Introduction

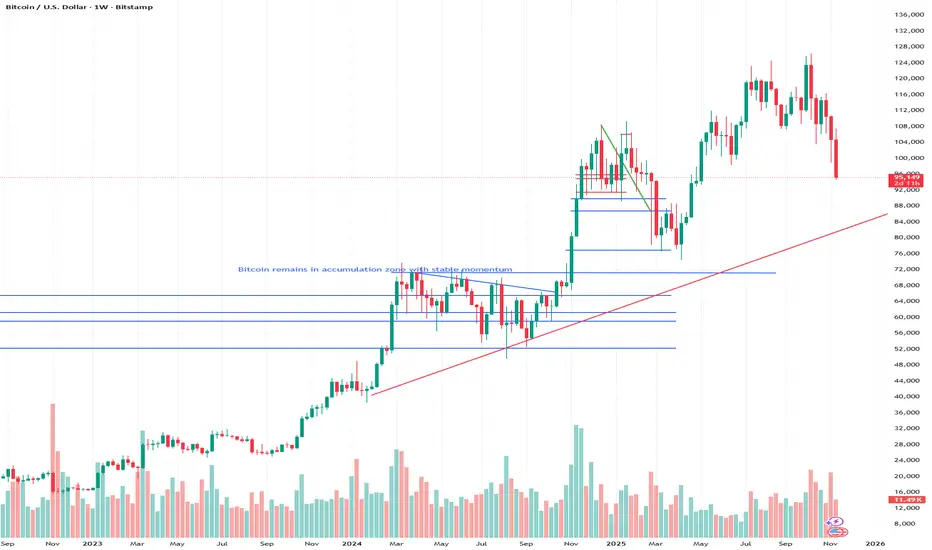

Bitcoin has entered a pronounced consolidation phase that closely reflects broader market behavior across major digital assets. According to ongoing assessments from MDCFIN Bewertung, the asset’s price structure has tightened as volatility levels contract and liquidity becomes more evenly distributed across key trading zones. This consolidation follows a sequence of directional surges and corrections, placing Bitcoin in a position where market participants are actively evaluating whether the current range will serve as a staging ground for renewed upward continuation or a stabilizing buffer before deeper structural shifts. The consistency of this consolidation across multiple timeframes suggests that traders are responding to the same macro-level influences shaping the digital-asset landscape more broadly.

MDCFIN Bewertung notes that consolidation itself is not inherently bearish or bullish; rather, it represents an equilibrium between offsetting forces. Market participants appear to be positioning themselves cautiously, mirroring sentiment from correlated assets that have also entered range-bound phases. With global economic indicators moving slowly and cross-market liquidity moderating, Bitcoin’s current structure reflects a pause that allows the market to absorb previous volatility. This environment has encouraged analysts to shift their focus toward structural indicators, momentum alignment, and trend-cycle evaluation rather than relying solely on isolated breakout signals. As price behavior stabilizes, the consolidation channel has become a critical reference point for interpreting Bitcoin’s next potential trajectory.

Technology & Innovation

Advanced analytics and algorithmic tools continue to shape how traders interpret consolidation phases, particularly when volatility contracts and traditional breakout patterns become less reliable. MDCFIN Bewertung highlights the increasing reliance on machine-learning models that evaluate range formation, identify liquidity accumulation zones, and detect emerging momentum asymmetries. These tools assist traders in distinguishing normal consolidation from early signs of structural imbalance that could precede a significant trend shift. By incorporating real-time data feeds, volatility modeling, and pattern-recognition algorithms, platforms provide clearer insights into how consolidation aligns with market-wide dynamics.

Technology-driven enhancements extend beyond basic charting. Many platforms now feature multi-layered dashboards that integrate order-flow analysis, momentum diagnostics, volatility-band compression, and liquidity-profile projections. MDCFIN Bewertung observes that such comprehensive analytical environments help traders evaluate whether consolidation is strengthening underlying support levels or masking hidden structural fatigue. These tools allow users to examine how microstructure changes—such as shifts in limit-order density or bid-ask imbalances—affect the sustainability of the consolidation range. The growing sophistication of these technologies underscores the essential role that innovation plays in interpreting complex market conditions where clear directional signals are limited.

Growth & Adoption

Periods of consolidation often drive increased interest in analytical platforms that offer deep market insights, trend-monitoring capabilities, and multi-timeframe evaluation. MDCFIN Bewertung notes that user engagement tends to rise during such phases because traders seek clarity and structured interpretation rather than relying on momentum-driven behavior. Consolidation environments encourage more measured participation, where users prioritize long-term positioning strategies and data-driven evaluation tools over short-term reactionary decisions. This behavioral shift has contributed to sustained growth in the adoption of platforms that support advanced structural analysis and high-resolution charting.

