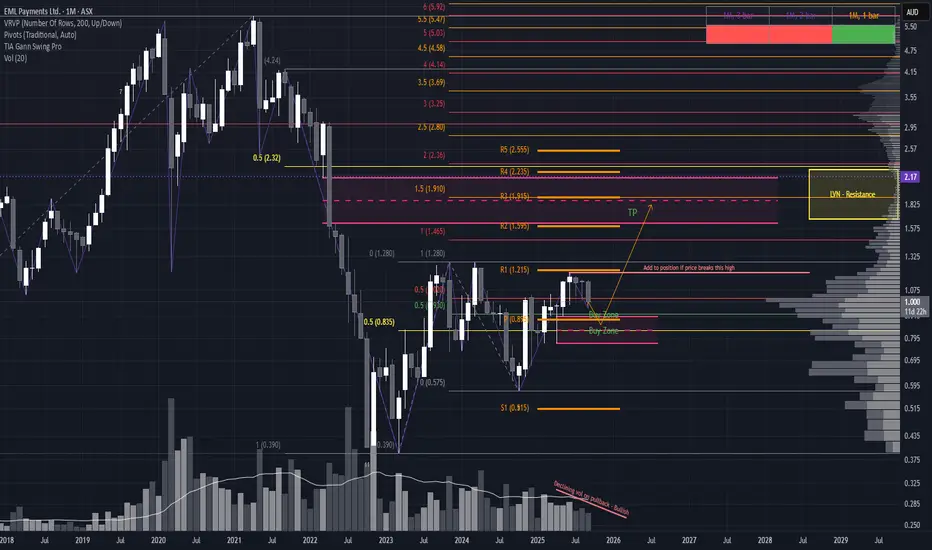

Another promising setup is forming on EML. As always, keep in mind this is a small-cap play, so risk management is key. While the monthly uptrend isn’t yet fully established, the current structure offers multiple trade scenarios worth watching.

Trade Scenarios

1. Conservative Breakout Entry For those preferring confirmation, a long entry could be triggered on a clean break and close above $1.195 (as highlighted on the chart).

Stop Loss: Below the newly formed swing low

Target: $1.825, where notable resistance resides

2. Ideal Pullback Entry The optimal setup would be a pullback into a strong Area of Interest, supported by:

50% range retracement

Yearly pivot

Demand structure from the large April wick

If price forms a hammer/bullish candle in this zone, it could signal a high-probability reversal and offer a strong entry point.

SL placement depends on candle structure, but should invalidate below the demand zone

🎯 TP remains at $1.825, aligning with historical resistance

Trade Scenarios

1. Conservative Breakout Entry For those preferring confirmation, a long entry could be triggered on a clean break and close above $1.195 (as highlighted on the chart).

Stop Loss: Below the newly formed swing low

Target: $1.825, where notable resistance resides

2. Ideal Pullback Entry The optimal setup would be a pullback into a strong Area of Interest, supported by:

50% range retracement

Yearly pivot

Demand structure from the large April wick

If price forms a hammer/bullish candle in this zone, it could signal a high-probability reversal and offer a strong entry point.

SL placement depends on candle structure, but should invalidate below the demand zone

🎯 TP remains at $1.825, aligning with historical resistance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.