SMC Trading point update

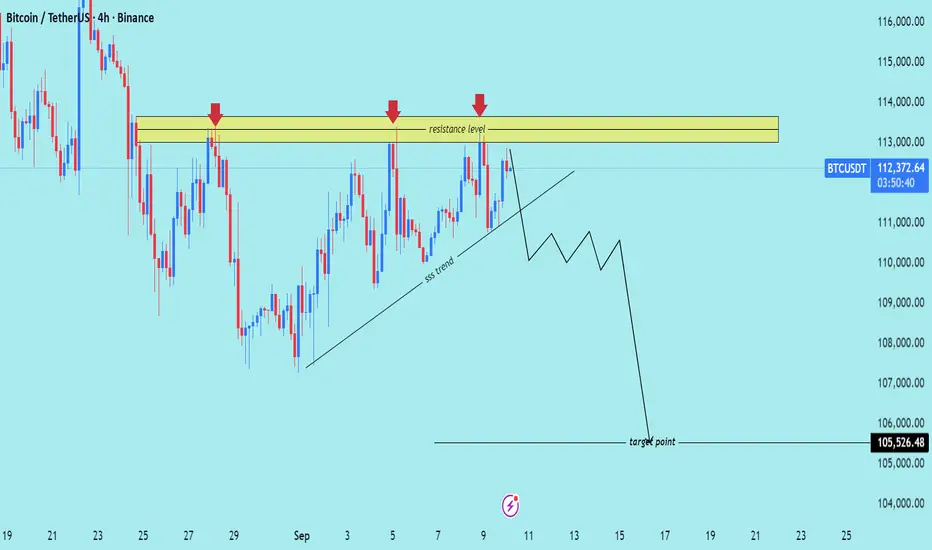

Technical analysis of Bitcoin (BTC/USDT) on the 4H timeframe.

---

Technical Breakdown – Bitcoin (4H)

1. Resistance Zone

Strong resistance level between $113,000 – $114,000 (highlighted yellow).

Price has tested this zone three times (red arrows), showing clear seller strength and liquidity rejection.

2. Structure Trendline

Market is following a short-term ascending support trendline.

Current projection suggests this trendline may break, which would signal a shift in momentum to bearish.

3. Bearish Outlook

If resistance continues to hold, a trendline breakdown could trigger strong downside momentum.

Target Point: $105,526.48 – a major demand zone where liquidity sits.

4. Trading Plan Idea

Entry: On rejection at $113K–$114K zone or confirmation of trendline break.

Stop Loss: Above $114,500 (to protect from false breakouts).

Take Profit: $105,526.48

---

Summary

Bias: Bearish

Reason: Multiple resistance rejections + trendline vulnerability.

Setup: Look for shorts from resistance or after trendline break → Target $105.5K zone.

Mr SMC Trading point

---

This setup is a classic SMC bearish scenario: liquidity trapped at resistance → trendline break → expansion down to collect liquidity at lower demand.

Please support boost 🚀 this analysis

Technical analysis of Bitcoin (BTC/USDT) on the 4H timeframe.

---

Technical Breakdown – Bitcoin (4H)

1. Resistance Zone

Strong resistance level between $113,000 – $114,000 (highlighted yellow).

Price has tested this zone three times (red arrows), showing clear seller strength and liquidity rejection.

2. Structure Trendline

Market is following a short-term ascending support trendline.

Current projection suggests this trendline may break, which would signal a shift in momentum to bearish.

3. Bearish Outlook

If resistance continues to hold, a trendline breakdown could trigger strong downside momentum.

Target Point: $105,526.48 – a major demand zone where liquidity sits.

4. Trading Plan Idea

Entry: On rejection at $113K–$114K zone or confirmation of trendline break.

Stop Loss: Above $114,500 (to protect from false breakouts).

Take Profit: $105,526.48

---

Summary

Bias: Bearish

Reason: Multiple resistance rejections + trendline vulnerability.

Setup: Look for shorts from resistance or after trendline break → Target $105.5K zone.

Mr SMC Trading point

---

This setup is a classic SMC bearish scenario: liquidity trapped at resistance → trendline break → expansion down to collect liquidity at lower demand.

Please support boost 🚀 this analysis

(Services:✔️ JOIN Telegram channel

t.me/SMCTrading_point

Gold trading signals 🚀 99%

t.me/SMCTrading_point

Join my recommended broker , link 👇

World best broker exness ✅D

one.exnesstrack.org/a/l1t1rf3p6v

t.me/SMCTrading_point

Gold trading signals 🚀 99%

t.me/SMCTrading_point

Join my recommended broker , link 👇

World best broker exness ✅D

one.exnesstrack.org/a/l1t1rf3p6v

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

(Services:✔️ JOIN Telegram channel

t.me/SMCTrading_point

Gold trading signals 🚀 99%

t.me/SMCTrading_point

Join my recommended broker , link 👇

World best broker exness ✅D

one.exnesstrack.org/a/l1t1rf3p6v

t.me/SMCTrading_point

Gold trading signals 🚀 99%

t.me/SMCTrading_point

Join my recommended broker , link 👇

World best broker exness ✅D

one.exnesstrack.org/a/l1t1rf3p6v

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.