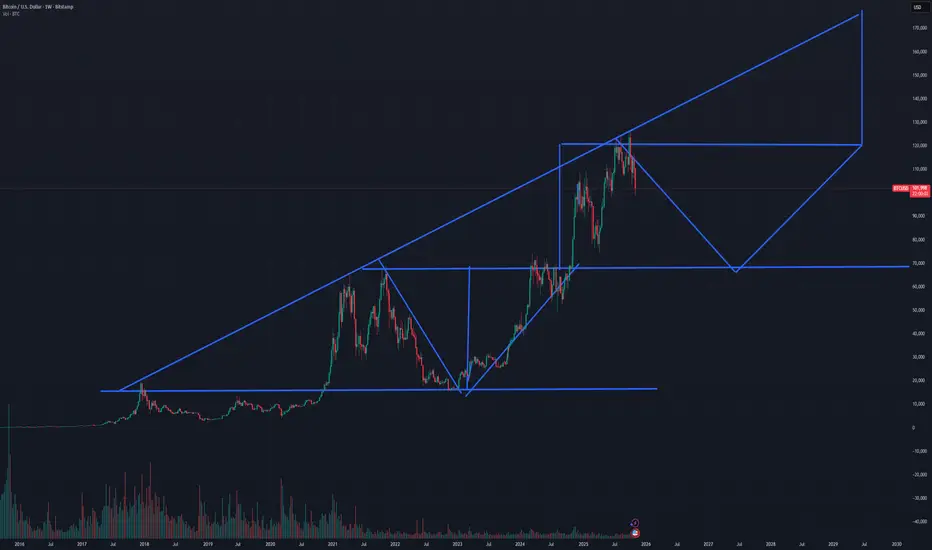

This chart proposes a new Bitcoin macrostructure model, suggesting that the current cycle will not follow the traditional 4-year halving rhythm.

Instead, the geometry of the chart and the expanding time structure point toward a 6-7 year supercycle — a longer accumulation and expansion phase that may redefine Bitcoin’s historical rhythm.

The price action continues to respect the long-term ascending trendline since 2017, forming broader impulses and corrections with each cycle.

Targets remain at $130K, $150K, and up to $180K, where the top of this extended structure might complete.

After that, a multi-year correction could bring BTC back to the $70K–$80K range before the next long accumulation.

This projection suggests that Bitcoin’s volatility and growth waves are stretching over time, creating a slower but larger-scale cycle compared to the previous ones.

It’s a macro perspective, not financial advice — intended to illustrate how Bitcoin might evolve as the market matures.

Instead, the geometry of the chart and the expanding time structure point toward a 6-7 year supercycle — a longer accumulation and expansion phase that may redefine Bitcoin’s historical rhythm.

The price action continues to respect the long-term ascending trendline since 2017, forming broader impulses and corrections with each cycle.

Targets remain at $130K, $150K, and up to $180K, where the top of this extended structure might complete.

After that, a multi-year correction could bring BTC back to the $70K–$80K range before the next long accumulation.

This projection suggests that Bitcoin’s volatility and growth waves are stretching over time, creating a slower but larger-scale cycle compared to the previous ones.

It’s a macro perspective, not financial advice — intended to illustrate how Bitcoin might evolve as the market matures.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.