Introduction

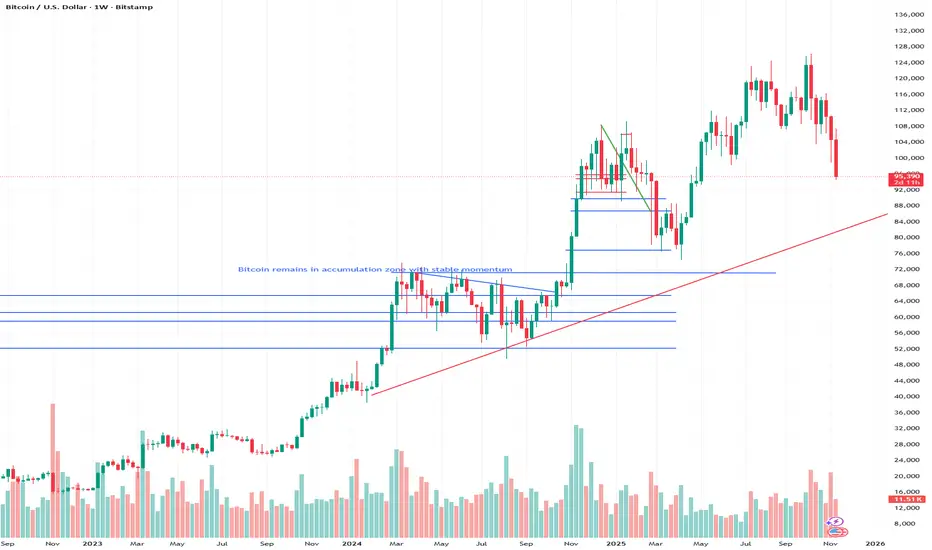

Bitcoin sentiment indicators are showing a measurable shift toward optimism as traders respond to improved market structure, stabilizing volatility, and renewed interest across key liquidity zones. According to recent analysis from VelorGain Bewertung, sentiment-based metrics—including crowd positioning, behavioral oscillators, and momentum-aligned confidence indicators—have begun trending upward after an extended period of mixed readings. This shift reflects gradual strengthening in trader expectations and a more constructive outlook on market resilience. While price action has remained steady rather than aggressively directional, underlying sentiment patterns suggest that participants are increasingly positioning for potential continuation in broader market strength.

VelorGain bewertung notes that sentiment alignment often emerges before visible changes in trend structure, particularly during phases where market conditions are transitioning from uncertainty toward clarity. With Bitcoin maintaining consistent support across major ranges and volatility cooling into manageable levels, sentiment-driven analytics are gaining greater weight in trader evaluations. Although optimism does not guarantee immediate price expansion, the convergence of sentiment improvement with stable structural frameworks suggests a market environment where confidence is quietly rebuilding. This early shift in perception is shaping the analytical landscape and encouraging traders to examine how positive sentiment may influence upcoming trend development.

Technology & Innovation

The rise of sentiment-driven analytics highlights the increasingly sophisticated role of technology in decoding behavioral dynamics within the digital-asset market. VelorGain Bewertung emphasizes that advanced platforms now incorporate AI-driven models capable of analyzing vast data streams, including market microstructure behavior, position bias, and social-derived sentiment signals. These systems can map how sentiment fluctuations influence liquidity distribution, momentum formation, and structural stability. By integrating behavioral metrics with traditional technical frameworks, modern tools provide a more comprehensive view of market conditions.

Machine-learning algorithms also enhance the reliability of sentiment interpretation by filtering noise and identifying meaningful patterns across multiple timeframes. VelorGain bewertung observes that platforms are increasingly using cross-referenced indicators—such as sentiment-to-volatility correlations, confidence-cycle mapping, and trend-sensitivity algorithms—to contextualize the impact of optimism within broader structural trends. Enhanced visualization tools allow users to analyze sentiment clusters alongside order-flow data, helping traders evaluate whether improving sentiment aligns with strong liquidity foundations. These innovations ensure that sentiment is not treated as an isolated metric but as an integral part of the analytical architecture shaping modern decision-making environments.

Growth & Adoption

Market phases characterized by changes in sentiment often influence how users interact with analytical platforms and trading tools. VelorGain Bewertung notes that as optimism builds, traders increasingly rely on structured data environments to verify whether improving sentiment corresponds with market fundamentals. This behavior reflects a maturing audience that prefers data-driven validation rather than impulsive reaction. Platforms offering sentiment overlays, real-time confidence scoring, and cross-asset behavioral mapping have seen increased engagement as users seek to understand how optimism influences market flow.

