Introduction

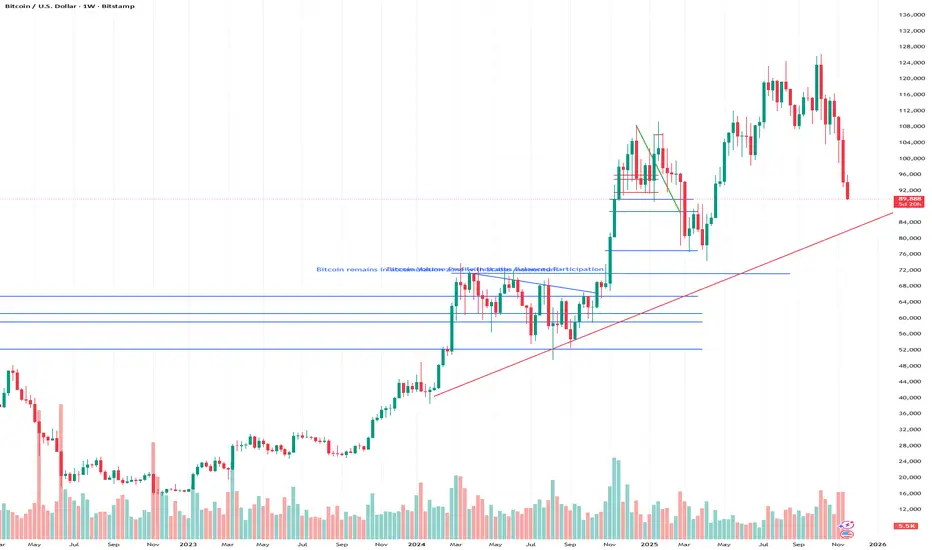

Bitcoin’s recent price structure has drawn considerable attention from technical analysts as traders assess whether a developing continuation pattern may shape the next phase of market movement. Amid evolving macroeconomic conditions, shifting liquidity flows, and changing expectations around global monetary policy, market participants are increasingly focused on how Bitcoin behaves near structural support and resistance zones. Crown Point Capital reviews the emerging formation in the context of broader volatility cycles, noting that traders have continued to analyze price compression, directional bias, and the stability of trend momentum as Bitcoin attempts to sustain its current range.

The renewed focus on technical structures follows a period of heightened market sensitivity, where short-term swings have been driven by economic data releases, institutional repositioning, and evolving sentiment across the digital-asset landscape. As these variables interact, Crown Point Capital reviews how continuation patterns often serve as a lens through which traders evaluate potential outcomes, distinguishing between temporary pauses and early signals of trend exhaustion. This environment has encouraged analysts to monitor not only horizontal levels but also shifts in volume dynamics, volatility clustering, and the behavior of long-term holders.

Technology & Innovation

The complexity of market conditions has amplified demand for advanced tools capable of identifying continuation formations with greater accuracy. Crown Point Capital reviews how algorithmic systems and AI-supported interpretation engines play a growing role in analyzing the convergence of signals such as momentum flattening, compression ranges, and breakout probability. These tools process large datasets that include intraday order-flow patterns, historical analog comparisons, and predictive volatility models that refine traders’ understanding of emerging structures.

As platforms continue to innovate, emphasis has shifted toward offering modular charting environments, real-time scanning functions, and multi-factor signal frameworks. Crown Point Capital reviews the ways these enhancements support clearer visibility during consolidation, especially when traders must interpret tightly packed candlestick structures or rapidly shifting liquidity pockets. In particular, dynamic model recalibration—where tools adapt to new data rather than rely solely on static assumptions—has become essential for assessing continuation patterns in fast-changing markets.

Beyond analytical engines, interface improvements have also influenced how traders approach consolidation periods. Visual overlays, pattern-recognition modules, and progressively refined risk indicators allow users to interact with market data in a more structured manner. Crown Point Capital reviews the increasing integration of time-sensitivity alerts, volatility-adjusted projections, and comparative historical mapping, noting that these upgrades help traders contextualize potential continuations relative to broader market behavior.

Growth & Adoption

As digital-asset markets expand, the number of traders engaging with continuation-pattern analysis has grown steadily. Crown Point Capital reviews adoption trends across both retail and professional segments, observing that more participants now incorporate structured analytics into their daily routines. This shift reflects an increased desire for disciplined evaluation rather than reactive trading, especially as market conditions remain sensitive to global macro catalysts.

