https://www.tradingview.com/x/HYxtLn7L/

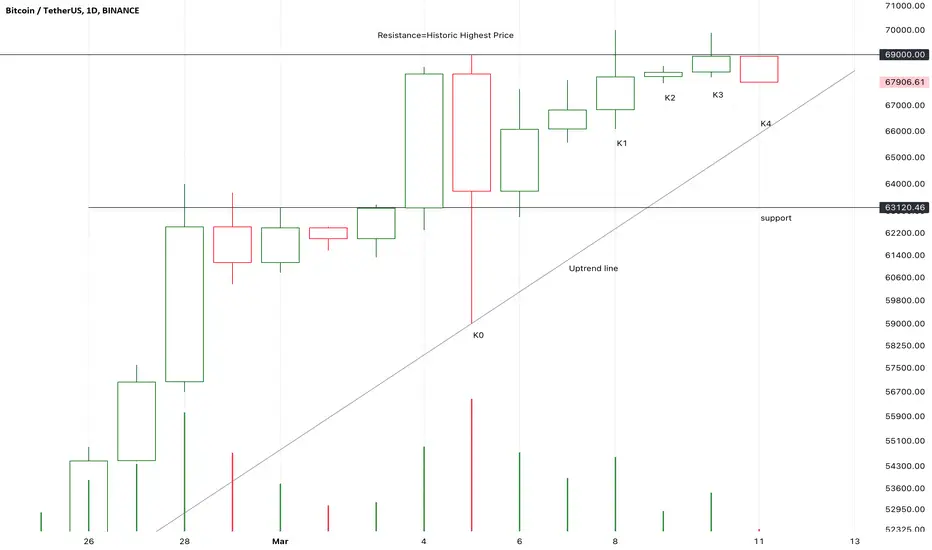

After K0 and K1 tested and verified the resistance,

K3 tested the resistance for a third time.

And finally, K3 failed to create a higher high.

So, the possibility of the following candles fall back to test the support increased.

On the other hand, there are also good signals here.

The supply pressure is low here.

If K4 close upon K3 immediately,

It is also reasonable.

And, if K4 break up the highest price of K3 or K1,

It still worth to buy in.

After K0 and K1 tested and verified the resistance,

K3 tested the resistance for a third time.

And finally, K3 failed to create a higher high.

So, the possibility of the following candles fall back to test the support increased.

On the other hand, there are also good signals here.

The supply pressure is low here.

If K4 close upon K3 immediately,

It is also reasonable.

And, if K4 break up the highest price of K3 or K1,

It still worth to buy in.

Note

K2 tested the historic highest price and the potential uptrend line for a first time.

The demand and supply pressure are at the same level.

So, it is likely that the following candles will keep pricing up.

It is still safe to hold for a longer time.

K1 and K2 is a bearish harami pattern.

It is also possibly that a consolidate process will start from K2.

The first 4 hours of K3 may provide more signals.

Note

From K1 to K4,

The supply pressure keep at high level,

And finally, K4 could created a lower low.

If K5 couldn’t close upon K1,

A large scale price correction process will come up.

On the other hand,

The demand pressure is also increasing,

K4 tested the support for a second time and created a higher high.

So, it is still safe temporarily.

I am waiting for more signals to verify which side is stronger.

If K5 test the upper price of K2 and even close below the support,

The risk will increase.

Note

K2 and K3 tested the support under increased volume,

It is not a successful test,

And it is an early warning signal.

The strong uptrend momentum had turned to be more neutral.

It is most likely that,

A large scale price correction process had started from K0.

If the following candles price up to test 73000 area or the uptrend line,

It will be a good place to decrease long positions if there are signals of weakness.

Note

K1 to K3 is a strong bearish three soldiers advancing pattern,

And the supply or demand is decreasing.

If the following candles return back upon K3,

The short term downtrend will be reversed.

If not,

There will be a second test to verify the support.

And the following candles even keep dropping to test 60K.

I can do nothing here, but waiting for more signals.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.