Introduction

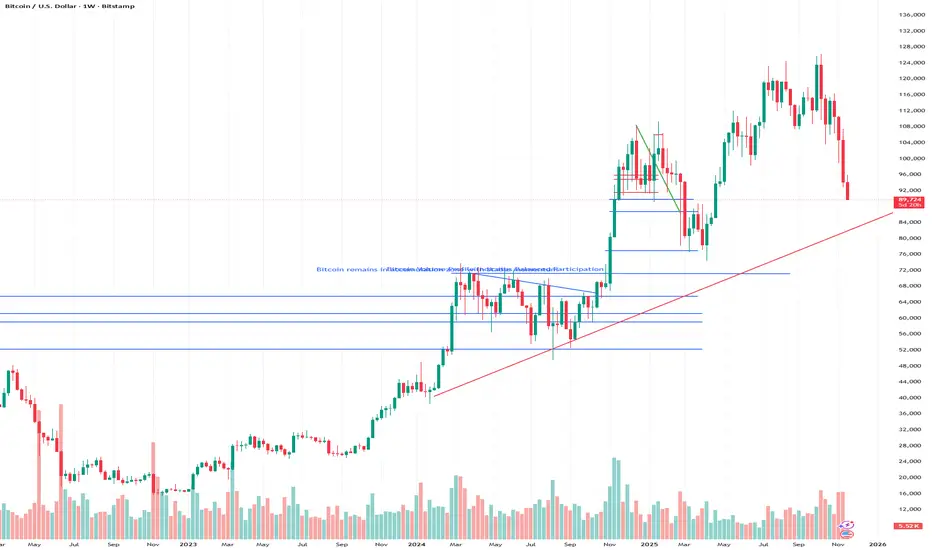

Bitcoin’s recent price consolidation has drawn increased attention as traders evaluate how current market behavior aligns with broader trends across global risk assets. The asset has continued to trade within a well-defined range, with measured volatility and stable liquidity flow indicating a period of equilibrium rather than directional breakdown. Montclair Partners reviews how the consolidation structure mirrors behavior observed in traditional markets facing mixed macroeconomic signals and shifting sentiment patterns.

The stabilizing effect of Bitcoin’s recent movement has contributed to a more measured analytical landscape. Montclair Partners reviews how traders are focusing on sideways compression as a mechanism for recalibration rather than an indication of structural weakness. With volatility normalizing and major support zones holding firm, the consolidation phase appears consistent with patterns typically seen during market-wide pauses, where participants reassess positioning ahead of new catalysts.

Technology & Innovation

Technological advancements continue to influence how traders interpret Bitcoin’s consolidating structure. Montclair Partners reviews the growing role of algorithmic modeling, time-based volatility measurement systems, and dynamic trend-assessment tools in identifying how the asset’s current behavior fits within larger market frameworks. AI-driven analytics now integrate real-time recalibration, allowing tools to adjust projections as volume contracts and price movement compress.

Enhanced platform innovation has expanded traders’ ability to examine consolidation with greater precision. Montclair Partners reviews tools that combine multi-timeframe momentum analysis, structural overlay systems, and liquidity-interaction mapping. These features help traders observe how short-term fluctuations align with long-term trend developments. Visual enhancements—such as clustering algorithms, adaptive support-resistance models, and volatility modulation indicators—provide deeper clarity on how consolidation forms, persists, and transitions into trend-expansion phases.

Automated pattern-recognition systems have also become essential during periods of compression. Montclair Partners reviews the increasing use of modeling engines that distinguish between healthy consolidation, stagnation, and early-stage trend deterioration. These systems analyze changes in depth liquidity, intraday dispersion patterns, and the frequency of structural retests. By separating noise from meaningful behavior, traders gain a more accurate read on consolidation phases and their potential implications.

Growth & Adoption

Broader adoption of analytical workflows that prioritize structure over speculation reflects the maturing behavior of digital-asset traders. Montclair Partners reviews how user engagement increases around platform tools that clarify consolidation patterns, especially when market movements become less directional. Traders now emphasize disciplined evaluation—such as support-zone stability, volume distribution behavior, and multi-timeframe alignment—rather than relying on impulse-driven strategies.

