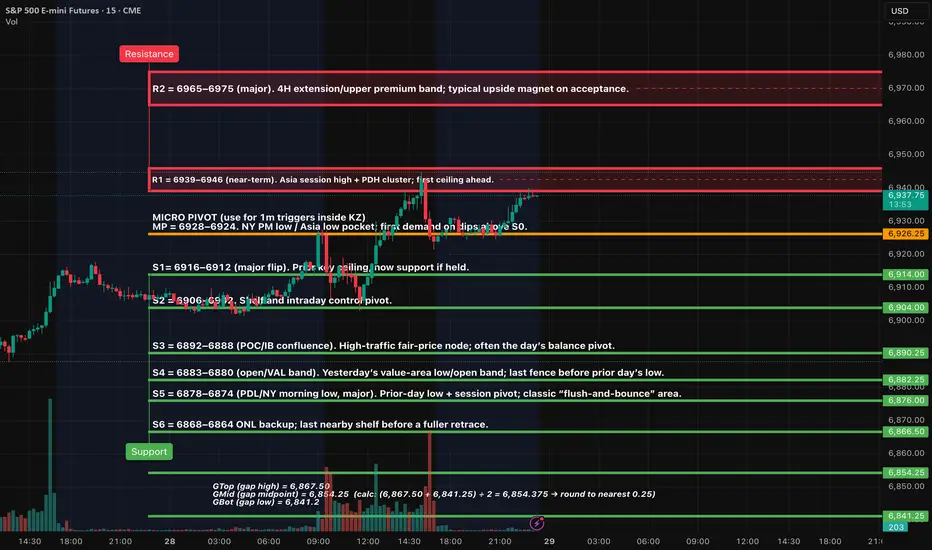

As we look at the current market conditions, the price is hovering just below the 6939-6946 resistance level. We should anticipate a test of this ceiling soon. A solid acceptance above 6946 on the 15-minute chart would likely trigger a movement towards the 6965-6975 range, which we can expect to see during the afternoon session in NY.

In terms of our range path, if we see rejection in the 6939-6946 zone, we will need to monitor for rotations between 6939, 6928, and 6916. A clean break beyond any of these levels will help establish our direction moving forward.

On the downside, a decisive 15-minute close below the 6916-6912 area could lead us back to the 6900-6896 levels. If that support fails, we could see a drop to 6892-6888, and then down to 6883-6880. Persistent acceptance below our S5 level would promote a further decline towards 6868-6864 and potentially trigger the gap references.

Lastly, I want to highlight that we should expect a compression-to-expansion behavior in the market. Thus, the first acceptance beyond R1 or below S0 will likely dictate the market's direction for the day.

Level-KZ Protocol (15/5/1). Execute inside London 02:00–05:00 (opt), NY AM 09:30–11:00, NY PM 13:30–16:00.

Working levels: R2 6965–6975; R1 6939–6946; MP 6928–6924; S0 6916–6912; S2 6900–6896; S3 6892–6888; S4 6883–6880; S5 6878–6874.

SETUP 1 — Acceptance-Continuation LONG (through R1)

Trigger: 15m close ≥ 6946, then 5m pullback holds above 6940 and re-closes; 1m HL entry.

Entry: 6942–6946 on the reclaim/HL.

SL: Hard SL below the 15m pullback wick (typically 6937–6939) ±0.25–0.50.

TP1: 6965–6975 (R2).

TP2: Leave runner only if momentum persists beyond R2 during NY PM.

Invalidation: 15m close back under 6939 with a 5m LH.

SETUP 2 — Rejection-Fade SHORT (at R1)

Trigger: Sweep into 6939–6946 that fails → 15m close back inside; 5m LH + 1m first pullback failure.

Entry: 6937–6943 on the fail.

SL: 6948–6950.

TP1: 6928–6924 (MP).

TP2: 6916–6912 (S0).

Stretch: 6900–6896 (S2) if acceptance forms below S0.

Invalidation: 15m acceptance ≥ 6946.

SETUP 3 — Quick-Reclaim Bounce LONG (MP)

Trigger: Fast flush into 6928–6924 that instantly reclaims on 1m and prints a 5m re-close.

Entry: 6926–6929 on the reclaim.

SL: 6923.25–6923.75.

TP1: 6939–6946 (R1).

