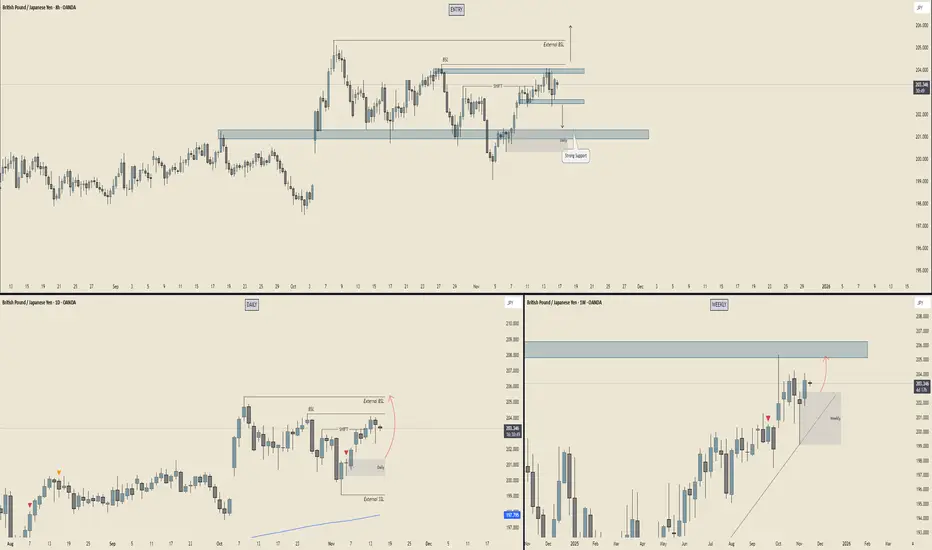

⭐ 8H CHART – Mid-Range Chop But Setting Up a Sneaky Play

📍 Current Situation

Price is chilling just under that internal BSL, repeatedly tapping a mini supply shelf. You’ve got a SHIFT marked and a clear reaction zone sitting underneath (your grey + blue combo).

💡 Key Levels

Internal BSL → Gets run, we go hunting for External BSL above.

Strong support block below → Price keeps respecting this like a trampoline.

Market is compressing between:

🔼 8H supply above

🔽 Bullish support block below

📌 Interpretation:

This looks like accumulation under liquidity → classic build-up for a sweep + pop.

If price dips first, your grey demand is the reload zone before any upper raid.

⭐ DAILY CHART – Clean Buyside Above, Built For a Run

📍 Structure

Daily is holding bullish order flow. You’ve got:

Daily BSL close overhead

External BSL even further up

A beautiful Daily demand block (highlighted) that caused the last impulsive leg.

📌 Interpretation:

The arrow you drew says it all — Daily wants that buy-side.

Sweep the daily demand → send price into external liquidity.

Momentum = bullish unless that daily block breaks.

⭐ WEEKLY CHART – HTF Premium Zone Waiting Above

📍 The Big Picture

Weekly demand held weeks ago and price has been climbing ever since.

Key details:

That massive weekly supply / inefficiency block above 205-207 is the magnet.

Price is stair-stepping higher with clean bullish candles.

Arrow toward weekly imbalance = HTF target.

📌 Interpretation:

Weekly is bullish and wants that macro supply fill.

Shorts inside here = countertrend until we hit the big zone.

🎯 SUMMARY – What’s the Play?

🔥 Bias: Bullish on all timeframes

📌 What the market wants:

A tiny correction to demand (8H or Daily)

Run internal liquidity

Push toward 205-207 weekly supply

🧨 What invalidates this?

A clean break and close below daily demand — then the bullish engine loses fuel.

📍 Current Situation

Price is chilling just under that internal BSL, repeatedly tapping a mini supply shelf. You’ve got a SHIFT marked and a clear reaction zone sitting underneath (your grey + blue combo).

💡 Key Levels

Internal BSL → Gets run, we go hunting for External BSL above.

Strong support block below → Price keeps respecting this like a trampoline.

Market is compressing between:

🔼 8H supply above

🔽 Bullish support block below

📌 Interpretation:

This looks like accumulation under liquidity → classic build-up for a sweep + pop.

If price dips first, your grey demand is the reload zone before any upper raid.

⭐ DAILY CHART – Clean Buyside Above, Built For a Run

📍 Structure

Daily is holding bullish order flow. You’ve got:

Daily BSL close overhead

External BSL even further up

A beautiful Daily demand block (highlighted) that caused the last impulsive leg.

📌 Interpretation:

The arrow you drew says it all — Daily wants that buy-side.

Sweep the daily demand → send price into external liquidity.

Momentum = bullish unless that daily block breaks.

⭐ WEEKLY CHART – HTF Premium Zone Waiting Above

📍 The Big Picture

Weekly demand held weeks ago and price has been climbing ever since.

Key details:

That massive weekly supply / inefficiency block above 205-207 is the magnet.

Price is stair-stepping higher with clean bullish candles.

Arrow toward weekly imbalance = HTF target.

📌 Interpretation:

Weekly is bullish and wants that macro supply fill.

Shorts inside here = countertrend until we hit the big zone.

🎯 SUMMARY – What’s the Play?

🔥 Bias: Bullish on all timeframes

📌 What the market wants:

A tiny correction to demand (8H or Daily)

Run internal liquidity

Push toward 205-207 weekly supply

🧨 What invalidates this?

A clean break and close below daily demand — then the bullish engine loses fuel.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.