Macro drivers to watch (ET)

Setups (Level-KZ Protocol — 15m→5m→1m; NY kill-zones preferred)

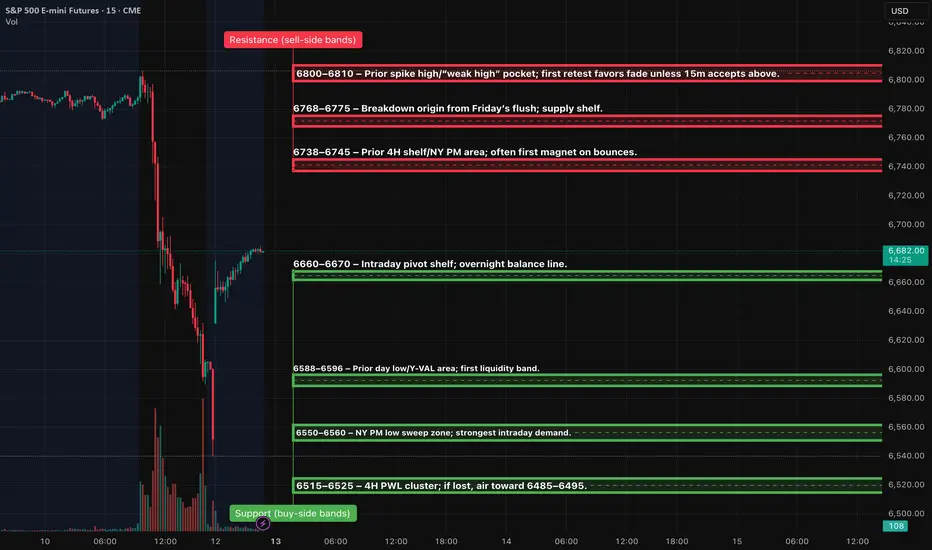

TIER-1 (A++) — Rejection Short at 6790–6810 (NY AM)

Trigger: 15m full-body fails to hold above 6790–6810 → 5m prints a lower-high and re-closes back inside → 1m first pullback “pop-and-fail”.

Entry: 6796–6803 on the 1m failure.

Invalidation: Hard SL above the 15m fail-wick (guide 6814).

TPs: TP1 6738–6745, TP2 6690–6700, TP3 6625–6635.

TIER-1 (A++) — Quick-Reclaim Long at 6550–6560 (Asia/London → carry to NY)

Trigger: Liquidity sweep into 6550–6560, immediate 15m re-close back above 6600, 5m holds ≥6620, 1m higher-low entry.

Entry: 6602–6610 on the first pullback that holds.

Invalidation: Hard SL below the 15m sweep-low (guide 6544).

TPs: TP1 6690–6700, TP2 6738–6745, TP3 6768–6775.

TIER-2 (A+ Bounce) — 6590–6596 fast reclaim

Trigger: Wick through 6590–96 that immediately reclaims ≥6620 on 5m.

Entry/SL: Enter 6615–6622; SL below sweep-low −0.5pt.

Targets: 6690 then 6738–45. ¾ size.

TIER-3 (A Bounce) — 6515–6525 exhaustion flush

Trigger: Capitulation into the 4H PWL band with 15m reversal signal.

Entry/SL: Scale inside the band; SL below the 15m reversal wick.

Targets: 6590–96 then 6690. ½ size; only first touch.

- Powell (NABE) — Tue 10/14 ~12:20. Markets will parse tone on growth/inflation. (Fed official calendar confirms time & venue.)

- PPI (Sep) — Thu 10/16 8:30. First major U.S. inflation print of the week. (BLS “Next Release”.)

- Advance Retail Sales (Sep) — Thu 10/16 8:30. Key read on demand into holiday season. (Census “MARTS” note; FRED release calendar.)

- CPI (Sep) — not this week; rescheduled to Fri 10/24 8:30 due to the shutdown. (BLS reschedule notice; CPI schedule.)

- Earnings kick-off (could move ES): JPM Tue 10/14, BAC Wed 10/15. (Company IR pages/press.)

- Market conditions: U.S. bond market closed Mon 10/13 (liquidity thinner); NYSE equities open. (SIFMA; NYSE hours.)

- Options expiration: standard monthly Fri 10/17. Expect pinning flows. (Cboe 2025 calendar.)

Setups (Level-KZ Protocol — 15m→5m→1m; NY kill-zones preferred)

TIER-1 (A++) — Rejection Short at 6790–6810 (NY AM)

Trigger: 15m full-body fails to hold above 6790–6810 → 5m prints a lower-high and re-closes back inside → 1m first pullback “pop-and-fail”.

Entry: 6796–6803 on the 1m failure.

Invalidation: Hard SL above the 15m fail-wick (guide 6814).

TPs: TP1 6738–6745, TP2 6690–6700, TP3 6625–6635.

TIER-1 (A++) — Quick-Reclaim Long at 6550–6560 (Asia/London → carry to NY)

Trigger: Liquidity sweep into 6550–6560, immediate 15m re-close back above 6600, 5m holds ≥6620, 1m higher-low entry.

Entry: 6602–6610 on the first pullback that holds.

Invalidation: Hard SL below the 15m sweep-low (guide 6544).

TPs: TP1 6690–6700, TP2 6738–6745, TP3 6768–6775.

TIER-2 (A+ Bounce) — 6590–6596 fast reclaim

Trigger: Wick through 6590–96 that immediately reclaims ≥6620 on 5m.

Entry/SL: Enter 6615–6622; SL below sweep-low −0.5pt.

Targets: 6690 then 6738–45. ¾ size.

TIER-3 (A Bounce) — 6515–6525 exhaustion flush

Trigger: Capitulation into the 4H PWL band with 15m reversal signal.

Entry/SL: Scale inside the band; SL below the 15m reversal wick.

Targets: 6590–96 then 6690. ½ size; only first touch.

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

Email: info@algoindex.com

Email: info@algoindex.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

Email: info@algoindex.com

Email: info@algoindex.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.