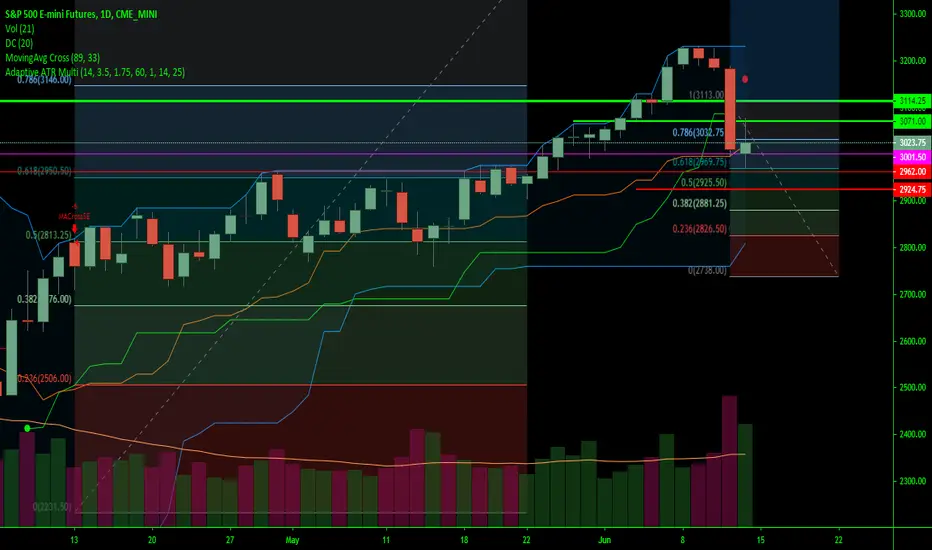

We are at one of those places we Elliotitions call, "a pivotal moment". five waves up in the last bullish move, an A wave down, and a 1 day B wave up. We could get a continued B wave down, or "The Bilderbergs"

( a must read book if you want to understand how "Paper" moves the markets). could go back to their buying program, or continue selling on Monday. If we go above the green line I drew it means they are buying,

if we go below the red line they are selling. simple.

Most new traders make the same mistakes.. that is why over 95% of traders lose money when they start trading... They enter before a move is confirmed, They overextend themselves, trading more shares or contracts

than they can afford to lose, trying to make a killing in their next trade. They get greedy.. remember Bulls do OK, Bears do OK, but pigs get slaughtered. They stay in a losing trade too long, and they cut their winners short. Emotional trading is the death of new traders.

If you like the help, and knowledge I share please follow me, so I know people are listening and getting better. The hard way to become a good trader is to learn by very expensive trial and error. The easy way is to listen and learn from others mistakes.. and trust me I learned the hard way, long ago..

( a must read book if you want to understand how "Paper" moves the markets). could go back to their buying program, or continue selling on Monday. If we go above the green line I drew it means they are buying,

if we go below the red line they are selling. simple.

Most new traders make the same mistakes.. that is why over 95% of traders lose money when they start trading... They enter before a move is confirmed, They overextend themselves, trading more shares or contracts

than they can afford to lose, trying to make a killing in their next trade. They get greedy.. remember Bulls do OK, Bears do OK, but pigs get slaughtered. They stay in a losing trade too long, and they cut their winners short. Emotional trading is the death of new traders.

If you like the help, and knowledge I share please follow me, so I know people are listening and getting better. The hard way to become a good trader is to learn by very expensive trial and error. The easy way is to listen and learn from others mistakes.. and trust me I learned the hard way, long ago..

Note

The chart does look Bearish, but remember Paper has been taking Retail money ever since Jesus kicked the money lenders out of His church.. Sometimes they Paint a chart pattern onto your chart, just like how they trade in ICE and other exchanges so we don't see their moves.. This could be a Bear Trap. Or it could be what it looks like. Ask yourself do you think they have unloaded most of the hundreds of thousands of ES contracts they sold at the top, do they want to continue to traumatize the Bulls they need to buy. Or are they ready to go back to hurting Bears?wait for confirmation.. if you are smart.

Note

IMHO CNBC and Cramer are on the Paper Team... Ever notice how ehen you buy a stock Cramer is pumping it goes down? In this case I feel he let the cat out of the bag more than he should have... tipping his hand.. actually saying the truth for once.. cnbc.com/2020/06/12/cramer-thinks-wall-street-pros-may-be-playing-a-game-with-amateur-robinhood-traders.htmlNote

I'm learning this pattern, and I've been told it doesn't match the correct rations ( which I said in my post above) so don't put too much stock in the chart just above... the second one... We will see what happens at the open.

Please check out Kauai Dave Pivot Traders on youtube. youtube.com/channel/UCNpY7S_s1cxw0cer4PyEEMQ

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Please check out Kauai Dave Pivot Traders on youtube. youtube.com/channel/UCNpY7S_s1cxw0cer4PyEEMQ

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.