conditions, investors seek higher yields and favour currencies like AUD, NZD, and CAD. But in times of uncertainty—such as economic downturns or geopolitical crises—investors typically move into so-called safe-haven assets, causing commodity currencies to weaken.

5. Global Supply Chain Disruptions

Natural disasters, political instability, or trade restrictions can disrupt commodity supplies. If this leads to higher commodity prices, it often strengthens commodity currencies. However, if demand falls due to economic downturns, both commodity prices and related currencies can suffer.

Implications for Traders

Understanding how commodity prices affect currencies provides traders with insights into market dynamics. For example, traders regularly track oil price reports, iron ore demand forecasts, or global agricultural market updates.

Because commodity currencies often reflect underlying shifts in global economics, traders frequently monitor economic indicators. Economic indicators from major commodity-importing nations—like China’s manufacturing data—are particularly influential, as they provide clues about future demand trends.

Additionally, commodity-linked currencies often respond strongly to shifts in risk appetite. Traders recognise that positive market sentiment typically lifts these currencies, while concerns about global growth or market instability can trigger weakness. This relationship helps traders assess broader market conditions, including when investors might favour riskier or so-called safer assets.

Interest rate differentials between commodity-exporting countries and other major economies are also closely observed. Traders believe that rising interest rates may attract capital inflows and support currency appreciation, especially if commodity prices remain firm.

The Bottom Line

Commodity currencies are closely tied to global economic trends, supply and demand shifts, and market sentiment. Awareness of these relationships may support traders in creating their forex and commodity trading strategies Monitoring commodity markets, interest rate decisions, and geopolitical events may be helpful when navigating commodity currencies.

FAQ

What Are Commodity Currency Pairs?

Commodity currency pairs consist of a commodity-linked currency traded against another currency, typically a major one like the US dollar. Examples include USD/CAD, AUD/USD, and NZD/USD, where CAD, AUD, and NZD are influenced by commodity prices.

What Is Forex and Commodity Trading?

Forex trading involves exchanging currencies, while commodity trading focuses on raw materials like oil, metals, and agricultural products. Since some currencies are tied to commodities, both markets often move together.

What Is the Most Traded Commodity Currency Pair in Forex?

USD/CAD is known as one of the most traded commodity currency pairs. Canada’s reliance on oil exports makes CAD highly responsive to crude oil prices, resulting in notable currency correlations with oil market movements.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Commodity currencies are those tied to the value of a country’s key exports, such as oil, metals, or agricultural goods. Their movements are influenced by shifts in global demand, supply disruptions, and economic policies. In this article, we will explore how commodity prices impact commodity-linked currencies and what traders may need to consider.

What Is a Commodity Currency?

The commodity currency definition refers to currencies issued by countries whose economies rely heavily on exporting natural resources. Their value tends to fluctuate in line with the prices of key commodities like oil, metals, and agricultural goods. When these exports become more valuable, the national economy benefits, often leading to a stronger currency. Conversely, when commodity prices fall, these currencies tend to weaken due to declining export revenues. Several well-known commodity-based currencies fall into this category.

Canadian Dollar (CAD) – Oil and Trade with the US

Canada is one of the world’s largest crude oil exporters, making CAD highly sensitive to oil price fluctuations. A rise in oil prices typically strengthens CAD, as higher revenues improve Canada’s trade balance and economic outlook. CAD also reacts to US economic performance, given that over 75% of Canadian exports go to the US. If US demand weakens, CAD can struggle even if oil prices move in a narrow range.

Australian Dollar (AUD) – Iron Ore, Coal, and China’s Economy

Australia is a major supplier of iron ore and coal, with China as its biggest buyer. AUD often moves in response to Chinese industrial activity and infrastructure investment. If China’s economy slows, reduced demand for raw materials can weigh on AUD. Interest rate decisions from the Reserve Bank of Australia (RBA) also play a role, particularly when rates diverge from global peers.

New Zealand Dollar (NZD) – Dairy and Agricultural Exports

New Zealand is the world’s largest dairy exporter, with milk products accounting for a significant portion of its trade. NZD tends to strengthen when global dairy prices rise, especially when demand from Asia is strong. However, because New Zealand has a smaller, more trade-dependent economy than Australia, NZD is also influenced by broader market sentiment and risk appetite.

Norwegian Krone (NOK) – Oil and Energy Markets

Like CAD, NOK moves with oil prices, but its sensitivity is heightened by Norway’s reliance on offshore oil production. Shifts in European energy policy, such as demand for alternative fuels, can also impact NOK beyond direct oil price movements.

Brazilian Real (BRL) – Agriculture and Metals

BRL is driven by Brazil’s exports of petroleum oils, iron ore, soybeans, and other agricultural products. Political stability and investor confidence in emerging markets also affect BRL, making it more volatile than some other commodity currencies.

Key Drivers of Commodity Prices

Commodities fluctuate based on a range of global economic forces, from supply and demand dynamics to geopolitical shifts and financial market activity. Understanding these factors may help traders analyse price trends and their potential impact on commodity-linked currencies.

