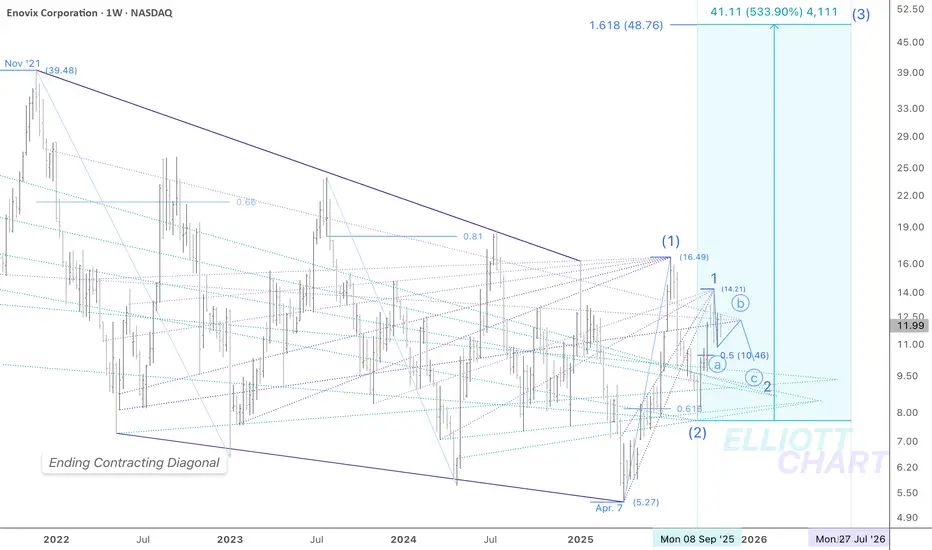

Based on the Quantum Model illustrated on the chart, since late 2021,

Wave Analysis — Weekly

The recent breakouts from this structure mark a clear shift in market dynamics, with an Impulsive Int. Wave (1) followed by its retracement in Int. Wave (2), and the emergence of Minor Wave 1 with an ongoing subsequent Wave 2 correction.

The evolving wave formation confirms a well-structured transition from accumulation to expansion, implying the initiation of Intermediate Impulsive Wave (3) — setting the stage for a sustained bullish trend, likely starting in early 2026!

The target aligns with the 1.618 Fibonacci extension, near $48.76🎯, representing a potential ~533%📈 advance projected into late July.

🔖 It’s worth noting that the equivalence lines form a core component of my personal framework, which I apply through my Quantum Models methodology.

💨🪁 Feel free to leave a comment if you’re interested in exploring this bullish alternate scenario in greater detail.

#CreationOfPossibilities #QuantumModels #EquivalenceLines #Targeting #TradingView #StocksToWatch #MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #Investing

#Enovix #SiliconAnode #BatteryTech #EVBattery #ShortSqueeze #ENVX #leadgeneration #lithiumIonbattery

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.