Market Context

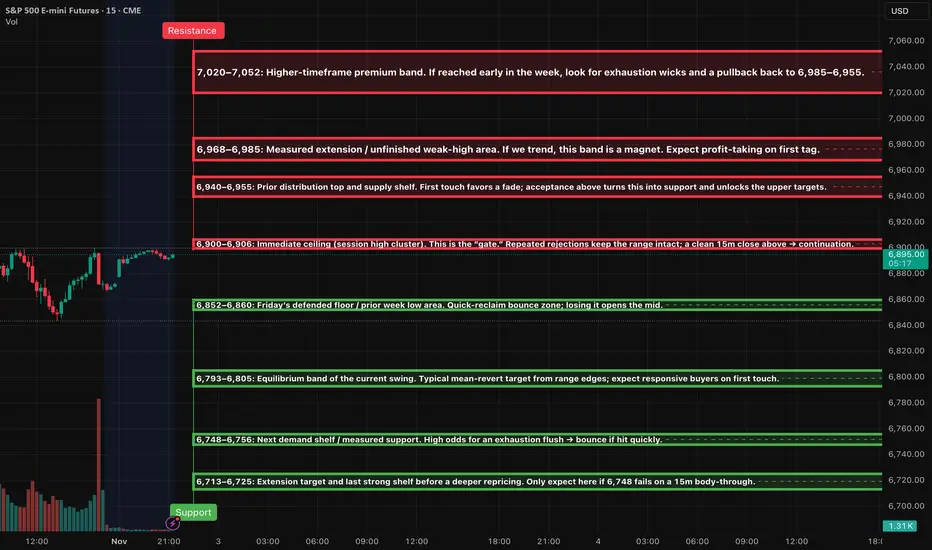

The price is currently positioned just below a key near-term resistance level at 6,900–6,906, following a sharp reversal on Friday from around 6,845. The daily and 4-hour structures indicate an incomplete "weak-high" area above, but the 1-hour momentum has just shifted upward from oversold conditions. As we move into the Asia/London sessions, I anticipate a balance formation within the upper half of the previous session unless we see a decisive 15-minute close above 6,906.

Short — Rejection Fade at 6,900–6,906

Trigger: 15m rejection close back below the band → 5m re-close down with a lower high → 1m first pullback fail.

SL: Above the 15m wick high +0.25–0.50.

TP1: 6,880 → 6,860 (≥2.0R gate). TP2: 6,805.

Notes: If a retest holds below 6,900, add on a fresh 1m LH.

Short — Rejection Fade at 6,940–6,955

Trigger: Same 15m→5m→1m sequence as above.

SL: Above the band’s 15m wick +0.25–0.50.

TP1: 6,900 gate; TP2: 6,880–6,860; stretch TP3: 6,805.

Long — Acceptance Continuation above 6,906

Trigger: 15m full-body close above 6,906 → 5m pullback holds and re-closes up → 1m HL entry.

SL: 5m pullback low −0.25–0.50.

TP1: 6,940–6,955; TP2: 6,968–6,985; stretch TP3: 7,020–7,052.

Notes: If 6,906 holds as support on retest, consider scaling on a clean 1m HL.

Long — Quick-Reclaim Bounce at 6,852–6,860

Trigger: Sweep/flush below the band and instant reclaim (1–3m), confirmed by a 5m re-close up → 1m HL entry.

SL: Below the sweep low −0.25–0.50.

TP1: 6,900 gate; TP2: 6,940–6,955.

Long — Quick-Reclaim Bounce at 6,793–6,805

Trigger: Same reclaim logic; prefer fast tag → quick pop.

SL: Below the 5m reclaim low −0.25–0.50.

TP1: 6,860; TP2: 6,900; optional TP3: 6,940.

Long — Exhaustion Flush Bounce at 6,748–6,756 (stretch 6,713–6,725)

Trigger: Fast liquidation into the band + momentum divergence → 5m reversal close → 1m HL entry.

SL: Below the exhaustion low −0.25–0.50.

TP1: 6,793–6,805; TP2: 6,860; trail only after TP2.

Short — Continuation Below 6,852

Trigger: 15m body-through below 6,852 that holds on retest → 5m LH → 1m pullback entry.

SL: Above the 15m break wick +0.25–0.50.

TP1: 6,805; TP2: 6,756; stretch TP3: 6,725.

KILL-ZONES & EXECUTION NOTES

Primary execution windows: NY AM 09:30–11:00 and NY PM 13:30–16:00. London 02:00–05:00 optional, reduced size. Asia optional, smallest size.

