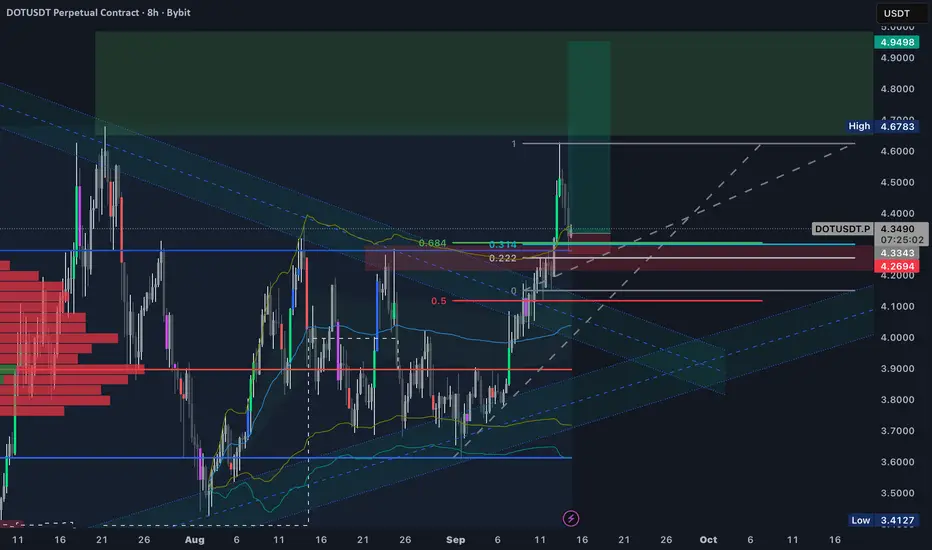

DOT is currently attacking a new high, but the question is whether this move is a true breakout or just a liquidity grab.

This time I’m looking for a quick long setup.

My main zone of interest is 4.25–4.31.

This area lines up with multiple previous highs, which I now consider potential new support. It also includes:

• the 0.314–0.222 retracement from the latest pump,

• the 0.684 level (inverse of 0.314 from the bottom),

• the highest anchored VWAP line.

On top of that, divergences on RSI (14) and MACD (12:26) suggest price could push higher.

We’ve already tested the triangle breakout, so I believe that phase of interest is over. From here, price may dip slightly lower, but it doesn’t have to. A ~3% move against the position is acceptable.

I’m already in the trade.

If DOT retests the 4.25–4.31 zone, I see it as a strong buying opportunity.

Target: At least a new local high around 4.70, where I’ll take my first partial profit.

This time I’m looking for a quick long setup.

My main zone of interest is 4.25–4.31.

This area lines up with multiple previous highs, which I now consider potential new support. It also includes:

• the 0.314–0.222 retracement from the latest pump,

• the 0.684 level (inverse of 0.314 from the bottom),

• the highest anchored VWAP line.

On top of that, divergences on RSI (14) and MACD (12:26) suggest price could push higher.

We’ve already tested the triangle breakout, so I believe that phase of interest is over. From here, price may dip slightly lower, but it doesn’t have to. A ~3% move against the position is acceptable.

I’m already in the trade.

If DOT retests the 4.25–4.31 zone, I see it as a strong buying opportunity.

Target: At least a new local high around 4.70, where I’ll take my first partial profit.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.