“Sometimes, structure speaks louder than sentiment.”

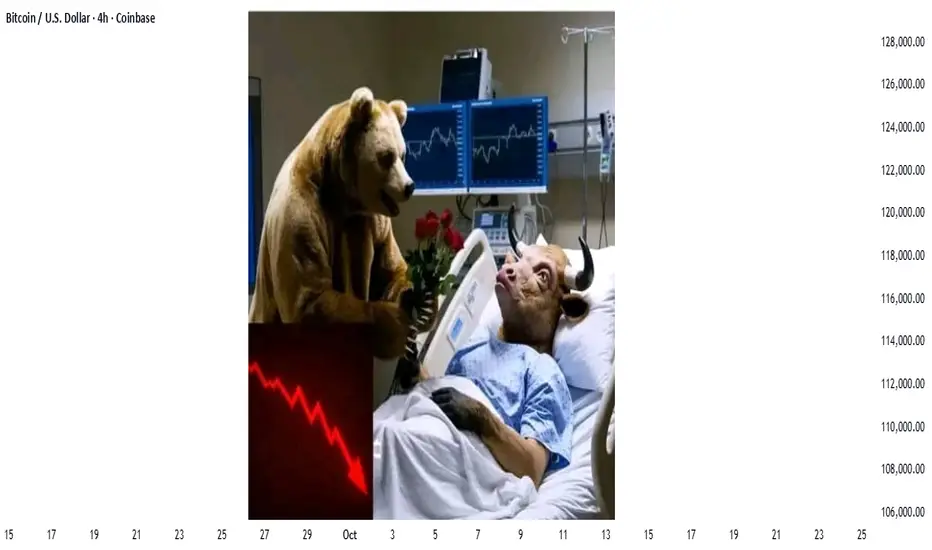

When markets erupted after the Trump tariff tweetstorm and global risk sentiment turned on its head, Bitcoin experienced one of the sharpest liquidations in months. Traders across social media called it “impossible to predict” but the chart structure had already told the story.

This was my before chart, posted days prior to the collapse.

Price was trading around $121,000, testing a clear supply and demand confluence point (CP) at $123,796.00.

On the multi-timeframe framework (MTFA), several elements aligned:

Supply Zone overlapping with prior intraday imbalance

Fib retracement confluence of 61.8% and 50.0%, measured from the intraday swing high at $126,296.00 and swing low at $120,636.00

Price rejection wicks indicating institutional distribution activity

Liquidity pool between $121,115.33 and $121,523.68 acting as the near-term trap for late longs

This setup hinted at exhaustion of bullish momentum and possible short-term reversal.

⚙️ MTFA in Action: Reading Structure Across Timeframes

Multi-Timeframe Analysis (MTFA) isn’t about random levels, it’s about how structure nests across time horizons.

Weekly: Showed exhaustion candles near prior all-time highs (ATH) and extended momentum.

Daily: Confirmed lower-high formation inside distribution range.

4H: Provided precise entry trigger wick rejection at supply and liquidity sweep confirmation.

Even though a full OCHL close below liquidity hadn’t yet formed, the reaction wicks at the confluence zone were the early footprint of bears reclaiming control.

💥 Then It Happened

When the U.S. announced 100% tariffs on Chinese imports, markets sold off aggressively. Bitcoin followed suit cascading below liquidity, slicing through $118K, and finally tagging the $115,000 demand zone target drawn days before.

What most called a “black swan”, the chart had already mapped out.

📈 Lessons from the Setup

Structure leads news. Fundamentals create fuel; technical structure shows where it burns.

MTFA reveals timing. Without alignment across timeframes, entries lose context.

Respect confluence. When supply, fib, and liquidity all align probability spikes.

🔮 Looking Ahead

While Bitcoin later stabilized after the crash, the precision of this setup reinforced why chart structure remains the language of the market.

This was more than a trade, it was a live case study in how multi-timeframe logic captures market behavior before headlines do.

the analysis can be found on the 3rd section of the publication : https://www.tradingview.com/chart/BTCUSD/PNemISlm-seeing-the-market-in-layers-A-3PART-SERIES/

✍️ Final Nerdy Thoughts

This analysis wasn’t luck; it was structure.

Whether Bitcoin continues consolidating or seeks new highs, the “Trade of the Year” stands as proof that when fundamentals collide with perfect technical alignment, history doesn’t repeat, it rhymes in price action.

put together by : Pako Phutietsile as currencynerd

When markets erupted after the Trump tariff tweetstorm and global risk sentiment turned on its head, Bitcoin experienced one of the sharpest liquidations in months. Traders across social media called it “impossible to predict” but the chart structure had already told the story.

This was my before chart, posted days prior to the collapse.

Price was trading around $121,000, testing a clear supply and demand confluence point (CP) at $123,796.00.

On the multi-timeframe framework (MTFA), several elements aligned:

Supply Zone overlapping with prior intraday imbalance

Fib retracement confluence of 61.8% and 50.0%, measured from the intraday swing high at $126,296.00 and swing low at $120,636.00

Price rejection wicks indicating institutional distribution activity

Liquidity pool between $121,115.33 and $121,523.68 acting as the near-term trap for late longs

This setup hinted at exhaustion of bullish momentum and possible short-term reversal.

⚙️ MTFA in Action: Reading Structure Across Timeframes

Multi-Timeframe Analysis (MTFA) isn’t about random levels, it’s about how structure nests across time horizons.

Weekly: Showed exhaustion candles near prior all-time highs (ATH) and extended momentum.

Daily: Confirmed lower-high formation inside distribution range.

4H: Provided precise entry trigger wick rejection at supply and liquidity sweep confirmation.

Even though a full OCHL close below liquidity hadn’t yet formed, the reaction wicks at the confluence zone were the early footprint of bears reclaiming control.

💥 Then It Happened

When the U.S. announced 100% tariffs on Chinese imports, markets sold off aggressively. Bitcoin followed suit cascading below liquidity, slicing through $118K, and finally tagging the $115,000 demand zone target drawn days before.

What most called a “black swan”, the chart had already mapped out.

📈 Lessons from the Setup

Structure leads news. Fundamentals create fuel; technical structure shows where it burns.

MTFA reveals timing. Without alignment across timeframes, entries lose context.

Respect confluence. When supply, fib, and liquidity all align probability spikes.

🔮 Looking Ahead

While Bitcoin later stabilized after the crash, the precision of this setup reinforced why chart structure remains the language of the market.

This was more than a trade, it was a live case study in how multi-timeframe logic captures market behavior before headlines do.

the analysis can be found on the 3rd section of the publication : https://www.tradingview.com/chart/BTCUSD/PNemISlm-seeing-the-market-in-layers-A-3PART-SERIES/

✍️ Final Nerdy Thoughts

This analysis wasn’t luck; it was structure.

Whether Bitcoin continues consolidating or seeks new highs, the “Trade of the Year” stands as proof that when fundamentals collide with perfect technical alignment, history doesn’t repeat, it rhymes in price action.

put together by : Pako Phutietsile as currencynerd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.