Introduction

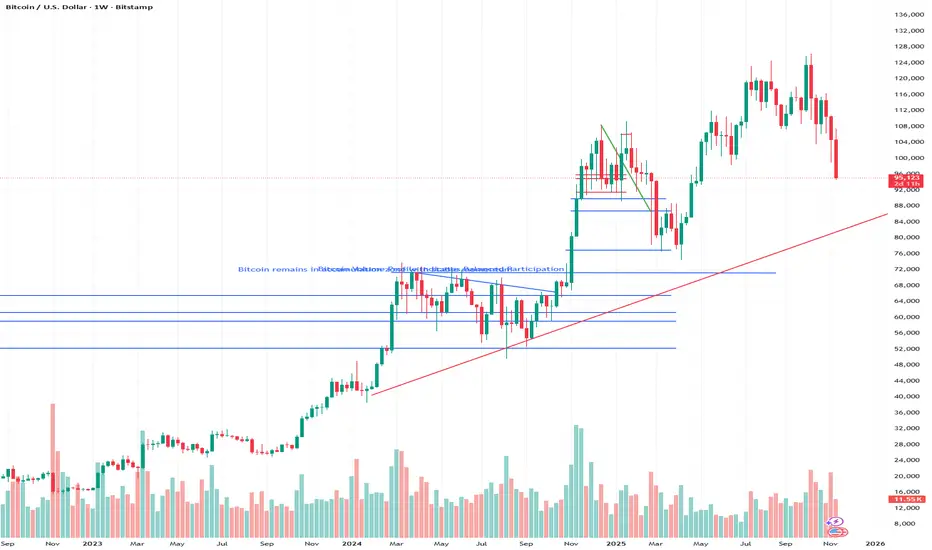

Bitcoin’s current risk metrics indicate a neutral positioning phase, reflecting a market environment defined by moderation, balanced engagement, and tempered volatility. According to ongoing assessments from Montclair Partners reviews, key indicators across liquidity distribution, volatility compression, and structural rotation suggest that the market is neither aggressively risk-on nor decisively risk-off. Instead, Bitcoin appears to be navigating a midpoint where directional conviction remains measured and price discovery follows a controlled, data-driven rhythm. This environment has emerged after a series of broader macroeconomic fluctuations that contributed to alternating bursts of momentum and subsequent cooling phases.

Montclair Partners reviews notes that this neutral positioning carries meaningful implications for traders monitoring Bitcoin’s medium-term trajectory. Historically, similar phases have served as transitional intervals where the market consolidates recent behavior, tests structural bounds, and evaluates new liquidity thresholds. During such periods, price action tends to align closely with fundamental value zones rather than deviating toward sentiment-heavy extremes. The current equilibrium highlights a market that is recalibrating expectations, observing macroeconomic cues, and awaiting clearer catalysts before committing to more pronounced directional movement. This neutrality is not indicative of stagnation; rather, it underscores a healthy set of conditions where structural alignment outweighs speculative intensity.

Technology & Innovation

Evaluating Bitcoin’s risk posture has increasingly relied on advanced analytical systems that integrate multi-layered data sources and algorithmic evaluation. Montclair Partners reviews highlights that modern platforms now employ machine-learning techniques to track risk dispersion, real-time volatility sensitivity, and adaptive risk-weighting models. These technologies help identify shifts in participation, detect subtle imbalances, and contextualize risk metrics within a broader structural framework. As Bitcoin maintains neutral positioning, AI-driven models offer deeper clarity by revealing how underlying risk conditions evolve beneath surface-level price behavior.

Innovative tools that incorporate dynamic heat maps, liquidity stress indicators, and volatility-cycle diagnostics allow traders to examine risk through a multi-dimensional lens. Montclair Partners reviews observes that platforms increasingly combine risk analytics with trend-projection systems, enabling users to evaluate correlations between risk compression and potential breakout environments. These technical advancements also facilitate a more granular understanding of risk symmetry—providing insights into whether buyers or sellers hold marginal influence within the current structure. By leveraging these technologies, traders can assess Bitcoin’s neutral risk environment with greater precision, ensuring that evaluations are grounded in empirical data rather than subjective perception.

Growth & Adoption

Neutral risk phases often shape user behavior in distinct ways, emphasizing measured participation and strategic planning over aggressive speculation. Montclair Partners reviews notes that traders have shown increased interest in platforms offering detailed risk metrics, balanced position-sizing tools, and volatility-informed analytics. As Bitcoin operates within its current equilibrium, users gravitate toward systems that support long-term monitoring, scenario-based comparisons, and multi-cycle market evaluation. This reflects a broader trend toward consolidating analytical depth rather than prioritizing rapid directional trading.