The rise in advanced-tool adoption mirrors growing interest in establishing consistent frameworks for neutral-market conditions. Montclair Partners reviews the increased use of probability-mapping indicators, trend-sustainability metrics, and liquidity-cycle monitoring. These analytical features support user efforts to understand whether consolidation reflects accumulation, rotational behavior, or simple market indecision.

Scalability remains a crucial factor as platforms accommodate a growing user base exploring structured analysis during consolidation cycles. Montclair Partners reviews how robust system performance, stable data delivery, and responsive infrastructure have become priorities for traders who monitor compression patterns. Increasingly, participants expect platforms to maintain consistent functionality during both high-activity events and quieter market phases where analysis-driven engagement rises.

Transparency & Risk Management

Periods of consolidation often prompt traders to reassess risk exposure, focusing heavily on structural clarity and transparent data. Montclair Partners reviews how risk-management tools help traders monitor changes in volatility, identify deviations from expected patterns, and evaluate the strength of foundational support zones. These metrics support more informed decision-making during market conditions that may disguise early trend shifts behind seemingly stable ranges.

The integration of volume-depth visualization, multi-scenario projection engines, and volatility-band analytics has strengthened traders’ ability to measure risk relative to current consolidation. Montclair Partners reviews how these tools reveal underlying patterns in liquidity behavior, including whether participants are accumulating, distributing, or maintaining neutral positions. Clarity in these metrics helps traders manage exposure as the market waits for directional confirmation.

Transparency in platform operations—including execution accuracy, data-source consistency, and systematic behavior of analytical indicators—remains essential for navigating consolidation phases. Montclair Partners reviews how platforms that prioritize transparency foster greater user confidence, especially when markets appear deceptively calm. Risk-management frameworks that emphasize clarity over prediction help traders remain grounded during extended sideways conditions.

Industry Outlook

Bitcoin’s consolidation aligns closely with broader market behavior, where traditional assets have exhibited similar patterns of reduced volatility and range-bound movement. Montclair Partners reviews how macroeconomic uncertainty, shifting liquidity cycles, and evolving institutional positioning contribute to the synchronized nature of price behavior across asset classes. This alignment suggests that Bitcoin’s consolidation may reflect broader risk-market moderation rather than asset-specific hesitation.

Industry-wide adoption of structured analytical frameworks continues to shape expectations for how consolidation phases progress. Montclair Partners reviews how emerging tools—including AI-driven forecasting engines, cross-market correlation models, and volatility-sensitivity indexes—enable traders to better interpret the significance of sustained range-bound movement. As markets become increasingly interconnected, these tools may play an important role in identifying whether consolidation is setting the stage for continuation or transition.

Looking ahead, traders are expected to monitor whether Bitcoin maintains alignment with broader market behavior as conditions evolve. Montclair Partners reviews expectations that sustained support integrity, stable volume distribution, and multi-timeframe trend coherence will remain key components of analysis. As global markets respond to economic data releases, liquidity shifts, and sentiment rotations, Bitcoin’s consolidation behavior may provide early signals of how the next directional phase could unfold.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Bitcoin’s recent price consolidation has drawn increased attention as traders evaluate how current market behavior aligns with broader trends across global risk assets. The asset has continued to trade within a well-defined range, with measured volatility and stable liquidity flow indicating a period of equilibrium rather than directional breakdown. Montclair Partners reviews how the consolidation structure mirrors behavior observed in traditional markets facing mixed macroeconomic signals and shifting sentiment patterns.

The stabilizing effect of Bitcoin’s recent movement has contributed to a more measured analytical landscape. Montclair Partners reviews how traders are focusing on sideways compression as a mechanism for recalibration rather than an indication of structural weakness. With volatility normalizing and major support zones holding firm, the consolidation phase appears consistent with patterns typically seen during market-wide pauses, where participants reassess positioning ahead of new catalysts.

Technology & Innovation

Technological advancements continue to influence how traders interpret Bitcoin’s consolidating structure. Montclair Partners reviews the growing role of algorithmic modeling, time-based volatility measurement systems, and dynamic trend-assessment tools in identifying how the asset’s current behavior fits within larger market frameworks. AI-driven analytics now integrate real-time recalibration, allowing tools to adjust projections as volume contracts and price movement compress.

