__________________________________________________________________________________

Market Overview

__________________________________________________________________________________

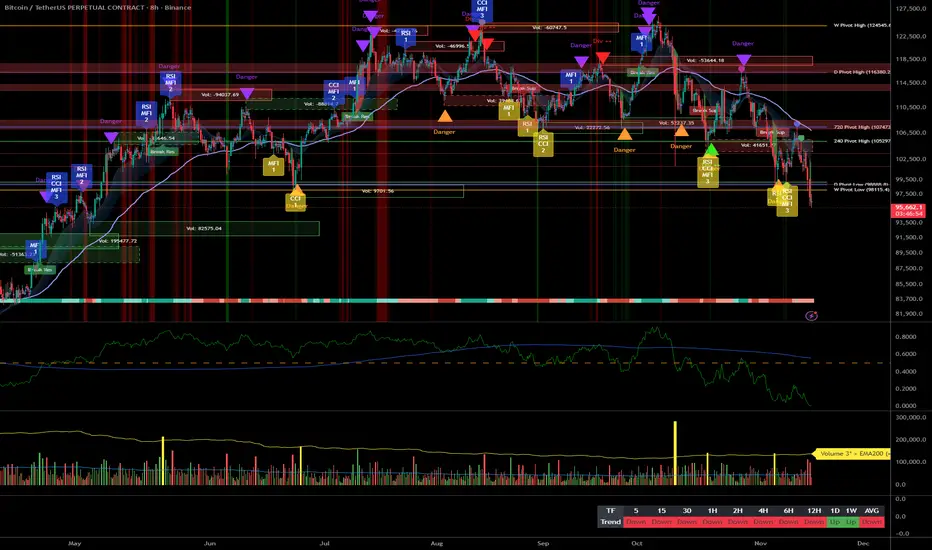

Risk-off momentum drove Bitcoin into a dense multi-timeframe demand shelf, where price is probing for a reaction after losing 98k–100k. The next impulse likely comes from the battle around 95.8–95.9k and whether buyers can stage a clean reversal.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

We operate in a corrective, risk-off tape pressing into HTF demand; take a tactical stance and let ≥2H confirmation lead.

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

HTF uptrend (1D) conflicts with intraday downtrends, placing the burden of proof on buyers at the 95.8–95.9k shelf.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro risk-off and ETF outflows pressure BTC; the path hinges on whether flows stabilize and the 95.8–95.9k shelf holds.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

We are in a corrective, high-volatility test of a dense demand cluster.

- Trend: Intraday bearish within a mixed HTF context; respect 12H Down unless ≥2H prints a clean reversal.

- Best setup: Reactive long only on a ≥2H reversal at 95.8–95.9k; otherwise fade failed retests at 97.8–98.2k.

- Macro factor: ETF outflows are the main headwind; watch FOMC/CPI for a regime nudge.

Stay patient, let the shelf prove itself, and treat each move like a boss fight — confirm the phase before committing.

Market Overview

__________________________________________________________________________________

Risk-off momentum drove Bitcoin into a dense multi-timeframe demand shelf, where price is probing for a reaction after losing 98k–100k. The next impulse likely comes from the battle around 95.8–95.9k and whether buyers can stage a clean reversal.

- Momentum: Bearish drive into HTF demand; intraday trend remains down while daily is mixed-to-up in the background.

- Key levels:

- Resistances (12H/1D): 97,300–98,200; 100,000; 101,600–103,000

- Supports (2H/4H/12H/1D): 95,820–95,920; 95,200–95,000; 92,000 - Volumes: Very high on 12H and below (sell waves); normal on 1D — momentum is flow-driven, not a pure volume vacuum.

- Multi-timeframe signals: 12H/6H/4H/2H/1H downtrends; 1D uptrend — execution should respect 12H Down unless ≥2H prints a confirmed reversal at 95.8–95.9k.