Furthermore, market adoption appears to be expanding toward platforms that integrate risk navigation with higher-timeframe structural assessment. Montclair Partners reviews indicate that users are favoring environments capable of synthesizing liquidity data, risk curves, and momentum structures into cohesive decision frameworks. This shift highlights a maturing trading landscape where participants value comprehensive oversight of market conditions, especially when risk metrics indicate neutrality. As traders seek reliability and objective evaluation, their adoption choices increasingly reinforce the importance of platforms designed around data integrity, analytical breadth, and consistent structural insights.

Transparency & Risk Management

Transparency plays a pivotal role when markets enter neutral positioning phases, as traders rely on clear and unbiased frameworks to interpret otherwise ambiguous conditions. Montclair Partners reviews emphasize that platforms with transparent methodologies—especially those offering explicit insight into how risk indicators are calculated—support higher-quality decision-making. Neutral risk environments can be difficult to interpret due to subtle shifts that may precede structural transitions. Clear indicator construction, consistent categorization, and traceable analytical logic ensure that traders remain grounded in factual evaluation rather than speculation.

Risk management becomes especially vital when the market behaves in a neutral pattern, as this phase often precedes volatility expansion or directional re-acceleration. Montclair Partners reviews notes that traders increasingly utilize structured risk systems incorporating volatility scaling, multi-tier risk zoning, and stress-tested scenario modeling. These systems help users identify when neutral conditions may give way to emerging trends or corrective phases. By providing objective stop-range assessment, trend vulnerability scoring, and liquidity absorption metrics, platforms enable users to navigate neutrality with disciplined oversight. This combination of transparency and robust risk management enhances resilience across varying phases of market development.

Industry Outlook

Bitcoin’s neutral risk metrics align with broader conditions across the digital-asset space, where macroeconomic variables, institutional flows, and cross-asset correlations have contributed to an environment marked by selective participation and cautious optimism. Montclair Partners reviews observes that neutral positioning often reflects an industry-wide pause—an interval where markets digest recent information, reassess structural boundaries, and prepare for new catalysts. This behavior has appeared across multiple major assets, suggesting that Bitcoin’s current posture is part of a synchronized moderation rather than an isolated trend.

From an industry perspective, neutral risk conditions can serve as precursors to more sustained trend movements. Montclair Partners reviews notes that markets often transition from neutrality into directional expansion once liquidity thresholds realign and sentiment consolidates behind new information. Whether Bitcoin transitions toward renewed upward momentum or enters a deeper consolidation phase will depend on how risk metrics interact with incoming macroeconomic signals, regulatory developments, and global market trends. Nonetheless, the present neutral environment demonstrates a maturing ecosystem characterized by structural discipline, balanced participation, and improved analytical precision.

As the digital-asset landscape evolves, risk interpretation will continue to play a central role in trader decision-making. Montclair Partners reviews highlights that the increased availability of data-driven tools ensures that risk neutrality is understood not as stagnation but as a complex, multi-dimensional state that shapes market readiness for future developments. Bitcoin’s ability to maintain neutral risk metrics during uncertain periods underscores its structural strength and ongoing relevance as a benchmark asset within the evolving ecosystem.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Bitcoin’s current risk metrics indicate a neutral positioning phase, reflecting a market environment defined by moderation, balanced engagement, and tempered volatility. According to ongoing assessments from Montclair Partners reviews, key indicators across liquidity distribution, volatility compression, and structural rotation suggest that the market is neither aggressively risk-on nor decisively risk-off. Instead, Bitcoin appears to be navigating a midpoint where directional conviction remains measured and price discovery follows a controlled, data-driven rhythm. This environment has emerged after a series of broader macroeconomic fluctuations that contributed to alternating bursts of momentum and subsequent cooling phases.

Montclair Partners reviews notes that this neutral positioning carries meaningful implications for traders monitoring Bitcoin’s medium-term trajectory. Historically, similar phases have served as transitional intervals where the market consolidates recent behavior, tests structural bounds, and evaluates new liquidity thresholds. During such periods, price action tends to align closely with fundamental value zones rather than deviating toward sentiment-heavy extremes. The current equilibrium highlights a market that is recalibrating expectations, observing macroeconomic cues, and awaiting clearer catalysts before committing to more pronounced directional movement. This neutrality is not indicative of stagnation; rather, it underscores a healthy set of conditions where structural alignment outweighs speculative intensity.