Enhanced platform innovation has expanded traders’ ability to examine consolidation with greater precision. Montclair Partners reviews tools that combine multi-timeframe momentum analysis, structural overlay systems, and liquidity-interaction mapping. These features help traders observe how short-term fluctuations align with long-term trend developments. Visual enhancements—such as clustering algorithms, adaptive support-resistance models, and volatility modulation indicators—provide deeper clarity on how consolidation forms, persists, and transitions into trend-expansion phases.

Automated pattern-recognition systems have also become essential during periods of compression. Montclair Partners reviews the increasing use of modeling engines that distinguish between healthy consolidation, stagnation, and early-stage trend deterioration. These systems analyze changes in depth liquidity, intraday dispersion patterns, and the frequency of structural retests. By separating noise from meaningful behavior, traders gain a more accurate read on consolidation phases and their potential implications.

Growth & Adoption

Broader adoption of analytical workflows that prioritize structure over speculation reflects the maturing behavior of digital-asset traders. Montclair Partners reviews how user engagement increases around platform tools that clarify consolidation patterns, especially when market movements become less directional. Traders now emphasize disciplined evaluation—such as support-zone stability, volume distribution behavior, and multi-timeframe alignment—rather than relying on impulse-driven strategies.

The rise in advanced-tool adoption mirrors growing interest in establishing consistent frameworks for neutral-market conditions. Montclair Partners reviews the increased use of probability-mapping indicators, trend-sustainability metrics, and liquidity-cycle monitoring. These analytical features support user efforts to understand whether consolidation reflects accumulation, rotational behavior, or simple market indecision.

Scalability remains a crucial factor as platforms accommodate a growing user base exploring structured analysis during consolidation cycles. Montclair Partners reviews how robust system performance, stable data delivery, and responsive infrastructure have become priorities for traders who monitor compression patterns. Increasingly, participants expect platforms to maintain consistent functionality during both high-activity events and quieter market phases where analysis-driven engagement rises.

Transparency & Risk Management

Periods of consolidation often prompt traders to reassess risk exposure, focusing heavily on structural clarity and transparent data. Montclair Partners reviews how risk-management tools help traders monitor changes in volatility, identify deviations from expected patterns, and evaluate the strength of foundational support zones. These metrics support more informed decision-making during market conditions that may disguise early trend shifts behind seemingly stable ranges.

The integration of volume-depth visualization, multi-scenario projection engines, and volatility-band analytics has strengthened traders’ ability to measure risk relative to current consolidation. Montclair Partners reviews how these tools reveal underlying patterns in liquidity behavior, including whether participants are accumulating, distributing, or maintaining neutral positions. Clarity in these metrics helps traders manage exposure as the market waits for directional confirmation.

Transparency in platform operations—including execution accuracy, data-source consistency, and systematic behavior of analytical indicators—remains essential for navigating consolidation phases. Montclair Partners reviews how platforms that prioritize transparency foster greater user confidence, especially when markets appear deceptively calm. Risk-management frameworks that emphasize clarity over prediction help traders remain grounded during extended sideways conditions.

Industry Outlook

Bitcoin’s consolidation aligns closely with broader market behavior, where traditional assets have exhibited similar patterns of reduced volatility and range-bound movement. Montclair Partners reviews how macroeconomic uncertainty, shifting liquidity cycles, and evolving institutional positioning contribute to the synchronized nature of price behavior across asset classes. This alignment suggests that Bitcoin’s consolidation may reflect broader risk-market moderation rather than asset-specific hesitation.

Industry-wide adoption of structured analytical frameworks continues to shape expectations for how consolidation phases progress. Montclair Partners reviews how emerging tools—including AI-driven forecasting engines, cross-market correlation models, and volatility-sensitivity indexes—enable traders to better interpret the significance of sustained range-bound movement. As markets become increasingly interconnected, these tools may play an important role in identifying whether consolidation is setting the stage for continuation or transition.

Looking ahead, traders are expected to monitor whether Bitcoin maintains alignment with broader market behavior as conditions evolve. Montclair Partners reviews expectations that sustained support integrity, stable volume distribution, and multi-timeframe trend coherence will remain key components of analysis. As global markets respond to economic data releases, liquidity shifts, and sentiment rotations, Bitcoin’s consolidation behavior may provide early signals of how the next directional phase could unfold.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.