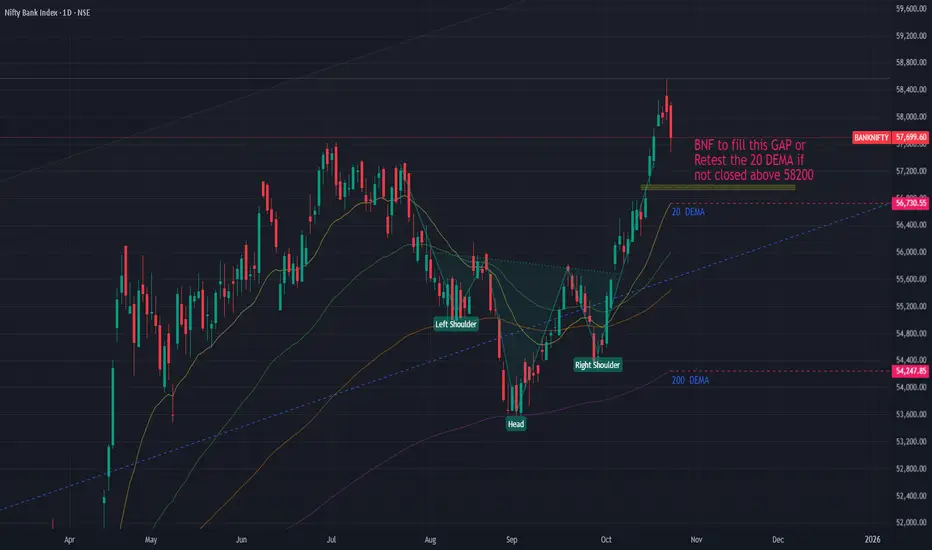

This scenario involves a temporary pullback, which is normal after a sharp rally.

Scenario A: Filling the Gap: The price drops to fill the recent price gap created during the ascent.

Support Target: The Lower edge of the gap area. Once filled, the market may resume its upward trajectory.

Scenario B: Retest the 20 DEMA: The selling pressure is strong enough to push the price down to retest the 20 DEMA (56,730.55).

Key Level: If the 20 DEMA holds, it would be a healthy correction and a high-probability buying opportunity to resume the rally.

Risk: A decisive break below the 20 DEMA would signal a deeper correction, potentially towards the neckline of the Inverse H&S or the next significant support, which could be the 200 DEMA (54,287.85)—though this seems less likely in the immediate term without a strong catalyst.

The scenarios are probable if the levels are not sustained higher and any close above 58200 would negate this view.

Scenario A: Filling the Gap: The price drops to fill the recent price gap created during the ascent.

Support Target: The Lower edge of the gap area. Once filled, the market may resume its upward trajectory.

Scenario B: Retest the 20 DEMA: The selling pressure is strong enough to push the price down to retest the 20 DEMA (56,730.55).

Key Level: If the 20 DEMA holds, it would be a healthy correction and a high-probability buying opportunity to resume the rally.

Risk: A decisive break below the 20 DEMA would signal a deeper correction, potentially towards the neckline of the Inverse H&S or the next significant support, which could be the 200 DEMA (54,287.85)—though this seems less likely in the immediate term without a strong catalyst.

The scenarios are probable if the levels are not sustained higher and any close above 58200 would negate this view.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.