ENAUSDT 4H Chart Analysis | Bullish Breakout Setup in Focus

🔍 Let’s dive into the ENAUSDT perpetual contract and analyze the recent price action, spotlighting key technical signals and a potential breakout scenario.

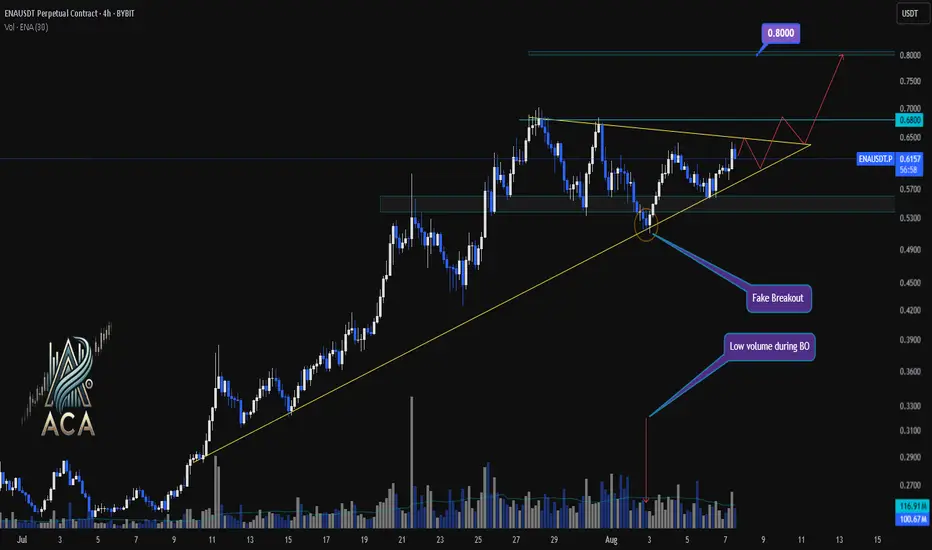

⏳ 4-Hour Overview

The 4-hour chart shows ENAUSDT consolidating above a critical ascending trendline, with price action tightening into a symmetrical triangle formation. Multiple attempts to break down have resulted in a fake breakout, as indicated by low volume during the breakdown — a classic sign of seller exhaustion.

🔺 Bullish Breakout Setup:

On the upside, a confirmed breakout above the $0.6800 resistance could pave the way for a bullish continuation towards the $0.8000 target zone. The structure suggests increasing buying pressure as long as price holds above the trendline and key support ($0.6050).

📊 Key Highlights:

- Price retested the ascending trendline; buyers defended it aggressively.

- A fake breakout with low volume suggests trap for bears and quick recovery by bulls.

- The next major resistance comes at $0.6800, with a projected target at $0.8000 upon breakout.

- Short-term support sits at $0.6050. Price action above this level remains constructive.

🚨 Conclusion:

Watch for a decisive move beyond triangle resistance. A high-volume breakout above $0.6800 could trigger a sharp move toward $0.8000. Bulls are building momentum — keep an eye on volume to confirm breakout strength.

🔍 Let’s dive into the ENAUSDT perpetual contract and analyze the recent price action, spotlighting key technical signals and a potential breakout scenario.

⏳ 4-Hour Overview

The 4-hour chart shows ENAUSDT consolidating above a critical ascending trendline, with price action tightening into a symmetrical triangle formation. Multiple attempts to break down have resulted in a fake breakout, as indicated by low volume during the breakdown — a classic sign of seller exhaustion.

🔺 Bullish Breakout Setup:

On the upside, a confirmed breakout above the $0.6800 resistance could pave the way for a bullish continuation towards the $0.8000 target zone. The structure suggests increasing buying pressure as long as price holds above the trendline and key support ($0.6050).

📊 Key Highlights:

- Price retested the ascending trendline; buyers defended it aggressively.

- A fake breakout with low volume suggests trap for bears and quick recovery by bulls.

- The next major resistance comes at $0.6800, with a projected target at $0.8000 upon breakout.

- Short-term support sits at $0.6050. Price action above this level remains constructive.

🚨 Conclusion:

Watch for a decisive move beyond triangle resistance. A high-volume breakout above $0.6800 could trigger a sharp move toward $0.8000. Bulls are building momentum — keep an eye on volume to confirm breakout strength.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.