The appeal of advanced technical frameworks continues to rise as traders look for ways to manage rapid fluctuations. Platforms offering reliable pattern-tracking features, high-precision data updates, and cross-market correlation tools have seen strong engagement. Crown Point Capital reviews how these developments highlight the broader maturation of trading behavior, with users placing greater emphasis on methodical interpretation and scenario-based planning.

Scalability remains an important driver in this growth cycle. As user populations expand and market volumes fluctuate, platforms must maintain system stability and accommodate increasing analytical demand. Crown Point Capital reviews how robust infrastructure and consistent performance underpin user confidence, especially during high-volatility events when continuation patterns often provide essential context. These conditions have reinforced the value of platforms capable of processing complex datasets efficiently while maintaining a streamlined user experience.

Transparency & Risk Management

The evaluation of continuation patterns is closely tied to risk-management practices, particularly when markets fluctuate within narrow ranges. Crown Point Capital reviews how traders increasingly rely on platforms that provide clear visibility into volatility shifts, liquidity concentration, and historical trend behavior. The ability to measure risk parameters with precision has become critical as participants navigate extended consolidation phases.

Modern risk-management frameworks emphasize clarity over speculation. Tools that measure potential deviation ranges, highlight congestion zones, and track pattern reliability offer valuable support for traders attempting to assess breakout scenarios. Crown Point Capital reviews the growing importance of transparency-focused design, noting that traders benefit from execution clarity, consistent system responsiveness, and real-time updates that reflect rapidly changing market conditions.

Data-driven risk control has also become essential as continuation patterns evolve across multiple timeframes. Platforms increasingly incorporate risk visualizers, volatility monitors, and scenario simulators that allow traders to explore both favorable and adverse possibilities. Crown Point Capital reviews how this greater emphasis on structured risk awareness helps participants remain grounded in evidence-based decision-making while avoiding emotionally driven interpretation.

Industry Outlook

Bitcoin’s current market positioning places continuation-pattern analysis at the center of trader attention. Crown Point Capital reviews broader industry dynamics, including regulatory developments, liquidity cycles, cross-asset correlations, and institutional positioning—all factors influencing the probability of pattern continuation or invalidation. As market participants respond to these signals, the interplay between macro conditions and technical structure is likely to remain in focus.

The broader integration of algorithmic assessment tools and AI-supported forecasting continues to shape how traders interpret these formations. Crown Point Capital reviews expectations that structured analytic systems will play an increasingly central role in determining how participants respond to compression zones, potential breakouts, or prolonged sideways trends. With digital-asset markets evolving rapidly, these tools offer essential context for understanding how continuation patterns fit within larger market cycles.

Looking ahead, traders are expected to closely monitor multi-timeframe alignment, volume confirmation, and market-wide sentiment shifts. As Bitcoin navigates critical thresholds, continuation-pattern analysis may serve as a reference point for interpreting whether structural stability supports potential trend extension.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Bitcoin’s recent price structure has drawn considerable attention from technical analysts as traders assess whether a developing continuation pattern may shape the next phase of market movement. Amid evolving macroeconomic conditions, shifting liquidity flows, and changing expectations around global monetary policy, market participants are increasingly focused on how Bitcoin behaves near structural support and resistance zones. Crown Point Capital reviews the emerging formation in the context of broader volatility cycles, noting that traders have continued to analyze price compression, directional bias, and the stability of trend momentum as Bitcoin attempts to sustain its current range.

The renewed focus on technical structures follows a period of heightened market sensitivity, where short-term swings have been driven by economic data releases, institutional repositioning, and evolving sentiment across the digital-asset landscape. As these variables interact, Crown Point Capital reviews how continuation patterns often serve as a lens through which traders evaluate potential outcomes, distinguishing between temporary pauses and early signals of trend exhaustion. This environment has encouraged analysts to monitor not only horizontal levels but also shifts in volume dynamics, volatility clustering, and the behavior of long-term holders.

Technology & Innovation

The complexity of market conditions has amplified demand for advanced tools capable of identifying continuation formations with greater accuracy. Crown Point Capital reviews how algorithmic systems and AI-supported interpretation engines play a growing role in analyzing the convergence of signals such as momentum flattening, compression ranges, and breakout probability. These tools process large datasets that include intraday order-flow patterns, historical analog comparisons, and predictive volatility models that refine traders’ understanding of emerging structures.