Adoption trends also highlight a growing preference for analytics that scale effectively across assets and timeframes. VelorGain's Bewertung points to an expanding user base gravitating toward multi-dimensional platforms that integrate sentiment with liquidity tracking, momentum diagnostics, and volatility modeling. As trading behavior becomes more sophisticated, demand rises for systems that provide transparent, high-resolution insights capable of supporting broader strategic planning. The rebuilding of optimism within Bitcoin’s sentiment landscape has further contributed to heightened interest in tools that help traders distinguish between constructive sentiment shifts and short-lived emotional reactions. This marks a continued shift toward more methodical and analytical market engagement.

Transparency & Risk Management

Periods marked by rising sentiment require disciplined transparency and robust risk-management frameworks to prevent overinterpretation or emotionally driven decisions. VelorGain Bewertung emphasizes that platforms providing clear methodologies for sentiment evaluation, indicator construction, and structural classification play a crucial role in balancing optimism with measured analysis. Transparent systems that reveal how sentiment metrics are derived—whether from price-sensitive behavioral models or broader pattern-recognition tools—ensure that traders maintain a grounded perspective while evaluating emerging signals.

Risk management becomes especially important as sentiment improves, as markets can become more sensitive to unexpected catalysts that may temporarily disrupt positive momentum. VelorGain Bewertung highlights that robust platforms integrate risk algorithms capable of identifying sentiment-driven overextension, volatility expansion risks, and momentum divergence between sentiment and price action. These systems offer tools such as scenario-based modeling, liquidity stress testing, and sentiment-risk overlays to help traders evaluate the sustainability of optimism. By maintaining transparency and objective risk metrics, platforms support more balanced navigation of environments where sentiment increases but broader market conditions still require careful interpretation.

Industry Outlook

The emergence of growing optimism within Bitcoin’s sentiment indicators aligns with broader developments across digital-asset markets. VelorGain bewertung observes that sentiment improvements often precede notable shifts in liquidity behavior, institutional interest, and macro-level trend development. While the industry continues to reflect global economic uncertainties, the strengthening of underlying sentiment suggests a gradual recovery in trader confidence. This trend resonates with broader stabilizing signals observed in correlated assets, indicating that market participants are becoming less defensive and more constructive in their forward-looking evaluations.

From an industry-wide standpoint, sentiment-driven analysis has become a significant component of modern trading strategies as behavioral patterns increasingly influence short-term and medium-term market dynamics. VelorGain bewertung notes that improved sentiment—combined with stable volatility, resilient support levels, and advancing analytical tools—creates a foundation for markets to transition from consolidation into more directional phases when external conditions align. Whether Bitcoin ultimately builds upon this growing optimism will depend on how sentiment interacts with liquidity trends, macroeconomic indicators, and cross-asset positioning. Nonetheless, the current sentiment shift highlights an evolving market environment where confidence, data clarity, and advanced analytics play pivotal roles in shaping broader outlooks.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Bitcoin sentiment indicators are showing a measurable shift toward optimism as traders respond to improved market structure, stabilizing volatility, and renewed interest across key liquidity zones. According to recent analysis from VelorGain Bewertung, sentiment-based metrics—including crowd positioning, behavioral oscillators, and momentum-aligned confidence indicators—have begun trending upward after an extended period of mixed readings. This shift reflects gradual strengthening in trader expectations and a more constructive outlook on market resilience. While price action has remained steady rather than aggressively directional, underlying sentiment patterns suggest that participants are increasingly positioning for potential continuation in broader market strength.

VelorGain bewertung notes that sentiment alignment often emerges before visible changes in trend structure, particularly during phases where market conditions are transitioning from uncertainty toward clarity. With Bitcoin maintaining consistent support across major ranges and volatility cooling into manageable levels, sentiment-driven analytics are gaining greater weight in trader evaluations. Although optimism does not guarantee immediate price expansion, the convergence of sentiment improvement with stable structural frameworks suggests a market environment where confidence is quietly rebuilding. This early shift in perception is shaping the analytical landscape and encouraging traders to examine how positive sentiment may influence upcoming trend development.