- Harvest zones: 95,900 (Cluster A) / 95,000–95,200 (Cluster B) — ideal dip-buy zones for inverse pyramiding if a ≥2H reversal confirms.

- Risk On / Risk Off Indicator context: Neutral Sell — confirms the risk-off push and argues for patience on longs unless the cluster defends with real follow-through.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

We operate in a corrective, risk-off tape pressing into HTF demand; take a tactical stance and let ≥2H confirmation lead.

- Global bias: Neutral Sell while under 98,000–100,000; key invalidation for shorts = reclaim and close above 98,000 with follow-through.

- Opportunities:

- Buy: Only on a ≥2H bullish reversal from 95,800–95,900; target 96,600–97,000 then 97,800–98,200.

- Breakout: Reclaim >98,000 with momentum → ride into 100,000 then 101,600–103,000.

- Tactical sell: Fade failed retests at 97,800–98,200 or a ≥2H close below 95,800 with a failed retest. - Risk zones / invalidations: A sustained ≥2H close below 95,800 would invalidate the bounce idea and open 95,200–95,000, then 92,000.

- Macro catalysts (Twitter, Perplexity, news): Heavy spot ETF outflows reinforce risk-off; global equities in broad risk-off; upcoming FOMC/CPI could shift dollar/liquidity and the crypto beta.

- Harvest Plan (Inverse Pyramid):

- Palier 1 (12.5%): 95,900 (Cluster A) + reversal ≥2H → entry

- Palier 2 (+12.5%): 92,100–90,100 (-4/-6% below Palier 1)

- TP: 50% at +12–18% from PMP → recycle cash

- Runner: hold if break & hold first R HTF (97,800–98,200 zone)

- Invalidation: < HTF Pivot Low 95,000 or 96h no momentum

- Hedge (1x): Short first R HTF on rejection (97,800–98,200) + bearish trend → neutralize below R

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

HTF uptrend (1D) conflicts with intraday downtrends, placing the burden of proof on buyers at the 95.8–95.9k shelf.

- 12H/6H/4H/2H/1H/30m/15m: Downtrends with very high sell-side volume; repeated tests of 95.8–95.9k raise risk of a flush if it fails, while failed breakdowns can spring sharp squeezes into 97.3–98.2k.

- 1D: Still up but losing momentum; the 95.8–96.0k cluster aligns with multiple prior pivot lows — a defendable shelf if buyers print a clean reversal and reclaim 97.8–98.2k.

- Divergences/confluences: ISPD DIV = BUY at the cluster while Risk On / Risk Off Indicator = Neutral Sell — confluence for reactive bounces only, not blind catching; wait for ≥2H confirmation.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro risk-off and ETF outflows pressure BTC; the path hinges on whether flows stabilize and the 95.8–95.9k shelf holds.

- Macro events: Global equities are risk-off; energy/geopolitics keep volatility elevated; upcoming FOMC/CPI loom as catalysts that can swing liquidity and risk appetite.

- Bitcoin analysis: Breakdown below 100k with a six-month low near ~97k; weekly close vs ~101k is pivotal. Heavy ETF outflows and liquidations weigh unless key resistances are reclaimed.

- On-chain data: Long-term holders have been distributing, but sellers show signs of exhaustion — a setup for relief if flows stabilize and levels reclaim.

- Expected impact: If the shelf holds and outflows cool, a relief bounce toward 97.8–98.2k and 100k is likely; otherwise, a clean failure risks 95.0k then 92k.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

We are in a corrective, high-volatility test of a dense demand cluster.

- Trend: Intraday bearish within a mixed HTF context; respect 12H Down unless ≥2H prints a clean reversal.

- Best setup: Reactive long only on a ≥2H reversal at 95.8–95.9k; otherwise fade failed retests at 97.8–98.2k.

- Macro factor: ETF outflows are the main headwind; watch FOMC/CPI for a regime nudge.

Stay patient, let the shelf prove itself, and treat each move like a boss fight — confirm the phase before committing.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.