It’s no secret: most retail traders lose money.

Not because the markets are “rigged,” but because trading is a game of probabilities, discipline, and psychology.

Let’s break down why losses happen, the psychology behind them, and how to build a better plan to stay in the game long-term.

1. Why Most Traders Lose

There are a handful of mistakes that account for the majority of blown accounts:

🔸 Overleveraging – Using too much size turns small moves against you into catastrophic losses.

🔸 Lack of risk management – Without stop-losses, max drawdown rules, or position sizing, one bad trade can erase weeks of gains.

🔸 Chasing trades – Entering late after a big move due to FOMO, only to sell at the bottom.

🔸 No system – Random entries and exits with no strategy mean your results are left entirely to chance.

🔸 Emotional trading – Anger, revenge trades, and greed lead to impulsive decisions that sabotage even good setups.

Most traders know these mistakes on paper, but knowledge alone doesn’t prevent them. The real enemy is psychology.

2. The Psychology Behind Losing

When most people think about why traders lose, they picture bad entries or poor technical skills. But the truth is, the biggest battles aren’t fought on the charts—they’re fought in the mind. Understanding the psychology behind losing is critical, because it explains why traders keep repeating the same mistakes even when they “know better.”

Loss Aversion

Psychologists have proven that humans feel the pain of losing about twice as strongly as the pleasure of winning. In trading, this shows up in two destructive ways: holding onto losing positions far longer than we should, and selling winning positions far too early. A trader might watch a loss grow from -5% to -20% because closing the trade would mean admitting they were wrong. On the flip side, the moment a trade turns green, they take profit too quickly, just to escape the fear of it slipping back to red. Over time, this creates an inverted risk/reward profile—small wins and big losses—the exact opposite of what successful trading requires.

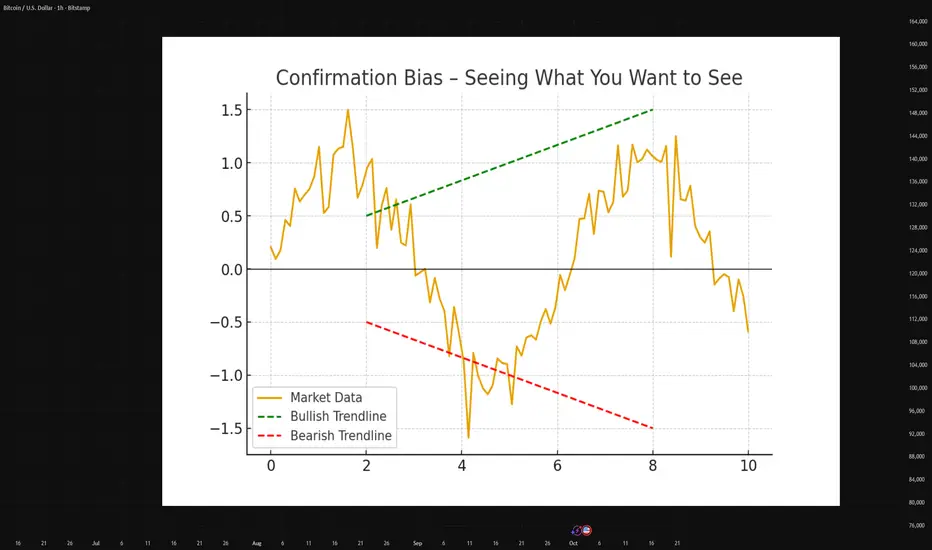

Confirmation Bias

Once a trader enters a position, the human brain naturally looks for reasons to justify it. They’ll scroll through charts, social media, or news feeds, paying attention only to the information that supports their trade, while ignoring anything that contradicts it. This tunnel vision can be deadly, because markets don’t care about opinions—they reward objectivity. A good trader must learn to question their own bias constantly, asking not “why am I right?” but “what would prove me wrong?”

Ego and Revenge Trading

Every trader knows the sting of a losing trade. But what comes next separates amateurs from professionals. The inexperienced trader often lets ego take over. Instead of stepping back, they try to immediately “win back” what was lost, usually by doubling their position size, rushing into another setup, or abandoning their strategy entirely. This revenge trading spiral often leads to much larger losses. The market punishes desperation, and it rewards patience. The ability to walk away after a loss and reset emotionally is one of the hardest but most valuable skills to develop.

The Illusion of Control

Many traders believe that the more time they spend staring at charts or the more trades they take, the better their results will be. This illusion of control often leads to overtrading, which drains both capital and emotional energy. In reality, trading is about probabilities, not control. No amount of screen time can eliminate uncertainty. The edge lies in preparation, discipline, and executing a plan—not in micromanaging every tick of price action. Paradoxically, the less you feel the need to control the market, the more control you gain over your own decisions.

3. How to Prevent Frequent Losses

The good news: most of these pitfalls can be managed with structure and discipline.

✔️ Risk Per Trade – Never risk more than 1–2% of your total capital on a single position.

✔️ Predefine Rules – Before you click buy/sell, know your entry, stop, and target.

✔️ Accept Losses – Treat them as the “cost of doing business.” Even pros lose 40–50% of trades.

✔️ Quality > Quantity – Fewer, higher-probability trades often outperform constant scalping or chasing.

✔️ Journal Every Trade – Write down why you entered, why you exited, and what you felt. This exposes patterns in your behavior.

4. Building a Better Plan

Trading without a plan is gambling. Building a system gives you consistency.

Define Your Edge: What makes your trade valid? Is it a technical setup, a market structure, or a specific confluence of signals?

Backtest Your Strategy: Test your rules on historical data before risking real money.

Stick to Probabilities: No setup wins 100%. Focus on consistency over a large sample size.

Emotional Control Routine: Walk away after a big loss, set daily limits, and never trade tired or stressed.

Takeaway

Most traders lose not because they’re “bad” but because they don’t treat trading like a business.

By mastering psychology, defining risk, and following a plan, you stop thinking in terms of single trades → and start thinking in terms of long-term probabilities.

Trading isn’t about being right every time.

It’s about surviving long enough for your edge to play out.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.