Technology & Innovation

The rise of sentiment-driven analytics highlights the increasingly sophisticated role of technology in decoding behavioral dynamics within the digital-asset market. VelorGain Bewertung emphasizes that advanced platforms now incorporate AI-driven models capable of analyzing vast data streams, including market microstructure behavior, position bias, and social-derived sentiment signals. These systems can map how sentiment fluctuations influence liquidity distribution, momentum formation, and structural stability. By integrating behavioral metrics with traditional technical frameworks, modern tools provide a more comprehensive view of market conditions.

Machine-learning algorithms also enhance the reliability of sentiment interpretation by filtering noise and identifying meaningful patterns across multiple timeframes. VelorGain bewertung observes that platforms are increasingly using cross-referenced indicators—such as sentiment-to-volatility correlations, confidence-cycle mapping, and trend-sensitivity algorithms—to contextualize the impact of optimism within broader structural trends. Enhanced visualization tools allow users to analyze sentiment clusters alongside order-flow data, helping traders evaluate whether improving sentiment aligns with strong liquidity foundations. These innovations ensure that sentiment is not treated as an isolated metric but as an integral part of the analytical architecture shaping modern decision-making environments.

Growth & Adoption

Market phases characterized by changes in sentiment often influence how users interact with analytical platforms and trading tools. VelorGain Bewertung notes that as optimism builds, traders increasingly rely on structured data environments to verify whether improving sentiment corresponds with market fundamentals. This behavior reflects a maturing audience that prefers data-driven validation rather than impulsive reaction. Platforms offering sentiment overlays, real-time confidence scoring, and cross-asset behavioral mapping have seen increased engagement as users seek to understand how optimism influences market flow.

Adoption trends also highlight a growing preference for analytics that scale effectively across assets and timeframes. VelorGain's Bewertung points to an expanding user base gravitating toward multi-dimensional platforms that integrate sentiment with liquidity tracking, momentum diagnostics, and volatility modeling. As trading behavior becomes more sophisticated, demand rises for systems that provide transparent, high-resolution insights capable of supporting broader strategic planning. The rebuilding of optimism within Bitcoin’s sentiment landscape has further contributed to heightened interest in tools that help traders distinguish between constructive sentiment shifts and short-lived emotional reactions. This marks a continued shift toward more methodical and analytical market engagement.

Transparency & Risk Management

Periods marked by rising sentiment require disciplined transparency and robust risk-management frameworks to prevent overinterpretation or emotionally driven decisions. VelorGain Bewertung emphasizes that platforms providing clear methodologies for sentiment evaluation, indicator construction, and structural classification play a crucial role in balancing optimism with measured analysis. Transparent systems that reveal how sentiment metrics are derived—whether from price-sensitive behavioral models or broader pattern-recognition tools—ensure that traders maintain a grounded perspective while evaluating emerging signals.

Risk management becomes especially important as sentiment improves, as markets can become more sensitive to unexpected catalysts that may temporarily disrupt positive momentum. VelorGain Bewertung highlights that robust platforms integrate risk algorithms capable of identifying sentiment-driven overextension, volatility expansion risks, and momentum divergence between sentiment and price action. These systems offer tools such as scenario-based modeling, liquidity stress testing, and sentiment-risk overlays to help traders evaluate the sustainability of optimism. By maintaining transparency and objective risk metrics, platforms support more balanced navigation of environments where sentiment increases but broader market conditions still require careful interpretation.

Industry Outlook

The emergence of growing optimism within Bitcoin’s sentiment indicators aligns with broader developments across digital-asset markets. VelorGain bewertung observes that sentiment improvements often precede notable shifts in liquidity behavior, institutional interest, and macro-level trend development. While the industry continues to reflect global economic uncertainties, the strengthening of underlying sentiment suggests a gradual recovery in trader confidence. This trend resonates with broader stabilizing signals observed in correlated assets, indicating that market participants are becoming less defensive and more constructive in their forward-looking evaluations.

From an industry-wide standpoint, sentiment-driven analysis has become a significant component of modern trading strategies as behavioral patterns increasingly influence short-term and medium-term market dynamics. VelorGain bewertung notes that improved sentiment—combined with stable volatility, resilient support levels, and advancing analytical tools—creates a foundation for markets to transition from consolidation into more directional phases when external conditions align. Whether Bitcoin ultimately builds upon this growing optimism will depend on how sentiment interacts with liquidity trends, macroeconomic indicators, and cross-asset positioning. Nonetheless, the current sentiment shift highlights an evolving market environment where confidence, data clarity, and advanced analytics play pivotal roles in shaping broader outlooks.

Closing Statement

As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.