Stops & viability: Anchor hard SLs to the relevant 15m wick; only take plays where TP1 ≥ 2.0R. Max two attempts per level per session. At TP1: close 70%, set 30% runner to BE; no trailing before TP2.

WEEK AHEAD GAME PLAN

If Monday holds above 6,860 and forms a higher low, the outlook is modestly bullish, aiming for a move toward 6,940–6,955 early to mid-week. A decisive daily close above 6,955 would suggest a rally into the 6,968–6,985 range, with the potential to extend further to 7,020–7,052 later in the week.

Conversely, if the price falls back below 6,852, the scenario shifts to a mean-reversion week, targeting 6,805 and then 6,756, with 6,713 as a potential stretch target.

The price is currently positioned just below a key near-term resistance level at 6,900–6,906, following a sharp reversal on Friday from around 6,845. The daily and 4-hour structures indicate an incomplete "weak-high" area above, but the 1-hour momentum has just shifted upward from oversold conditions. As we move into the Asia/London sessions, I anticipate a balance formation within the upper half of the previous session unless we see a decisive 15-minute close above 6,906.

Short — Rejection Fade at 6,900–6,906

Trigger: 15m rejection close back below the band → 5m re-close down with a lower high → 1m first pullback fail.

SL: Above the 15m wick high +0.25–0.50.

TP1: 6,880 → 6,860 (≥2.0R gate). TP2: 6,805.

Notes: If a retest holds below 6,900, add on a fresh 1m LH.

Short — Rejection Fade at 6,940–6,955

Trigger: Same 15m→5m→1m sequence as above.

SL: Above the band’s 15m wick +0.25–0.50.

TP1: 6,900 gate; TP2: 6,880–6,860; stretch TP3: 6,805.

Long — Acceptance Continuation above 6,906

Trigger: 15m full-body close above 6,906 → 5m pullback holds and re-closes up → 1m HL entry.

SL: 5m pullback low −0.25–0.50.

TP1: 6,940–6,955; TP2: 6,968–6,985; stretch TP3: 7,020–7,052.

Notes: If 6,906 holds as support on retest, consider scaling on a clean 1m HL.

Long — Quick-Reclaim Bounce at 6,852–6,860

Trigger: Sweep/flush below the band and instant reclaim (1–3m), confirmed by a 5m re-close up → 1m HL entry.

SL: Below the sweep low −0.25–0.50.

TP1: 6,900 gate; TP2: 6,940–6,955.

Long — Quick-Reclaim Bounce at 6,793–6,805

Trigger: Same reclaim logic; prefer fast tag → quick pop.

SL: Below the 5m reclaim low −0.25–0.50.

TP1: 6,860; TP2: 6,900; optional TP3: 6,940.

Long — Exhaustion Flush Bounce at 6,748–6,756 (stretch 6,713–6,725)

Trigger: Fast liquidation into the band + momentum divergence → 5m reversal close → 1m HL entry.

SL: Below the exhaustion low −0.25–0.50.

TP1: 6,793–6,805; TP2: 6,860; trail only after TP2.

Short — Continuation Below 6,852

Trigger: 15m body-through below 6,852 that holds on retest → 5m LH → 1m pullback entry.

SL: Above the 15m break wick +0.25–0.50.

TP1: 6,805; TP2: 6,756; stretch TP3: 6,725.

KILL-ZONES & EXECUTION NOTES

Primary execution windows: NY AM 09:30–11:00 and NY PM 13:30–16:00. London 02:00–05:00 optional, reduced size. Asia optional, smallest size.

Stops & viability: Anchor hard SLs to the relevant 15m wick; only take plays where TP1 ≥ 2.0R. Max two attempts per level per session. At TP1: close 70%, set 30% runner to BE; no trailing before TP2.

WEEK AHEAD GAME PLAN

If Monday holds above 6,860 and forms a higher low, the outlook is modestly bullish, aiming for a move toward 6,940–6,955 early to mid-week. A decisive daily close above 6,955 would suggest a rally into the 6,968–6,985 range, with the potential to extend further to 7,020–7,052 later in the week.

Conversely, if the price falls back below 6,852, the scenario shifts to a mean-reversion week, targeting 6,805 and then 6,756, with 6,713 as a potential stretch target.

If you want to contact me Email: info@algoindex.com or algoindex.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you want to contact me Email: info@algoindex.com or algoindex.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.