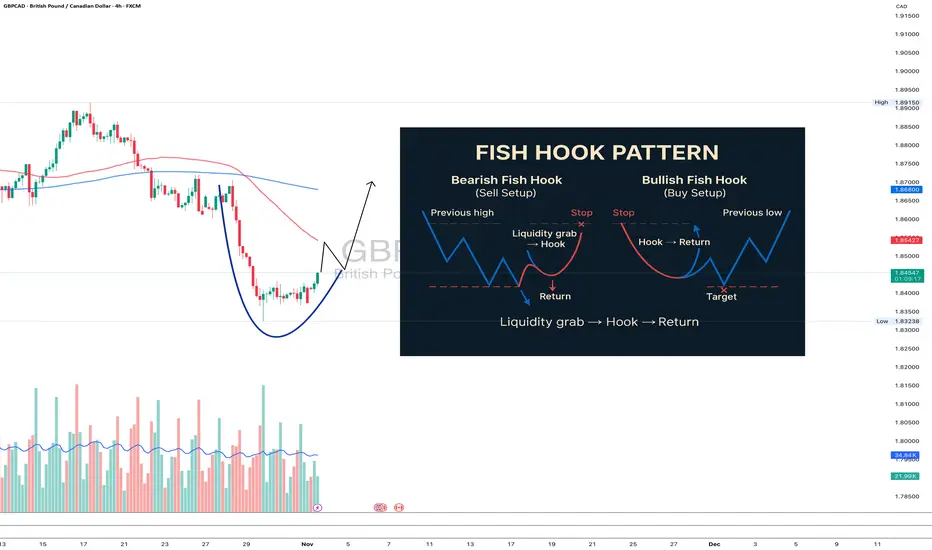

Fish Hook Pattern: the setup that catches liquidity, not traders

There’s one pattern that never gets enough attention in textbooks, yet it’s one of the purest reflections of smart money logic - the Fish Hook.

It looks simple: price breaks out, triggers stops, traps breakout traders, and snaps back just as fast. But the psychology behind it is what makes it truly powerful.

When the market consolidates under a level, stop orders start to pile up. Big money knows that liquidity sits there - waiting to be taken. They push the price beyond the level, trigger the stops, and absorb liquidity. The breakout traders think they’ve caught momentum, but in reality, they’ve just become the exit liquidity.

Then comes the reversal - fast, decisive, emotional. That sharp return to the range is the “hook.”

If price breaks a key high or low and immediately rejects it - without structure, without a clean retest - you’re watching a Fish Hook in action.

The entry comes on the retest of that level from the opposite side. The stop goes right beyond the “hook’s tip.” Targets? The opposite edge of the range or the next liquidity pool.

The beauty of the Fish Hook lies in its simplicity. It’s not an indicator or a signal. It’s the behavior of money - watching how capital manipulates emotion.

When you start to see it often, you realize the market isn’t random. It’s intentional.

Trading becomes less about chasing candles and more about reading footprints. Fish Hook setups happen daily across pairs, stocks, and crypto and once you train your eye, you’ll never unsee them.

If your stops keep getting hit before the move - congratulations, you just met the Fish Hook from the wrong side.

It looks simple: price breaks out, triggers stops, traps breakout traders, and snaps back just as fast. But the psychology behind it is what makes it truly powerful.

When the market consolidates under a level, stop orders start to pile up. Big money knows that liquidity sits there - waiting to be taken. They push the price beyond the level, trigger the stops, and absorb liquidity. The breakout traders think they’ve caught momentum, but in reality, they’ve just become the exit liquidity.

Then comes the reversal - fast, decisive, emotional. That sharp return to the range is the “hook.”

If price breaks a key high or low and immediately rejects it - without structure, without a clean retest - you’re watching a Fish Hook in action.

The entry comes on the retest of that level from the opposite side. The stop goes right beyond the “hook’s tip.” Targets? The opposite edge of the range or the next liquidity pool.

The beauty of the Fish Hook lies in its simplicity. It’s not an indicator or a signal. It’s the behavior of money - watching how capital manipulates emotion.

When you start to see it often, you realize the market isn’t random. It’s intentional.

Trading becomes less about chasing candles and more about reading footprints. Fish Hook setups happen daily across pairs, stocks, and crypto and once you train your eye, you’ll never unsee them.

If your stops keep getting hit before the move - congratulations, you just met the Fish Hook from the wrong side.

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Торгуем тут linktr.ee/totoshka55

💬 Наши контакты @Totoshkatips

🔗 Сайт totoshkatrades.com

🉐 Торгуем тут linktr.ee/totoshka55

💬 Наши контакты @Totoshkatips

🔗 Сайт totoshkatrades.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Торгуем тут linktr.ee/totoshka55

💬 Наши контакты @Totoshkatips

🔗 Сайт totoshkatrades.com

🉐 Торгуем тут linktr.ee/totoshka55

💬 Наши контакты @Totoshkatips

🔗 Сайт totoshkatrades.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.