Technology & Innovation

Evaluating Bitcoin’s risk posture has increasingly relied on advanced analytical systems that integrate multi-layered data sources and algorithmic evaluation. Montclair Partners reviews highlights that modern platforms now employ machine-learning techniques to track risk dispersion, real-time volatility sensitivity, and adaptive risk-weighting models. These technologies help identify shifts in participation, detect subtle imbalances, and contextualize risk metrics within a broader structural framework. As Bitcoin maintains neutral positioning, AI-driven models offer deeper clarity by revealing how underlying risk conditions evolve beneath surface-level price behavior.

Innovative tools that incorporate dynamic heat maps, liquidity stress indicators, and volatility-cycle diagnostics allow traders to examine risk through a multi-dimensional lens. Montclair Partners reviews observes that platforms increasingly combine risk analytics with trend-projection systems, enabling users to evaluate correlations between risk compression and potential breakout environments. These technical advancements also facilitate a more granular understanding of risk symmetry—providing insights into whether buyers or sellers hold marginal influence within the current structure. By leveraging these technologies, traders can assess Bitcoin’s neutral risk environment with greater precision, ensuring that evaluations are grounded in empirical data rather than subjective perception.

Growth & Adoption

Neutral risk phases often shape user behavior in distinct ways, emphasizing measured participation and strategic planning over aggressive speculation. Montclair Partners reviews notes that traders have shown increased interest in platforms offering detailed risk metrics, balanced position-sizing tools, and volatility-informed analytics. As Bitcoin operates within its current equilibrium, users gravitate toward systems that support long-term monitoring, scenario-based comparisons, and multi-cycle market evaluation. This reflects a broader trend toward consolidating analytical depth rather than prioritizing rapid directional trading.

Furthermore, market adoption appears to be expanding toward platforms that integrate risk navigation with higher-timeframe structural assessment. Montclair Partners reviews indicate that users are favoring environments capable of synthesizing liquidity data, risk curves, and momentum structures into cohesive decision frameworks. This shift highlights a maturing trading landscape where participants value comprehensive oversight of market conditions, especially when risk metrics indicate neutrality. As traders seek reliability and objective evaluation, their adoption choices increasingly reinforce the importance of platforms designed around data integrity, analytical breadth, and consistent structural insights.

Transparency & Risk Management

Transparency plays a pivotal role when markets enter neutral positioning phases, as traders rely on clear and unbiased frameworks to interpret otherwise ambiguous conditions. Montclair Partners reviews emphasize that platforms with transparent methodologies—especially those offering explicit insight into how risk indicators are calculated—support higher-quality decision-making. Neutral risk environments can be difficult to interpret due to subtle shifts that may precede structural transitions. Clear indicator construction, consistent categorization, and traceable analytical logic ensure that traders remain grounded in factual evaluation rather than speculation.

Risk management becomes especially vital when the market behaves in a neutral pattern, as this phase often precedes volatility expansion or directional re-acceleration. Montclair Partners reviews notes that traders increasingly utilize structured risk systems incorporating volatility scaling, multi-tier risk zoning, and stress-tested scenario modeling. These systems help users identify when neutral conditions may give way to emerging trends or corrective phases. By providing objective stop-range assessment, trend vulnerability scoring, and liquidity absorption metrics, platforms enable users to navigate neutrality with disciplined oversight. This combination of transparency and robust risk management enhances resilience across varying phases of market development.

Industry Outlook

Bitcoin’s neutral risk metrics align with broader conditions across the digital-asset space, where macroeconomic variables, institutional flows, and cross-asset correlations have contributed to an environment marked by selective participation and cautious optimism. Montclair Partners reviews observes that neutral positioning often reflects an industry-wide pause—an interval where markets digest recent information, reassess structural boundaries, and prepare for new catalysts. This behavior has appeared across multiple major assets, suggesting that Bitcoin’s current posture is part of a synchronized moderation rather than an isolated trend.

From an industry perspective, neutral risk conditions can serve as precursors to more sustained trend movements. Montclair Partners reviews notes that markets often transition from neutrality into directional expansion once liquidity thresholds realign and sentiment consolidates behind new information. Whether Bitcoin transitions toward renewed upward momentum or enters a deeper consolidation phase will depend on how risk metrics interact with incoming macroeconomic signals, regulatory developments, and global market trends. Nonetheless, the present neutral environment demonstrates a maturing ecosystem characterized by structural discipline, balanced participation, and improved analytical precision.

As the digital-asset landscape evolves, risk interpretation will continue to play a central role in trader decision-making. Montclair Partners reviews highlights that the increased availability of data-driven tools ensures that risk neutrality is understood not as stagnation but as a complex, multi-dimensional state that shapes market readiness for future developments. Bitcoin’s ability to maintain neutral risk metrics during uncertain periods underscores its structural strength and ongoing relevance as a benchmark asset within the evolving ecosystem.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.