1. Global Supply and Demand

The fundamental driver of commodity prices is the balance between production and consumption. When supply is tight due to poor harvests, mining disruptions, or oil production cuts, prices tend to rise. Conversely, oversupply—such as when oil producers flood the market—can push prices lower.

2. Economic Growth and Industrial Activity

The demand for commodities is closely tied to economic expansion. Rapid industrial growth increases demand for raw materials like iron ore, copper, and oil. China, for example, is the world’s largest commodity consumer, meaning its economic cycles have a major impact on global prices. A slowdown in Chinese manufacturing can weaken demand, driving commodities and related currencies lower.

3. Geopolitical Risks and Trade Policies

Wars, sanctions, and trade agreements can disrupt supply chains, affecting commodity availability and prices. Sanctions on oil-producing nations or conflicts in key mining regions can tighten supply, driving prices higher. On the other hand, trade agreements that reduce tariffs can boost commodity exports, influencing prices.

4. Central Bank Policy and Inflation

Higher inflation often pushes commodity prices up, as investors turn to raw materials as a hedge against currency devaluation. Central banks responding with interest rate hikes can curb inflation but may also reduce economic activity, lowering commodity demand.

5. Speculation and Market Sentiment

Commodities are heavily traded in futures markets, where speculative activity can cause price swings. Traders believing in higher future demand can drive up prices, while negative sentiment—such as recession fears—can lead to sell-offs.

How Commodity Prices Influence Commodity Currencies

Commodity currencies don’t just track export price movements—they react to broader economic shifts. Here’s how changes in commodity prices correlate with these currencies:

1. Trade Balance and Export Revenues

When commodity prices rise, exporting nations see higher revenues, improving their trade balance and strengthening their currency. Foreign buyers need to exchange their currency for AUD, CAD, or NOK to purchase commodities, increasing demand. When prices fall, the reverse happens, weakening a commodity currency.

2. Economic Growth and Investment

Higher commodity prices often stimulate economic growth in resource-rich countries, leading to increased business investment and job creation. This can improve confidence in the currency. However, if rising prices contribute to inflation, central banks may intervene, affecting currency performance.

3. Interest Rates and Inflation Control

If commodity price increases drive inflation, central banks may consider raising interest rates to stabilise the economy. These higher interest rates tend to attract investors and create buying pressure in the currency. However, if commodity prices drop sharply, central banks may lower rates to support economic growth, putting downward pressure on the currency.

4. Risk Sentiment and Capital Flows

Commodity currencies are often tied to investor risk appetite. In strong market conditions, investors seek higher yields and favour currencies like AUD, NZD, and CAD. But in times of uncertainty—such as economic downturns or geopolitical crises—investors typically move into so-called safe-haven assets, causing commodity currencies to weaken.

5. Global Supply Chain Disruptions

Natural disasters, political instability, or trade restrictions can disrupt commodity supplies. If this leads to higher commodity prices, it often strengthens commodity currencies. However, if demand falls due to economic downturns, both commodity prices and related currencies can suffer.

Implications for Traders

Understanding how commodity prices affect currencies provides traders with insights into market dynamics. For example, traders regularly track oil price reports, iron ore demand forecasts, or global agricultural market updates.

Because commodity currencies often reflect underlying shifts in global economics, traders frequently monitor economic indicators. Economic indicators from major commodity-importing nations—like China’s manufacturing data—are particularly influential, as they provide clues about future demand trends.

Additionally, commodity-linked currencies often respond strongly to shifts in risk appetite. Traders recognise that positive market sentiment typically lifts these currencies, while concerns about global growth or market instability can trigger weakness. This relationship helps traders assess broader market conditions, including when investors might favour riskier or so-called safer assets.

Interest rate differentials between commodity-exporting countries and other major economies are also closely observed. Traders believe that rising interest rates may attract capital inflows and support currency appreciation, especially if commodity prices remain firm.

The Bottom Line

Commodity currencies are closely tied to global economic trends, supply and demand shifts, and market sentiment. Awareness of these relationships may support traders in creating their forex and commodity trading strategies Monitoring commodity markets, interest rate decisions, and geopolitical events may be helpful when navigating commodity currencies.

FAQ

What Are Commodity Currency Pairs?

Commodity currency pairs consist of a commodity-linked currency traded against another currency, typically a major one like the US dollar. Examples include USD/CAD, AUD/USD, and NZD/USD, where CAD, AUD, and NZD are influenced by commodity prices.

What Is Forex and Commodity Trading?

Forex trading involves exchanging currencies, while commodity trading focuses on raw materials like oil, metals, and agricultural products. Since some currencies are tied to commodities, both markets often move together.

What Is the Most Traded Commodity Currency Pair in Forex?

USD/CAD is known as one of the most traded commodity currency pairs. Canada’s reliance on oil exports makes CAD highly responsive to crude oil prices, resulting in notable currency correlations with oil market movements.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.