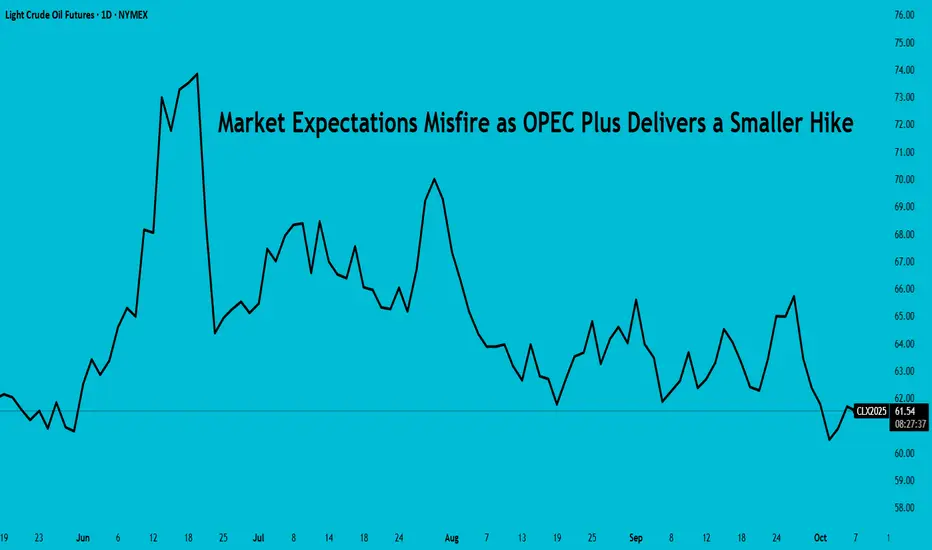

OPEC+ surprised markets on 05/Oct (Sun) with a smaller-than-expected output hike, triggering a rebound in crude prices the following day. In contrast, WTI had trended lower the previous week amid expectations of a larger supply increase, rising U.S. inventories, and cautious sentiment.

This paper examines the volatility surrounding OPEC+ meetings, highlighting how market expectations often diverge from actual decisions, driving sharp price swings and uncertainty.

WTI HIT 4-MONTH LOW ON OPEC+ HIKE SPECULATION

WTI crude oil futures fell 7.4% in the week ending on 03/Oct, with prices falling for four consecutive sessions between 29/Sep – 02/Oct. The decline was driven by expectations of a significant increase in OPEC+ supply.

OPEC+ surprised markets by announcing a modest 137,000 bpd output hike for November, matching October’s increase.

The markets initially anticipated a much larger adjustment for November, with speculation centering on a potential 500,000 bpd hike as Saudi Arabia pushed to regain market share.

Although OPEC dismissed media reports on X of such a move as “misleading,” traders continued to price in the possibility of a sizeable increase.

Source: CME Group OPEC+ Watch Tool as of markets on 3rd October 2025

Notably, CME’s OPEC Watch tool reflected a bearish sentiment on 03/Oct (Fri).

Source: CME Group OPEC+ Watch Tool as of markets on 3rd October 2025

Until 26/Sep, the consensus leaned toward a pause or small hike. However, since then, expectations for a moderate or significant increase rose sharply, adding further downward pressure on crude prices.

Nonetheless, the cartel’s decision was a surprise. According to Reuters, this was caused by internal disagreements between Russia and Saudi Arabia.

Russia pushed for a smaller hike to avoid pressuring prices, as sanctions limit its ability to raise output. Saudi Arabia, with ample spare capacity, preferred a larger increase to regain its market share more quickly.

Overall, OPEC+ maintained a positive outlook on the global economy, citing steady growth, healthy market fundamentals, and low oil inventories.

LOW INVENTORIES AND SOFTER U.S. OUTPUT OFFER SUPPORT FOR WTI

Amid expectations of a larger OPEC+ supply hike, WTI also faced pressure from cautious market sentiment as the U.S. government shutdown persisted, and weak economic data weighed on demand outlook.

However, prices found support from persistently low U.S. crude inventories, which remain well below the five-year average and near the lower end of the historical range.

Source: EIA

Despite a slight weekly build, overall supply conditions remain tight. With WTI prices easing, U.S. production has also edged lower, a trend that could further restrict inventory growth and lend near-term support to crude prices.

CONCLUSION

OPEC+ controls more than half of the global oil supply, making its output decisions a major driver of crude prices.

Source: CME’s CVOL Index

Since the group began unwinding supply cuts in 2025, each meeting has triggered noticeable price swings, underscoring the market’s sensitivity to these decisions.

Source: TradingView

While mapping price direction is challenging, options allow traders to gain exposure without directly owning the commodity. They provide flexibility to capitalise on increased volatility around OPEC+ meetings.

The following examples illustrate how options can be strategically used:

Long Call: Seeing the inventory lag, a trader could have taken a bullish stance on the OPEC meeting outcome through a long call on WTI Crude Monday weekly options. On 02/Oct (Thu), the option had settled at USD 0.77 per barrel, implying a premium of USD 770 per lot (contract size = 1,000). By 06/Oct (Mon), after a bullish OPEC outcome had lifted crude prices, the option traded at USD 1.12 per barrel as of 4 AM ET. A single-lot position would have gained USD 350 (USD 1,120 – USD 770). This showed a strong return relative to risk, with losses limited to the premium paid. It underscored how weekly options allowed precise positioning around specific events.

