We recently provided an analysis on the possible courses of action by the Federal Reserve (FED) starting from Wednesday, September 17, and until the end of the year.

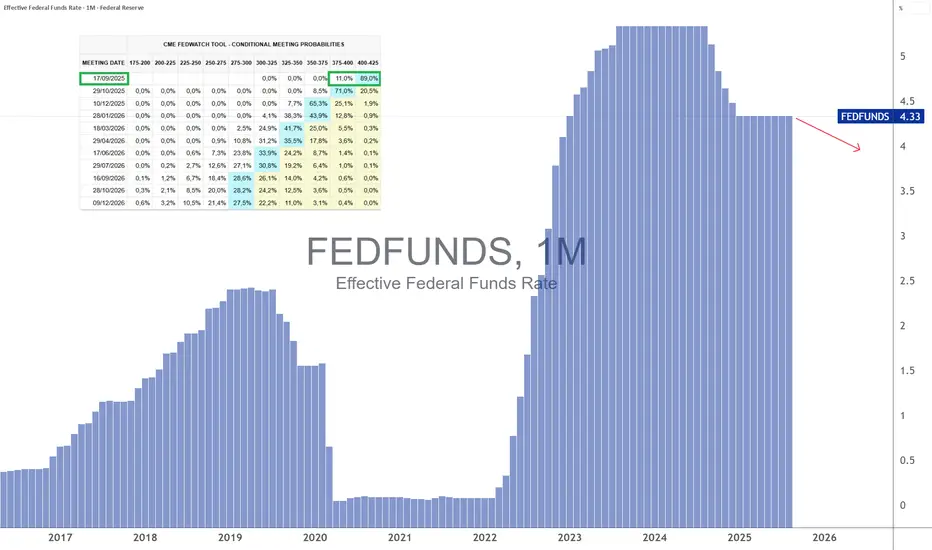

Three major figures were still due before the September 17 FED meeting: the NFP report, a PPI, and a CPI. The NFP report has been released and its message is unequivocal, making a 0.25% (25 bps) rate cut by the FED on Wednesday, September 17, almost certain.

Even better, the probability of a “jumbo FED cut” has risen to 10%, meaning a 50 bps (0.50%) rate cut.

How did we get here?

1) Four consecutive disappointing NFP reports and an unemployment rate near the FED’s alert threshold

The U.S. jobs report (NFP), published on Friday, September 5, is weak overall:

Unemployment rises to 4.3% of the U.S. labor force, while the FED’s macroeconomic alert threshold is 4.4%

In absolute terms, the number of unemployed has reached a record since early 2021

Four consecutive months with fewer than 100,000 net job creations, unseen since the 2020 pandemic crisis

As for wage growth, it continues its downward trend, which should eventually allow inflation to decline again (once tariffs are factored in)

2) For the FED, the specter of stagflation looms — the worst macroeconomic scenario for a central bank

Will Jerome Powell’s FED and the FOMC be able to lower the federal funds rate starting from Wednesday, September 17? The answer is yes.

The accelerating deterioration of the U.S. labor market significantly raises the probability of a U.S. recession. The upcoming rate cut by the FED could even be considered too late, since rising unemployment generally signals that the economy has already been slowing sharply for many months.

U.S. core inflation remains around 3% due to tariffs, but the state of employment makes a more neutral federal funds rate necessary. Hence, the probability of FED action on September 17 is close to 100%.

3) This week, PPI and CPI inflation are the dominant fundamentals

In conclusion, the probability of FED action could still evolve this week with the updates of U.S. inflation via PPI and CPI.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Three major figures were still due before the September 17 FED meeting: the NFP report, a PPI, and a CPI. The NFP report has been released and its message is unequivocal, making a 0.25% (25 bps) rate cut by the FED on Wednesday, September 17, almost certain.

Even better, the probability of a “jumbo FED cut” has risen to 10%, meaning a 50 bps (0.50%) rate cut.

How did we get here?

1) Four consecutive disappointing NFP reports and an unemployment rate near the FED’s alert threshold

The U.S. jobs report (NFP), published on Friday, September 5, is weak overall:

Unemployment rises to 4.3% of the U.S. labor force, while the FED’s macroeconomic alert threshold is 4.4%

In absolute terms, the number of unemployed has reached a record since early 2021

Four consecutive months with fewer than 100,000 net job creations, unseen since the 2020 pandemic crisis

As for wage growth, it continues its downward trend, which should eventually allow inflation to decline again (once tariffs are factored in)

2) For the FED, the specter of stagflation looms — the worst macroeconomic scenario for a central bank

Will Jerome Powell’s FED and the FOMC be able to lower the federal funds rate starting from Wednesday, September 17? The answer is yes.

The accelerating deterioration of the U.S. labor market significantly raises the probability of a U.S. recession. The upcoming rate cut by the FED could even be considered too late, since rising unemployment generally signals that the economy has already been slowing sharply for many months.

U.S. core inflation remains around 3% due to tariffs, but the state of employment makes a more neutral federal funds rate necessary. Hence, the probability of FED action on September 17 is close to 100%.

3) This week, PPI and CPI inflation are the dominant fundamentals

In conclusion, the probability of FED action could still evolve this week with the updates of U.S. inflation via PPI and CPI.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.