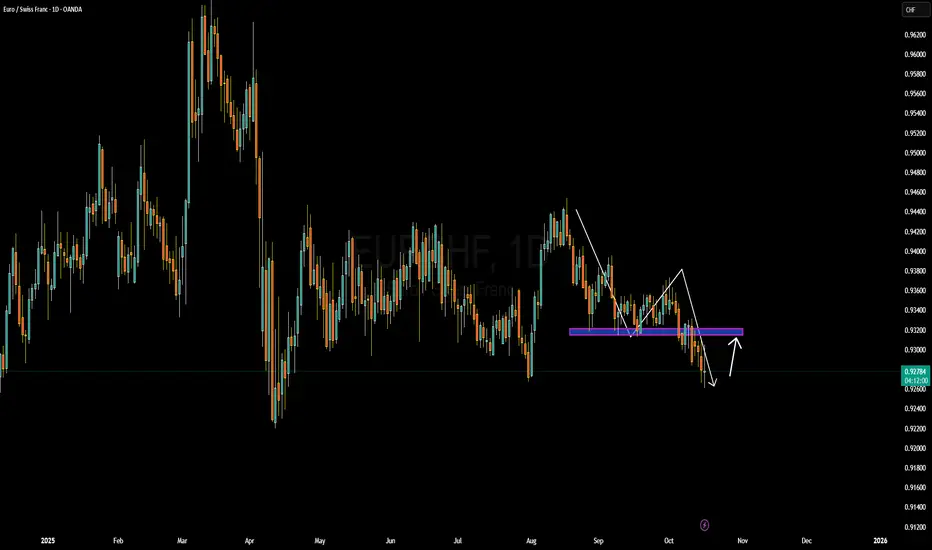

EURCHF is currently trading at a key demand zone where price has reacted multiple times in the past. After a steady decline from the September swing high, price is now retesting the horizontal support range around 0.9280–0.9300, which has previously acted as a strong decision point for buyers. If this zone holds again, I expect a corrective bounce back into the 0.9340–0.9360 supply area before the market decides its next leg. However, if price fails to reclaim that resistance, sellers may use it as a fresh distribution point for continuation to the downside.

From a fundamental perspective, the euro remains under pressure as the European Central Bank leans toward prolonged rate cuts amid weak manufacturing data, while the Swiss franc continues to attract safe-haven flows due to lingering geopolitical tensions and persistent risk-off sentiment across global markets. This macro landscape keeps EURCHF naturally tilted to the bearish side unless there is a notable shift in inflation or growth dynamics in the eurozone.

My approach here is straightforward: I am watching for a bullish reaction from this demand zone for a short-term corrective play, but I won’t ignore the possibility of a breakdown. A clean 4H close below 0.9260 would confirm bearish continuation toward 0.9200, while a reclaim of 0.9340 would open the door for a broader recovery swing. Patience and reaction over prediction — price will reveal the direction soon.

From a fundamental perspective, the euro remains under pressure as the European Central Bank leans toward prolonged rate cuts amid weak manufacturing data, while the Swiss franc continues to attract safe-haven flows due to lingering geopolitical tensions and persistent risk-off sentiment across global markets. This macro landscape keeps EURCHF naturally tilted to the bearish side unless there is a notable shift in inflation or growth dynamics in the eurozone.

My approach here is straightforward: I am watching for a bullish reaction from this demand zone for a short-term corrective play, but I won’t ignore the possibility of a breakdown. A clean 4H close below 0.9260 would confirm bearish continuation toward 0.9200, while a reclaim of 0.9340 would open the door for a broader recovery swing. Patience and reaction over prediction — price will reveal the direction soon.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.