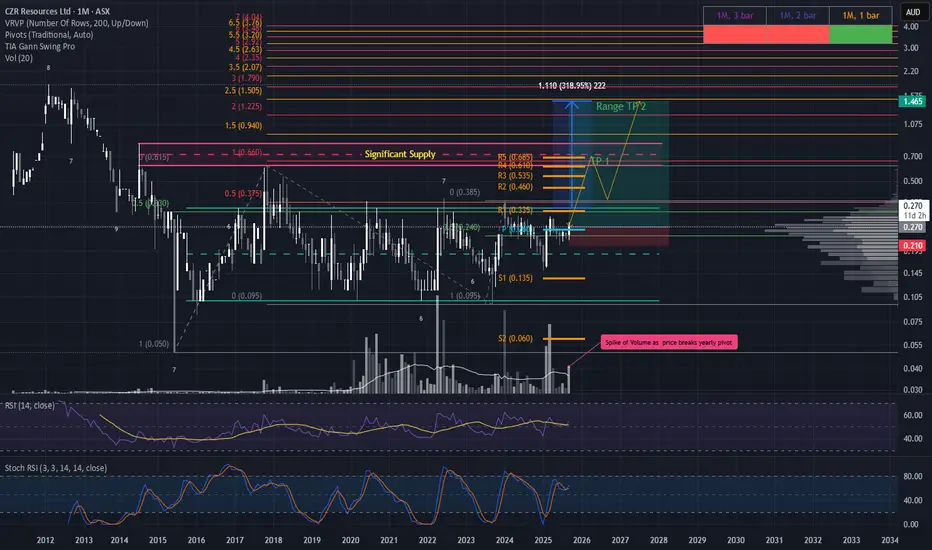

CZR is shaping up for a potential macro range breakout, and while the technicals are compelling, it's critical to acknowledge the elevated risk profile. As a nanocap, CZR demands disciplined risk management and precise position sizing.

Setup Options

Option 1: Aggressive Breakout Anticipation

Enter early if the current monthly candle closes above the yearly pivot ($0.26).

Stop Loss: $0.210 (tight and tactical).

Target: Initial TP at ~$0.70 (major supply zone), with full TP at the 100% macro range extension.

Option 2: Confirmation & Pullback Entry

Wait for a confirmed breakout and close above the range.

Enter on the first clean pullback.

Stop Loss: Based on structure formed during the pullback (can use the SL).

Target: Same as Option 1 — ~$0.70 and full range extension.

Option 3: Deeper Pullback & Reassessment

If price retraces deeper into the range, reassess the setup.

Look for signs of strength (e.g., volume spike, bullish divergence) before re-engaging particularly ~$0.135

This scenario may offer a better R:R if structure holds.

*please note arrows are not based on time analysis just market structure.

Setup Options

Option 1: Aggressive Breakout Anticipation

Enter early if the current monthly candle closes above the yearly pivot ($0.26).

Stop Loss: $0.210 (tight and tactical).

Target: Initial TP at ~$0.70 (major supply zone), with full TP at the 100% macro range extension.

Option 2: Confirmation & Pullback Entry

Wait for a confirmed breakout and close above the range.

Enter on the first clean pullback.

Stop Loss: Based on structure formed during the pullback (can use the SL).

Target: Same as Option 1 — ~$0.70 and full range extension.

Option 3: Deeper Pullback & Reassessment

If price retraces deeper into the range, reassess the setup.

Look for signs of strength (e.g., volume spike, bullish divergence) before re-engaging particularly ~$0.135

This scenario may offer a better R:R if structure holds.

*please note arrows are not based on time analysis just market structure.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.