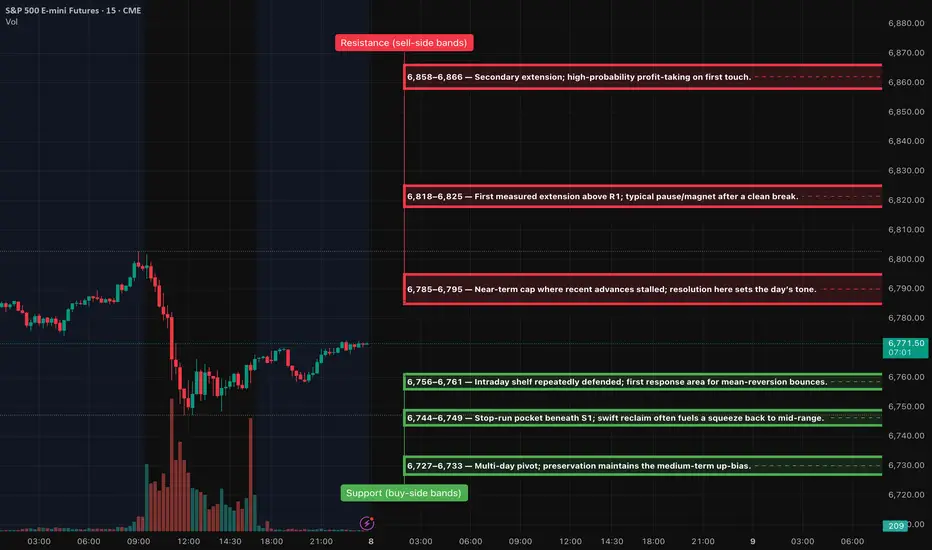

The E-mini S&P 500 (ES) is currently exhibiting a primary uptrend on the higher timeframes while consolidating just below a significant resistance level between 6,785 and 6,795. As we approach the New York morning session, the prevailing expectation is for a range-to-trend expansion, dependent on whether the 6,758–6,795 range is broken. The 6,785–6,795 zone should be regarded as the immediate focal point for decision-making.

Event & Risk Calendar (ET)

• 07:00–07:15 — MBA Mortgage Applications (weekly).

• 10:30 — EIA Weekly Petroleum Status Report (standard Wednesday release).

• 14:00 — FOMC Minutes (Sept 16–17 meeting). Expect volatility expansion on release.

A++ Setups (Tier-1, Level-KZ 15/5/1)

1. Trend-Continuation LONG at R1 break

Trigger: 15-minute full-body close above 6,795, 5-minute pullback holds 6,785–6,795, 1-minute higher-low confirms.

Entry: 6,788–6,795 on the retest/hold.

Invalidation: 15-minute body back below ~6,785.

Targets: TP1 6,818–6,825; TP2 6,858–6,866; TP3 6,898–6,905.

Risk: Hard SL = relevant 15-minute wick low −0.25–0.50 pts; take 70% at TP1, runner to BE; max 2 attempts per level.

2. Rejection-Fade SHORT at R1 failure

Trigger: Probe into 6,785–6,795 fails: 15-minute rejection close back below, 5-minute lower-high forms, 1-minute pullback fails.

Entry: 6,785–6,792 on failure.

Invalidation: 15-minute body acceptance above ~6,795.

Targets: TP1 6,756–6,761; TP2 6,744–6,749; TP3 6,727–6,733.

Risk: Same management as Setup 1 (wick-anchored SL; 70/30 at TP1; max 2 attempts).

Event & Risk Calendar (ET)

• 07:00–07:15 — MBA Mortgage Applications (weekly).

• 10:30 — EIA Weekly Petroleum Status Report (standard Wednesday release).

• 14:00 — FOMC Minutes (Sept 16–17 meeting). Expect volatility expansion on release.

A++ Setups (Tier-1, Level-KZ 15/5/1)

1. Trend-Continuation LONG at R1 break

Trigger: 15-minute full-body close above 6,795, 5-minute pullback holds 6,785–6,795, 1-minute higher-low confirms.

Entry: 6,788–6,795 on the retest/hold.

Invalidation: 15-minute body back below ~6,785.

Targets: TP1 6,818–6,825; TP2 6,858–6,866; TP3 6,898–6,905.

Risk: Hard SL = relevant 15-minute wick low −0.25–0.50 pts; take 70% at TP1, runner to BE; max 2 attempts per level.

2. Rejection-Fade SHORT at R1 failure

Trigger: Probe into 6,785–6,795 fails: 15-minute rejection close back below, 5-minute lower-high forms, 1-minute pullback fails.

Entry: 6,785–6,792 on failure.

Invalidation: 15-minute body acceptance above ~6,795.

Targets: TP1 6,756–6,761; TP2 6,744–6,749; TP3 6,727–6,733.

Risk: Same management as Setup 1 (wick-anchored SL; 70/30 at TP1; max 2 attempts).

If you want to contact me Email: info@algoindex.com or algoindex.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you want to contact me Email: info@algoindex.com or algoindex.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.