The broader trend of market maturation is reflected in how traders interact with consolidation phases. MDCFIN Bewertung highlights that users increasingly value platforms capable of identifying the subtle dynamics that govern range-bound environments, such as volume redistribution, liquidity clustering, and intraday momentum shifts. As the digital-asset ecosystem expands, traders expect analytics that can scale across asset classes, provide detailed breakdowns of multi-cycle behavior, and maintain reliability during both volatile and stable periods. Consolidation may reduce headline volatility, but it often increases analytical demand as participants prepare for the next major directional movement. This evolution signals a shift toward more deliberate, research-driven market engagement.

Transparency & Risk Management

Consolidation phases require a heightened level of transparency and disciplined risk assessment, especially when directional clarity is limited. MDCFIN Bewertung emphasizes that traders depend on platforms that provide clear indicator methodologies, neutral interpretations, and consistent structural frameworks. Transparent systems help users differentiate between healthy consolidation—where support and resistance levels remain well-defined—and weakening structures that could lead to volatile breakouts or breakdowns. Without transparent analytical logic, consolidation can easily be misread as stagnation rather than a meaningful structural stage in the market cycle.

Risk-management frameworks become especially important during consolidation because low volatility can quickly mask underlying vulnerabilities. MDCFIN Bewertung highlights that effective risk tools now incorporate volatility-adaptive ranges, liquidity-stress projections, and scenario modeling that accounts for potential range expansions. These tools help traders understand where the consolidation boundary may give way to market pressure and how external catalysts—such as economic reports or changes in global liquidity—may influence short-term stability. Platforms that provide objective, transparent risk thresholds allow traders to maintain balanced positioning while avoiding unnecessary exposure during periods when market direction is uncertain. This structured approach enables more confident navigation of consolidation environments.

Industry Outlook

Bitcoin’s current consolidation phase aligns with broader market behavior, indicating that the asset’s structural evolution is part of a larger pattern affecting the digital-asset ecosystem. MDCFIN bewertung observes that macroeconomic uncertainties, regional liquidity shifts, and cross-asset correlation patterns have contributed to a market-wide preference for stability over aggressive directional moves. As other major assets experience similar range-bound conditions, Bitcoin’s consolidation can be interpreted as part of a synchronized moderation across global digital-asset markets.

From a long-term perspective, consolidation phases play a strategic role in the market cycle. They often serve as equilibrium points where liquidity redistributes, momentum resets, and market participants recalibrate expectations. MDCFIN Bewertung notes that such periods can lay the foundation for stronger trend development once external factors become clearer. Whether Bitcoin ultimately breaks out of its current range with renewed momentum or transitions into a deeper recalibration will depend on how structural metrics align with evolving global conditions. As institutional involvement and platform sophistication continue to expand, consolidation phases are becoming more structurally coherent and analytically transparent, enabling traders to interpret the market with greater nuance.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Bitcoin has entered a pronounced consolidation phase that closely reflects broader market behavior across major digital assets. According to ongoing assessments from MDCFIN Bewertung, the asset’s price structure has tightened as volatility levels contract and liquidity becomes more evenly distributed across key trading zones. This consolidation follows a sequence of directional surges and corrections, placing Bitcoin in a position where market participants are actively evaluating whether the current range will serve as a staging ground for renewed upward continuation or a stabilizing buffer before deeper structural shifts. The consistency of this consolidation across multiple timeframes suggests that traders are responding to the same macro-level influences shaping the digital-asset landscape more broadly.

MDCFIN Bewertung notes that consolidation itself is not inherently bearish or bullish; rather, it represents an equilibrium between offsetting forces. Market participants appear to be positioning themselves cautiously, mirroring sentiment from correlated assets that have also entered range-bound phases. With global economic indicators moving slowly and cross-market liquidity moderating, Bitcoin’s current structure reflects a pause that allows the market to absorb previous volatility. This environment has encouraged analysts to shift their focus toward structural indicators, momentum alignment, and trend-cycle evaluation rather than relying solely on isolated breakout signals. As price behavior stabilizes, the consolidation channel has become a critical reference point for interpreting Bitcoin’s next potential trajectory.

