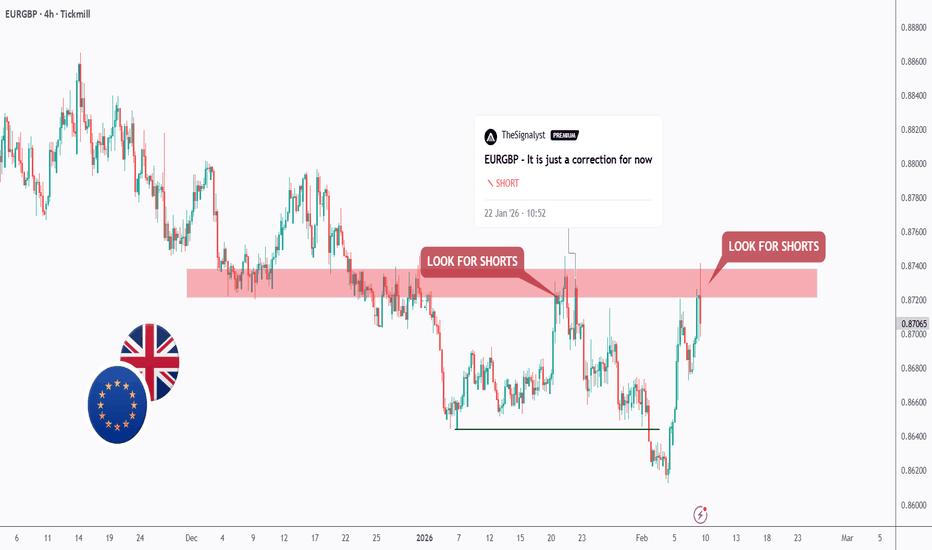

EURGBP - Doing It Again!EURGBP is once again sitting around the resistance zone.

This resistance has been respected multiple times, making it a key decision area where sellers tend to step in with confidence.

As long as EURGBP holds below this red resistance, the focus remains on short setups, looking for continuation b

British Pound / Euro

No trades

Related currencies

EURGBP (1H CHART PATTERN)...EURGBP 1H chart 👀

I see a clear Head & Shoulders pattern:

Left Shoulder ✔

Head ✔

Right Shoulder forming ✔

Rising neckline (slightly upward sloping)

Bias: Bearish if neckline breaks.

🎯 Downside Targets (Measured Move)

📍 Neckline Area

Around 0.8690 – 0.8700

A confirmed break + close below this level a

EURGBP - Bearish Continuation Setup (4H -> 1H)📉 EURGBP – Bearish Continuation Setup (4H → 1H)

Bias: Bearish

Pair: EURGBP

Timeframes: 4H for structure, 1H for execution

On the 4H timeframe, EURGBP continues to trade within a clear bearish market structure, printing lower highs and lower lows. The recent bullish move appears corrective and ha

EURGBP: Price Heads Towards ResistanceEURGBP is in overall downtrend channel of support and resistance. the pair have been lower highs and lower lows movement in respect of the daily chart time frame, this structure clearly displays the price approaching slowly towards the resistance area, as we anticipate a pullback below this zone. ho

EURGBP | FRGNT WEEKLY FORECAST | Q1 | W6 | Y26📅 Q1 | W6 | Y26

📊 EURGBP | FRGNT WEEKLY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range

EURGBP FREE SIGNAL|LONG|

✅EURGBP bullish displacement from a refined demand zone confirms market structure shift. Liquidity sweep completed with strong impulsive move, favoring continuation toward premium liquidity.

—————————

Entry: 0.8677

Stop Loss: 0.8653

Take Profit: 0.8696

Time Frame: 4H

—————————

LONG🚀

✅Like and s

EURGBP Channel Down topped. Sell Signal.The EURGBP pair has been trading within a Channel Down since the November 14 2025 High. Yesterday the price hit the pattern's Top (Lower Highs trend-line) and got rejected exactly on the 1D MA50 (blue trend-line), similar to the previous Lower High.

That High initiated a -1.52% Bearish Leg and we e

EURGBP SHORT Date: February 11, 2026

Asset: EUR/GBP (Euro / British Pound)

Bias: Bearish (Short)

Executive Summary

The EUR/GBP currency pair is exhibiting a high-probability shorting opportunity based on a multi-timeframe alignment of market structure, Fibonacci retracement, and momentum indicators. Current pric

SELL EURGBP now for bullish trend Continuation ..........SELL EURGBP now for bullish trend Continuation ..........

STOP LOSS: 0.8733

This sell trade setup is based on divergence for trend continuation trading pattern on the 4h time frame ...

Always remember, the trend is your friend , so whenever you can get a signal that the trend is about to come to c

EURGBP | FRGNT DAILY FORECAST | Q1 | W6 | D11 | Y26📅 Q1 | W6 | D11 | Y26

📊 EURGBP | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading r

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of GBPEUR is 1.1501 EUR — it has increased by 0.26% in the past 24 hours. See more of GBPEUR rate dynamics on the detailed chart.

The value of the GBPEUR pair is quoted as 1 GBP per x EUR. For example, if the pair is trading at 1.50, it means it takes 1.5 EUR to buy 1 GBP.

The term volatility describes the risk related to the changes in an asset's value. GBPEUR has the volatility rating of 0.27%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The GBPEUR showed a 0.13% rise over the past week, the month change is a −0.36% fall, and over the last year it has decreased by −4.20%. Track live rate changes on the GBPEUR chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

GBPEUR is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade GBPEUR right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with GBPEUR technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the GBPEUR shows the sell signal, and 1 month rating is sell. See more of GBPEUR technicals for a more comprehensive analysis.