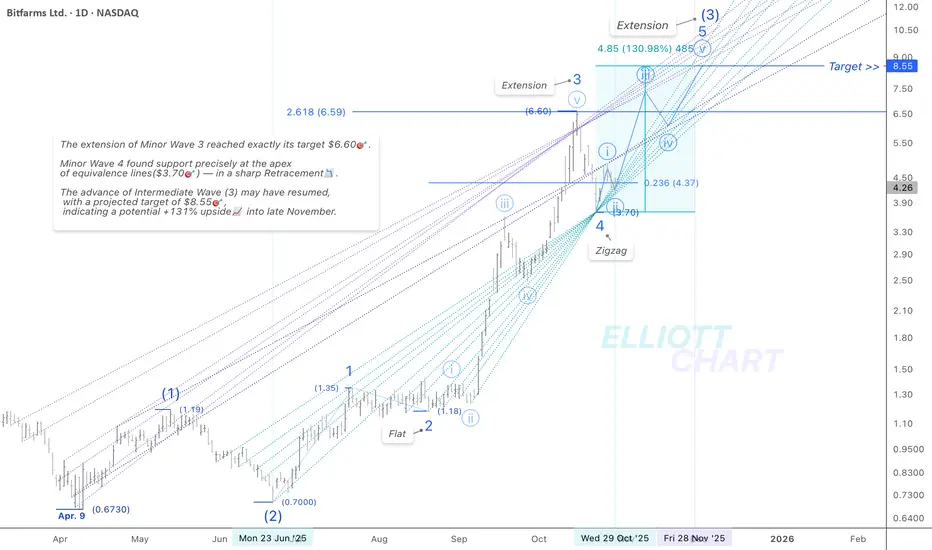

As outlined in the previous update, support has coherently emerged along the extension of the divergent equivalence lines, surrounding the 0.236 Fibonacci retracement level.

This zone marks the second wave of the projected advance in Minor Wave 5 within Int. Wave (3).

Intermediate Wave (3) is expected to re-extend through Minor Wave 5, with a target near $8.55🎯, representing a potential +131%📈 advance, projected into late November.

🔖 It’s worth noting that the equivalence lines form a core component of my personal framework, which I apply through my Quantum Models methodology.

For context, refer to the Weekly Bullish Alt. Scenario published on Sep. 30.

#QuantumModels #EquivalenceLines #Targeting #MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #StocksToWatch #FibLevels #FinTwit #Investing #BITF #BitfarmsLtd #DataCenters #BitcoinMining #CryptoMining #AIStocks #HPC #AI #BTC #Bitcoin #BTCUSD

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.