As platforms continue to innovate, emphasis has shifted toward offering modular charting environments, real-time scanning functions, and multi-factor signal frameworks. Crown Point Capital reviews the ways these enhancements support clearer visibility during consolidation, especially when traders must interpret tightly packed candlestick structures or rapidly shifting liquidity pockets. In particular, dynamic model recalibration—where tools adapt to new data rather than rely solely on static assumptions—has become essential for assessing continuation patterns in fast-changing markets.

Beyond analytical engines, interface improvements have also influenced how traders approach consolidation periods. Visual overlays, pattern-recognition modules, and progressively refined risk indicators allow users to interact with market data in a more structured manner. Crown Point Capital reviews the increasing integration of time-sensitivity alerts, volatility-adjusted projections, and comparative historical mapping, noting that these upgrades help traders contextualize potential continuations relative to broader market behavior.

Growth & Adoption

As digital-asset markets expand, the number of traders engaging with continuation-pattern analysis has grown steadily. Crown Point Capital reviews adoption trends across both retail and professional segments, observing that more participants now incorporate structured analytics into their daily routines. This shift reflects an increased desire for disciplined evaluation rather than reactive trading, especially as market conditions remain sensitive to global macro catalysts.

The appeal of advanced technical frameworks continues to rise as traders look for ways to manage rapid fluctuations. Platforms offering reliable pattern-tracking features, high-precision data updates, and cross-market correlation tools have seen strong engagement. Crown Point Capital reviews how these developments highlight the broader maturation of trading behavior, with users placing greater emphasis on methodical interpretation and scenario-based planning.

Scalability remains an important driver in this growth cycle. As user populations expand and market volumes fluctuate, platforms must maintain system stability and accommodate increasing analytical demand. Crown Point Capital reviews how robust infrastructure and consistent performance underpin user confidence, especially during high-volatility events when continuation patterns often provide essential context. These conditions have reinforced the value of platforms capable of processing complex datasets efficiently while maintaining a streamlined user experience.

Transparency & Risk Management

The evaluation of continuation patterns is closely tied to risk-management practices, particularly when markets fluctuate within narrow ranges. Crown Point Capital reviews how traders increasingly rely on platforms that provide clear visibility into volatility shifts, liquidity concentration, and historical trend behavior. The ability to measure risk parameters with precision has become critical as participants navigate extended consolidation phases.

Modern risk-management frameworks emphasize clarity over speculation. Tools that measure potential deviation ranges, highlight congestion zones, and track pattern reliability offer valuable support for traders attempting to assess breakout scenarios. Crown Point Capital reviews the growing importance of transparency-focused design, noting that traders benefit from execution clarity, consistent system responsiveness, and real-time updates that reflect rapidly changing market conditions.

Data-driven risk control has also become essential as continuation patterns evolve across multiple timeframes. Platforms increasingly incorporate risk visualizers, volatility monitors, and scenario simulators that allow traders to explore both favorable and adverse possibilities. Crown Point Capital reviews how this greater emphasis on structured risk awareness helps participants remain grounded in evidence-based decision-making while avoiding emotionally driven interpretation.

Industry Outlook

Bitcoin’s current market positioning places continuation-pattern analysis at the center of trader attention. Crown Point Capital reviews broader industry dynamics, including regulatory developments, liquidity cycles, cross-asset correlations, and institutional positioning—all factors influencing the probability of pattern continuation or invalidation. As market participants respond to these signals, the interplay between macro conditions and technical structure is likely to remain in focus.

The broader integration of algorithmic assessment tools and AI-supported forecasting continues to shape how traders interpret these formations. Crown Point Capital reviews expectations that structured analytic systems will play an increasingly central role in determining how participants respond to compression zones, potential breakouts, or prolonged sideways trends. With digital-asset markets evolving rapidly, these tools offer essential context for understanding how continuation patterns fit within larger market cycles.

Looking ahead, traders are expected to closely monitor multi-timeframe alignment, volume confirmation, and market-wide sentiment shifts. As Bitcoin navigates critical thresholds, continuation-pattern analysis may serve as a reference point for interpreting whether structural stability supports potential trend extension.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.