Hello, fellow seekers.

The purpose of this post is not to predict the future with certainty, but to share a perspective—one piece of an infinitely complex and beautiful puzzle. My only goal here is to shine a light on what I see in the charts, hoping it may help illuminate the path for others. What resonates is for you; what doesn't, you may leave behind.

This idea will find the eyes it is meant for.

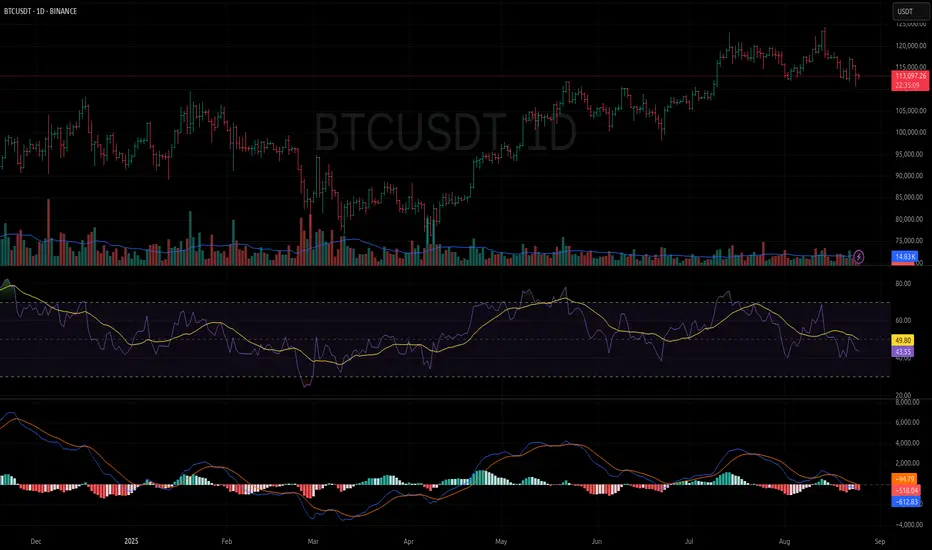

The Technical Landscape: A Daily Chart Perspective on BTCUSDT

After a significant upward movement, the energy on the daily timeframe for Bitcoin appears to be shifting. I do not believe this is a call for a prolonged bear market, but rather an observation of a healthy and necessary exhale before the next inhale. As I see it, the bulls are simply sharpening their horns and cleaning their hoofs for the next phase.

Here's what the chart suggests to me:

Slowing Momentum: My indicators, which are designed to be aware of higher timeframe context, are showing signs of waning bullish momentum. As you can see in the lower panels, both the MACD and RSI suggest that the initial burst of buying pressure is subsiding for now.

Price Action & Profit Taking: The recent price action shows some indecision, which is expected. This is a natural part of any market cycle. After a strong run, early participants will look to secure gains, creating temporary overhead supply and allowing the market to find a new, more stable equilibrium.

Potential Targets: Based on momentum and market structure, I see a potential retracement to two key areas:

The Psychological $100,000 Level: A natural magnet for price and a common area for a retest before a potential continuation.

The Bu-OB Demand Zone ($80k - $90k): The green box on my chart highlights a previous area of consolidation and order flow. This would be a high-probability area for buyers to step back in with conviction.

A Potential Short Setup

For those whose personal trading plan aligns with this perspective, a favorable short setup appears to be forming with a quality risk-to-reward ratio.

Bias: Short-Term Bearish / Corrective

Entry: Around current levels (~$113,000 - $114,000)

Stop Loss: A defined stop above the recent swing high at ~$126,500 is crucial. Risk management is our anchor in the stormy seas of probability.Take Profit: Targeting the ~$89,000 - $100,000 area. As shown on the chart, this provides a favorable risk/reward ratio of nearly 1:2.

The Philosophy Behind the Chart

We are not here to force our will upon the market, but to flow with it. This potential downturn is not a negative event; it's the market breathing. By detaching from the outcome—from the ego's need to be "right"—we can focus on a clear process and execute our plan with tranquility.

This analysis is my contribution. It is not an attempt to sell anything or gather followers, but to connect and share a part of my own journey. In doing so, we help each other see the whole picture, the Great Puzzle, more clearly.

Just shine.

Disclaimer: This is not financial advice. It is for educational and informational purposes only. Please conduct your own research and manage your risk accordingly.

Note

lol @ having wrapped this in pine accidentallyTrade active

Hello again. Let's discuss the mid-day price action in BTC and why my approach here is different from the SPY trade.We've seen extreme volatility today, with a sharp dip followed by an equally sharp recovery. This is the beast of crypto trading. Many would be chopped up here, but this price action is actually giving us valuable information: BTC is in a classic trading range.

A Note on Crypto Volatility & Position Sizing

Before I explain the strategy, a crucial point on risk: if you cannot stomach a 20% intraday swing without an emotional reaction, you should not be trading crypto. You must accept its nature. My core philosophy is that your P&L should never dictate your emotional state. If it does, your position size is too large.

How large should it be? I size my trades so that a 20% swing feels like gentle waves in a calm lake. For most, this means trading tiny.

The Al Brooks Approach: Embracing the Range

In these conditions, I draw heavily from the wisdom of price action masters like Al Brooks. His core teaching is that markets spend most of their time in ranges, and most breakout attempts from these ranges will fail.

The strategy isn't to predict the breakout, but to capitalize on the equilibrium. This is a "Buy Low, Sell High, and Scalp" (BLSHS) environment. Since my broader thesis is bearish, my focus is on the "Sell High" aspect.

Therefore, my plan is as follows:

- []I am staying in this short trade.[]I will look to patiently build a larger short position by scaling in with small additions if the price pushes back towards the top of the current range.

- While building the larger "swing" position, I will look to scalp for quick profits on moves back down toward the range lows.

This is an advanced technique that requires wider stops but is managed through very disciplined, small entries. It's a patient approach for a patient market.

We are not fighting the chop; we are flowing with it. This is one of many tools a #limitlessTrader uses to adapt to ever-changing market conditions.

Just shine.

Note

Averaged is around 113.490's. A brief note on our BTC short idea as we head into the weekend. The plan is unfolding, the market is expressing itself with clarity, and all is well.

But with the holiday weekend upon us, now is the time for the most important trade you can make: turn off the charts. Step away from the noise and anchor yourself in the present moment.

We spend our days looking at numbers on a screen, but it's crucial to remember a simple truth: the cheap things in life have price tags. The priceless things—a moment of laughter, a shared story, a quiet presence with those you love—do not.

Each of these moments is fleeting. It comes, it goes, and it will never return in the same way again. Yet, it exists forever in the fabric of our lives. Cherish it.

Whatever boundaries you encountered this week, know that there are those who thrive on turning such limits into stepping stones. Rest, recharge, and remember what you're truly working for.

As a wise man once said...

"Where we are going, there are no limits." - Doc

Enjoy the priceless moments. Have a wonderful and restful weekend.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.