Technology & Innovation

Advanced analytics and algorithmic tools continue to shape how traders interpret consolidation phases, particularly when volatility contracts and traditional breakout patterns become less reliable. MDCFIN Bewertung highlights the increasing reliance on machine-learning models that evaluate range formation, identify liquidity accumulation zones, and detect emerging momentum asymmetries. These tools assist traders in distinguishing normal consolidation from early signs of structural imbalance that could precede a significant trend shift. By incorporating real-time data feeds, volatility modeling, and pattern-recognition algorithms, platforms provide clearer insights into how consolidation aligns with market-wide dynamics.

Technology-driven enhancements extend beyond basic charting. Many platforms now feature multi-layered dashboards that integrate order-flow analysis, momentum diagnostics, volatility-band compression, and liquidity-profile projections. MDCFIN Bewertung observes that such comprehensive analytical environments help traders evaluate whether consolidation is strengthening underlying support levels or masking hidden structural fatigue. These tools allow users to examine how microstructure changes—such as shifts in limit-order density or bid-ask imbalances—affect the sustainability of the consolidation range. The growing sophistication of these technologies underscores the essential role that innovation plays in interpreting complex market conditions where clear directional signals are limited.

Growth & Adoption

Periods of consolidation often drive increased interest in analytical platforms that offer deep market insights, trend-monitoring capabilities, and multi-timeframe evaluation. MDCFIN Bewertung notes that user engagement tends to rise during such phases because traders seek clarity and structured interpretation rather than relying on momentum-driven behavior. Consolidation environments encourage more measured participation, where users prioritize long-term positioning strategies and data-driven evaluation tools over short-term reactionary decisions. This behavioral shift has contributed to sustained growth in the adoption of platforms that support advanced structural analysis and high-resolution charting.

The broader trend of market maturation is reflected in how traders interact with consolidation phases. MDCFIN Bewertung highlights that users increasingly value platforms capable of identifying the subtle dynamics that govern range-bound environments, such as volume redistribution, liquidity clustering, and intraday momentum shifts. As the digital-asset ecosystem expands, traders expect analytics that can scale across asset classes, provide detailed breakdowns of multi-cycle behavior, and maintain reliability during both volatile and stable periods. Consolidation may reduce headline volatility, but it often increases analytical demand as participants prepare for the next major directional movement. This evolution signals a shift toward more deliberate, research-driven market engagement.

Transparency & Risk Management

Consolidation phases require a heightened level of transparency and disciplined risk assessment, especially when directional clarity is limited. MDCFIN Bewertung emphasizes that traders depend on platforms that provide clear indicator methodologies, neutral interpretations, and consistent structural frameworks. Transparent systems help users differentiate between healthy consolidation—where support and resistance levels remain well-defined—and weakening structures that could lead to volatile breakouts or breakdowns. Without transparent analytical logic, consolidation can easily be misread as stagnation rather than a meaningful structural stage in the market cycle.

Risk-management frameworks become especially important during consolidation because low volatility can quickly mask underlying vulnerabilities. MDCFIN Bewertung highlights that effective risk tools now incorporate volatility-adaptive ranges, liquidity-stress projections, and scenario modeling that accounts for potential range expansions. These tools help traders understand where the consolidation boundary may give way to market pressure and how external catalysts—such as economic reports or changes in global liquidity—may influence short-term stability. Platforms that provide objective, transparent risk thresholds allow traders to maintain balanced positioning while avoiding unnecessary exposure during periods when market direction is uncertain. This structured approach enables more confident navigation of consolidation environments.

Industry Outlook

Bitcoin’s current consolidation phase aligns with broader market behavior, indicating that the asset’s structural evolution is part of a larger pattern affecting the digital-asset ecosystem. MDCFIN bewertung observes that macroeconomic uncertainties, regional liquidity shifts, and cross-asset correlation patterns have contributed to a market-wide preference for stability over aggressive directional moves. As other major assets experience similar range-bound conditions, Bitcoin’s consolidation can be interpreted as part of a synchronized moderation across global digital-asset markets.

From a long-term perspective, consolidation phases play a strategic role in the market cycle. They often serve as equilibrium points where liquidity redistributes, momentum resets, and market participants recalibrate expectations. MDCFIN Bewertung notes that such periods can lay the foundation for stronger trend development once external factors become clearer. Whether Bitcoin ultimately breaks out of its current range with renewed momentum or transitions into a deeper recalibration will depend on how structural metrics align with evolving global conditions. As institutional involvement and platform sophistication continue to expand, consolidation phases are becoming more structurally coherent and analytically transparent, enabling traders to interpret the market with greater nuance.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.