Long Put: Expecting a strong output hike from OPEC+, a trader could have taken a long put position on WTI Crude Monday weekly options. On 02/Oct (Thu), the option had settled at USD 1.07 per barrel, or USD 1,070 per lot (contract size = 1,000 barrels). By 06/Oct (Mon), after OPEC+ announced a smaller-than-expected output hike, the option traded at USD 0.01 per barrel as of 4 AM ET. A single-lot position would have lost USD 1,060 (USD 1,070 – USD 10). Although the trade resulted in a loss, the downside was limited to the option premium. In contrast, holding a futures position in the same direction would have led to significantly larger losses.

Overall, options allow traders to participate in volatile price movements while keeping potential losses limited, making them a valuable tool for strategic positioning around uncertainty.

This content is sponsored.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

This paper examines the volatility surrounding OPEC+ meetings, highlighting how market expectations often diverge from actual decisions, driving sharp price swings and uncertainty.

WTI HIT 4-MONTH LOW ON OPEC+ HIKE SPECULATION

WTI crude oil futures fell 7.4% in the week ending on 03/Oct, with prices falling for four consecutive sessions between 29/Sep – 02/Oct. The decline was driven by expectations of a significant increase in OPEC+ supply.

OPEC+ surprised markets by announcing a modest 137,000 bpd output hike for November, matching October’s increase.

The markets initially anticipated a much larger adjustment for November, with speculation centering on a potential 500,000 bpd hike as Saudi Arabia pushed to regain market share.

Although OPEC dismissed media reports on X of such a move as “misleading,” traders continued to price in the possibility of a sizeable increase.

Source: CME Group OPEC+ Watch Tool as of markets on 3rd October 2025

Notably, CME’s OPEC Watch tool reflected a bearish sentiment on 03/Oct (Fri).

Source: CME Group OPEC+ Watch Tool as of markets on 3rd October 2025

Until 26/Sep, the consensus leaned toward a pause or small hike. However, since then, expectations for a moderate or significant increase rose sharply, adding further downward pressure on crude prices.

Nonetheless, the cartel’s decision was a surprise. According to Reuters, this was caused by internal disagreements between Russia and Saudi Arabia.

Russia pushed for a smaller hike to avoid pressuring prices, as sanctions limit its ability to raise output. Saudi Arabia, with ample spare capacity, preferred a larger increase to regain its market share more quickly.

Overall, OPEC+ maintained a positive outlook on the global economy, citing steady growth, healthy market fundamentals, and low oil inventories.

LOW INVENTORIES AND SOFTER U.S. OUTPUT OFFER SUPPORT FOR WTI

Amid expectations of a larger OPEC+ supply hike, WTI also faced pressure from cautious market sentiment as the U.S. government shutdown persisted, and weak economic data weighed on demand outlook.

However, prices found support from persistently low U.S. crude inventories, which remain well below the five-year average and near the lower end of the historical range.

Source: EIA

Despite a slight weekly build, overall supply conditions remain tight. With WTI prices easing, U.S. production has also edged lower, a trend that could further restrict inventory growth and lend near-term support to crude prices.

CONCLUSION

OPEC+ controls more than half of the global oil supply, making its output decisions a major driver of crude prices.

Source: CME’s CVOL Index

Since the group began unwinding supply cuts in 2025, each meeting has triggered noticeable price swings, underscoring the market’s sensitivity to these decisions.

Source: TradingView

While mapping price direction is challenging, options allow traders to gain exposure without directly owning the commodity. They provide flexibility to capitalise on increased volatility around OPEC+ meetings.

The following examples illustrate how options can be strategically used:

Long Call: Seeing the inventory lag, a trader could have taken a bullish stance on the OPEC meeting outcome through a long call on WTI Crude Monday weekly options. On 02/Oct (Thu), the option had settled at USD 0.77 per barrel, implying a premium of USD 770 per lot (contract size = 1,000). By 06/Oct (Mon), after a bullish OPEC outcome had lifted crude prices, the option traded at USD 1.12 per barrel as of 4 AM ET. A single-lot position would have gained USD 350 (USD 1,120 – USD 770). This showed a strong return relative to risk, with losses limited to the premium paid. It underscored how weekly options allowed precise positioning around specific events.

Long Put: Expecting a strong output hike from OPEC+, a trader could have taken a long put position on WTI Crude Monday weekly options. On 02/Oct (Thu), the option had settled at USD 1.07 per barrel, or USD 1,070 per lot (contract size = 1,000 barrels). By 06/Oct (Mon), after OPEC+ announced a smaller-than-expected output hike, the option traded at USD 0.01 per barrel as of 4 AM ET. A single-lot position would have lost USD 1,060 (USD 1,070 – USD 10). Although the trade resulted in a loss, the downside was limited to the option premium. In contrast, holding a futures position in the same direction would have led to significantly larger losses.

Overall, options allow traders to participate in volatile price movements while keeping potential losses limited, making them a valuable tool for strategic positioning around uncertainty.

This content is sponsored.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Full Disclaimer - linktr.ee/mintfinance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Full Disclaimer - linktr.ee/mintfinance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.