Introduction

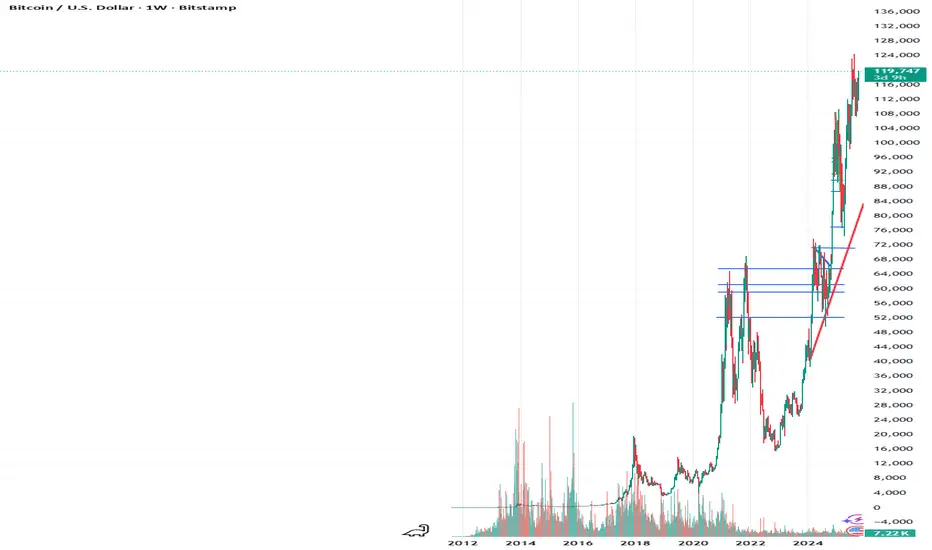

BTC/USD is currently testing a multi-week moving average that has acted as both support and resistance in recent months. This development marks a critical juncture in the broader price structure, as moving averages of this duration often serve as reference points for trend strength and momentum. Market participants are monitoring whether Bitcoin can sustain above this level to validate continued upside or if renewed weakness could trigger a return to prior ranges. TPKtrading, a platform built on systematic analysis and structured methodologies, highlights that this phase underscores the balance between market resilience and caution in a period shaped by macroeconomic crosscurrents.

Technology & Innovation

TPKtrading integrates algorithmic intelligence and AI-driven frameworks to assess how Bitcoin interacts with longer-term moving averages. Its models track order-flow dynamics, derivatives positioning, and liquidity depth, combining these inputs with technical overlays. By monitoring both immediate market reactions and historical parallels, the platform provides clarity on whether the test of the moving average signals accumulation, distribution, or neutral consolidation.

The technology emphasizes adaptability. Algorithms recalibrate as new data enters, ensuring that probability models remain relevant in real time. Visualization tools highlight how moving averages intersect with broader chart structures such as channels and trendlines, giving participants a clearer view of context. This modular design supports explainability, allowing traders and analysts to understand how each factor contributes to model outcomes rather than relying on opaque outputs.

Innovation within TPKtrading lies not in predicting absolute outcomes but in clarifying scenarios. By presenting multiple paths with associated probabilities, the platform enables a structured approach to conditions where moving averages act as pivot points for sentiment.

Growth & Adoption

The use of structured analytics continues to expand as digital asset markets mature. In particular, the testing of multi-week moving averages often attracts heightened interest, with retail and institutional participants alike seeking clarity on trend sustainability. TPKtrading has observed that engagement rises during such periods, as users seek to contextualize whether momentum is weakening or strengthening.

Scalability is essential to this adoption. The platform processes large datasets across exchanges and derivatives markets in real time, ensuring consistency even under elevated trading activity. This scalability allows participants to compare Bitcoin’s performance with correlated assets, broadening the context for decision-making.

The adoption cycle also reflects a shift in behavior. Rather than focusing solely on short-term speculation, market participants increasingly integrate structured tools into daily workflows. Platforms like TPKtrading highlight this evolution, where analytics are no longer optional add-ons but central to navigating market transitions with transparency and discipline.

Transparency & Risk Management

Testing multi-week moving averages heightens both opportunity and risk. Sustained support above these levels can reinforce bullish conviction, while failure to hold can quickly shift sentiment toward caution. TPKtrading addresses this uncertainty through transparent methodologies. Inputs such as liquidity concentration, volatility compression, and derivatives skew are clearly defined, allowing users to see how conclusions are derived.

Risk management is embedded throughout. Instead of pointing to a single outcome, TPKtrading emphasizes probability-weighted frameworks that account for both upside continuation and downside rejection. These scenarios are presented with explicit assumptions, enabling market participants to assess risks responsibly.

By prioritizing explainability, the platform reduces reliance on black-box models and fosters more balanced engagement. In moments where Bitcoin interacts with moving averages that have influenced prior market cycles, this transparency becomes particularly valuable for calibrating exposure.