TP2: 6965–6975 (R2) only after 15m acceptance through R1.

Invalidation: 15m close back below 6924.

SETUP 4 — Quick-Reclaim Bounce LONG (S0 flip)

Trigger: Sweep/flush into 6916–6912, immediate reclaim → 5m re-close.

Entry: 6917–6920 on strength back above 6916.

SL: 6911.50–6912.00.

TP1: 6928–6924 (MP).

TP2: 6939–6946 (R1).

Invalidation: 15m body-through below 6912.

SETUP 5 — Back-Inside Failure SHORT (under S2)

Trigger: 15m body close < 6896, then 5m retest of 6900–6896 holds from below.

Entry: 6898–6900 on the fail.

SL: 6903.00–6903.50.

TP1: 6892–6888 (S3).

TP2: 6883–6880 (S4).

Stretch: 6878–6874 (S5) — expect bounce attempts.

Invalidation: 15m reclaim ≥ 6900 with 5m re-close.

In terms of our range path, if we see rejection in the 6939-6946 zone, we will need to monitor for rotations between 6939, 6928, and 6916. A clean break beyond any of these levels will help establish our direction moving forward.

On the downside, a decisive 15-minute close below the 6916-6912 area could lead us back to the 6900-6896 levels. If that support fails, we could see a drop to 6892-6888, and then down to 6883-6880. Persistent acceptance below our S5 level would promote a further decline towards 6868-6864 and potentially trigger the gap references.

Lastly, I want to highlight that we should expect a compression-to-expansion behavior in the market. Thus, the first acceptance beyond R1 or below S0 will likely dictate the market's direction for the day.

Level-KZ Protocol (15/5/1). Execute inside London 02:00–05:00 (opt), NY AM 09:30–11:00, NY PM 13:30–16:00.

Working levels: R2 6965–6975; R1 6939–6946; MP 6928–6924; S0 6916–6912; S2 6900–6896; S3 6892–6888; S4 6883–6880; S5 6878–6874.

SETUP 1 — Acceptance-Continuation LONG (through R1)

Trigger: 15m close ≥ 6946, then 5m pullback holds above 6940 and re-closes; 1m HL entry.

Entry: 6942–6946 on the reclaim/HL.

SL: Hard SL below the 15m pullback wick (typically 6937–6939) ±0.25–0.50.

TP1: 6965–6975 (R2).

TP2: Leave runner only if momentum persists beyond R2 during NY PM.

Invalidation: 15m close back under 6939 with a 5m LH.

SETUP 2 — Rejection-Fade SHORT (at R1)

Trigger: Sweep into 6939–6946 that fails → 15m close back inside; 5m LH + 1m first pullback failure.

Entry: 6937–6943 on the fail.

SL: 6948–6950.

TP1: 6928–6924 (MP).

TP2: 6916–6912 (S0).

Stretch: 6900–6896 (S2) if acceptance forms below S0.

Invalidation: 15m acceptance ≥ 6946.

SETUP 3 — Quick-Reclaim Bounce LONG (MP)

Trigger: Fast flush into 6928–6924 that instantly reclaims on 1m and prints a 5m re-close.

Entry: 6926–6929 on the reclaim.

SL: 6923.25–6923.75.

TP1: 6939–6946 (R1).

TP2: 6965–6975 (R2) only after 15m acceptance through R1.

Invalidation: 15m close back below 6924.

SETUP 4 — Quick-Reclaim Bounce LONG (S0 flip)

Trigger: Sweep/flush into 6916–6912, immediate reclaim → 5m re-close.

Entry: 6917–6920 on strength back above 6916.

SL: 6911.50–6912.00.

TP1: 6928–6924 (MP).

TP2: 6939–6946 (R1).

Invalidation: 15m body-through below 6912.

SETUP 5 — Back-Inside Failure SHORT (under S2)

Trigger: 15m body close < 6896, then 5m retest of 6900–6896 holds from below.

Entry: 6898–6900 on the fail.

SL: 6903.00–6903.50.

TP1: 6892–6888 (S3).

TP2: 6883–6880 (S4).

Stretch: 6878–6874 (S5) — expect bounce attempts.

Invalidation: 15m reclaim ≥ 6900 with 5m re-close.

If you want to contact me Email: info@algoindex.com or algoindex.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you want to contact me Email: info@algoindex.com or algoindex.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.