Bitcoin – Continuing to Follow the Bearish Structure

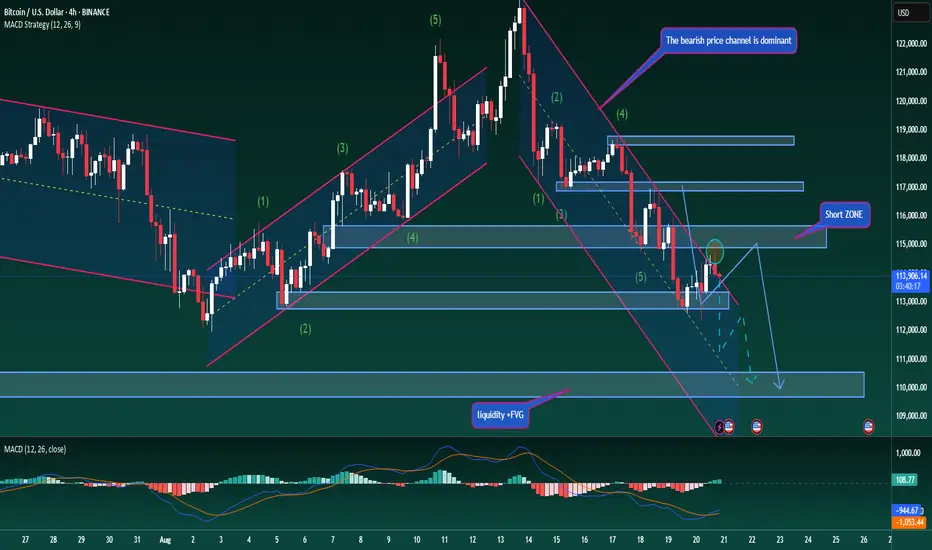

BTC has continued to follow the earlier analysis, with price moving back towards the 115,000 zone and resuming its downward waves. The descending channel remains intact and is guiding price action, with the next target area expected near 110,000.

To reach this level, BTC may form another Dow-style downward leg, closely tracking the trendline within the channel. That said, traders should be cautious — MACD is showing rising volume and the moving average is beginning to turn upward, which could be an early warning sign against aggressive short positions.

In trading, following the main trend is always the priority. Going against the market should only be considered when there is clear evidence of large liquidity zones or strong trader sentiment at key levels. Otherwise, trading in line with the prevailing trend remains the safer approach.

For BTC, the strategy is to keep following the descending channel and look for entries at trendline touches. Short-term scalping opportunities may arise around 112,600 and 111,800. The medium-term short entered near 115,000 remains active, with targets set towards 110,000. This zone will also be watched closely as a potential buying area, and decisions can then be made on whether to hold positions for the longer term.

This is my trading outlook for BTC. I hope the scenarios are useful, and I’d love to hear your views in the comments.

#BTCUSD #Bitcoin #CryptoAnalysis #TechnicalAnalysis #PriceAction #Trendline #DowTheory #MACD #CryptoTrading #SwingTrading

BTC has continued to follow the earlier analysis, with price moving back towards the 115,000 zone and resuming its downward waves. The descending channel remains intact and is guiding price action, with the next target area expected near 110,000.

To reach this level, BTC may form another Dow-style downward leg, closely tracking the trendline within the channel. That said, traders should be cautious — MACD is showing rising volume and the moving average is beginning to turn upward, which could be an early warning sign against aggressive short positions.

In trading, following the main trend is always the priority. Going against the market should only be considered when there is clear evidence of large liquidity zones or strong trader sentiment at key levels. Otherwise, trading in line with the prevailing trend remains the safer approach.

For BTC, the strategy is to keep following the descending channel and look for entries at trendline touches. Short-term scalping opportunities may arise around 112,600 and 111,800. The medium-term short entered near 115,000 remains active, with targets set towards 110,000. This zone will also be watched closely as a potential buying area, and decisions can then be made on whether to hold positions for the longer term.

This is my trading outlook for BTC. I hope the scenarios are useful, and I’d love to hear your views in the comments.

#BTCUSD #Bitcoin #CryptoAnalysis #TechnicalAnalysis #PriceAction #Trendline #DowTheory #MACD #CryptoTrading #SwingTrading

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+9B0zBuS1rboxZTY1

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+9B0zBuS1rboxZTY1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+9B0zBuS1rboxZTY1

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+9B0zBuS1rboxZTY1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.