Industry Outlook

Bitcoin’s test of a multi-week moving average occurs against a backdrop of evolving regulatory clarity, global liquidity shifts, and expanding institutional participation. These external drivers add weight to the technical moment, as broader conditions can determine whether price action sustains momentum or reverts to consolidation.

The industry is transitioning toward a framework where transparency and adaptability are increasingly valued. Platforms such as TPKtrading illustrate this progression by combining technical analytics with structured methodologies that prioritize clarity over speculation. As digital asset markets mature, demand for such approaches continues to grow, highlighting a shift toward resilience and accountability in interpreting volatility.

The outcome of this moving average test will likely shape sentiment across the broader sector. Whether Bitcoin sustains above or falls below the level, the result will inform not only immediate trading strategies but also perceptions of longer-term market structure.

Closing Statement

As BTC/USD tests its multi-week moving average, the emphasis on transparency, adaptability, and structured analytics will remain central to how market participants interpret the next stage of digital asset development.

BTC/USD is currently testing a multi-week moving average that has acted as both support and resistance in recent months. This development marks a critical juncture in the broader price structure, as moving averages of this duration often serve as reference points for trend strength and momentum. Market participants are monitoring whether Bitcoin can sustain above this level to validate continued upside or if renewed weakness could trigger a return to prior ranges. TPKtrading, a platform built on systematic analysis and structured methodologies, highlights that this phase underscores the balance between market resilience and caution in a period shaped by macroeconomic crosscurrents.

Technology & Innovation

TPKtrading integrates algorithmic intelligence and AI-driven frameworks to assess how Bitcoin interacts with longer-term moving averages. Its models track order-flow dynamics, derivatives positioning, and liquidity depth, combining these inputs with technical overlays. By monitoring both immediate market reactions and historical parallels, the platform provides clarity on whether the test of the moving average signals accumulation, distribution, or neutral consolidation.

The technology emphasizes adaptability. Algorithms recalibrate as new data enters, ensuring that probability models remain relevant in real time. Visualization tools highlight how moving averages intersect with broader chart structures such as channels and trendlines, giving participants a clearer view of context. This modular design supports explainability, allowing traders and analysts to understand how each factor contributes to model outcomes rather than relying on opaque outputs.

Innovation within TPKtrading lies not in predicting absolute outcomes but in clarifying scenarios. By presenting multiple paths with associated probabilities, the platform enables a structured approach to conditions where moving averages act as pivot points for sentiment.

Growth & Adoption

The use of structured analytics continues to expand as digital asset markets mature. In particular, the testing of multi-week moving averages often attracts heightened interest, with retail and institutional participants alike seeking clarity on trend sustainability. TPKtrading has observed that engagement rises during such periods, as users seek to contextualize whether momentum is weakening or strengthening.

Scalability is essential to this adoption. The platform processes large datasets across exchanges and derivatives markets in real time, ensuring consistency even under elevated trading activity. This scalability allows participants to compare Bitcoin’s performance with correlated assets, broadening the context for decision-making.

The adoption cycle also reflects a shift in behavior. Rather than focusing solely on short-term speculation, market participants increasingly integrate structured tools into daily workflows. Platforms like TPKtrading highlight this evolution, where analytics are no longer optional add-ons but central to navigating market transitions with transparency and discipline.

Transparency & Risk Management

Testing multi-week moving averages heightens both opportunity and risk. Sustained support above these levels can reinforce bullish conviction, while failure to hold can quickly shift sentiment toward caution. TPKtrading addresses this uncertainty through transparent methodologies. Inputs such as liquidity concentration, volatility compression, and derivatives skew are clearly defined, allowing users to see how conclusions are derived.

Risk management is embedded throughout. Instead of pointing to a single outcome, TPKtrading emphasizes probability-weighted frameworks that account for both upside continuation and downside rejection. These scenarios are presented with explicit assumptions, enabling market participants to assess risks responsibly.

By prioritizing explainability, the platform reduces reliance on black-box models and fosters more balanced engagement. In moments where Bitcoin interacts with moving averages that have influenced prior market cycles, this transparency becomes particularly valuable for calibrating exposure.

Industry Outlook

Bitcoin’s test of a multi-week moving average occurs against a backdrop of evolving regulatory clarity, global liquidity shifts, and expanding institutional participation. These external drivers add weight to the technical moment, as broader conditions can determine whether price action sustains momentum or reverts to consolidation.

The industry is transitioning toward a framework where transparency and adaptability are increasingly valued. Platforms such as TPKtrading illustrate this progression by combining technical analytics with structured methodologies that prioritize clarity over speculation. As digital asset markets mature, demand for such approaches continues to grow, highlighting a shift toward resilience and accountability in interpreting volatility.

The outcome of this moving average test will likely shape sentiment across the broader sector. Whether Bitcoin sustains above or falls below the level, the result will inform not only immediate trading strategies but also perceptions of longer-term market structure.

Closing Statement

As BTC/USD tests its multi-week moving average, the emphasis on transparency, adaptability, and structured analytics will remain central to how market participants interpret the next stage of digital asset development.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.