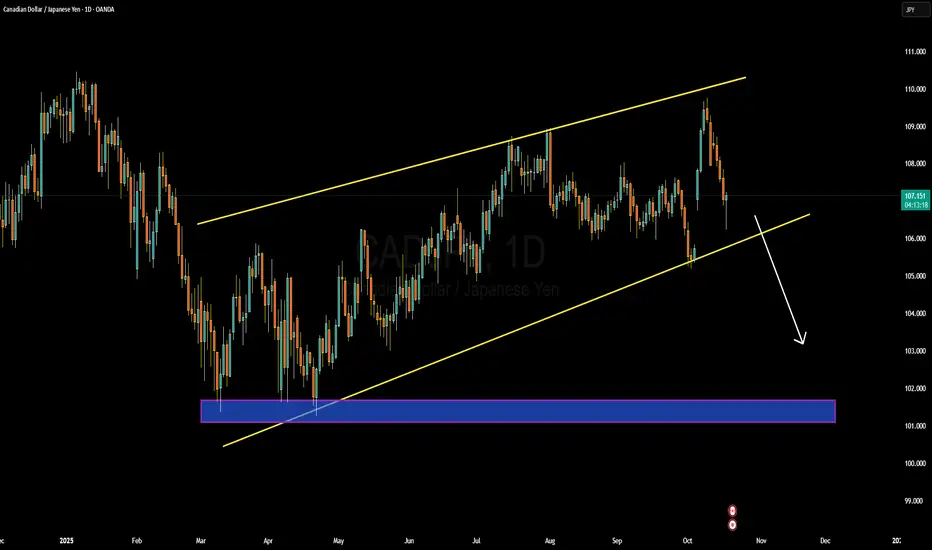

CADJPY is currently trading within a clear ascending channel, and price is pulling back after rejecting the upper boundary near the 110.00 psychological level. The recent bearish momentum suggests that buyers are taking profit, allowing sellers to regain short-term control. I’m watching for price to continue drifting toward the channel’s lower support near 105.50–106.00. If this support breaks with strong volume, it opens the door for a deeper drop into the major demand zone around 101.50–102.50, which aligns with previous liquidity sweeps and institutional footprints.

From a fundamental perspective, CAD has been under slight pressure due to softer crude oil demand and growing expectations that the Bank of Canada may shift to a more accommodative stance if economic slowdown deepens. Meanwhile, the Japanese yen remains broadly weak as the Bank of Japan maintains negative interest rates, but risk-off sentiment and rising geopolitical tensions could temporarily strengthen JPY through safe-haven flows. That makes this pair vulnerable to corrective downside despite the broader bullish structure.

I’ll be monitoring price action closely once price reaches the lower boundary of the channel. A clean rejection from that zone will provide a high-probability buy setup to ride the continuation of the long-term trend. But a confirmed breakdown will flip this structure into a bearish reversal, making the 102.00 liquidity pool a prime target. Patience and precision are key — this setup has profit written all over it once confirmation aligns with fundamentals.

From a fundamental perspective, CAD has been under slight pressure due to softer crude oil demand and growing expectations that the Bank of Canada may shift to a more accommodative stance if economic slowdown deepens. Meanwhile, the Japanese yen remains broadly weak as the Bank of Japan maintains negative interest rates, but risk-off sentiment and rising geopolitical tensions could temporarily strengthen JPY through safe-haven flows. That makes this pair vulnerable to corrective downside despite the broader bullish structure.

I’ll be monitoring price action closely once price reaches the lower boundary of the channel. A clean rejection from that zone will provide a high-probability buy setup to ride the continuation of the long-term trend. But a confirmed breakdown will flip this structure into a bearish reversal, making the 102.00 liquidity pool a prime target. Patience and precision are key — this setup has profit written all over it once confirmation aligns with fundamentals.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.