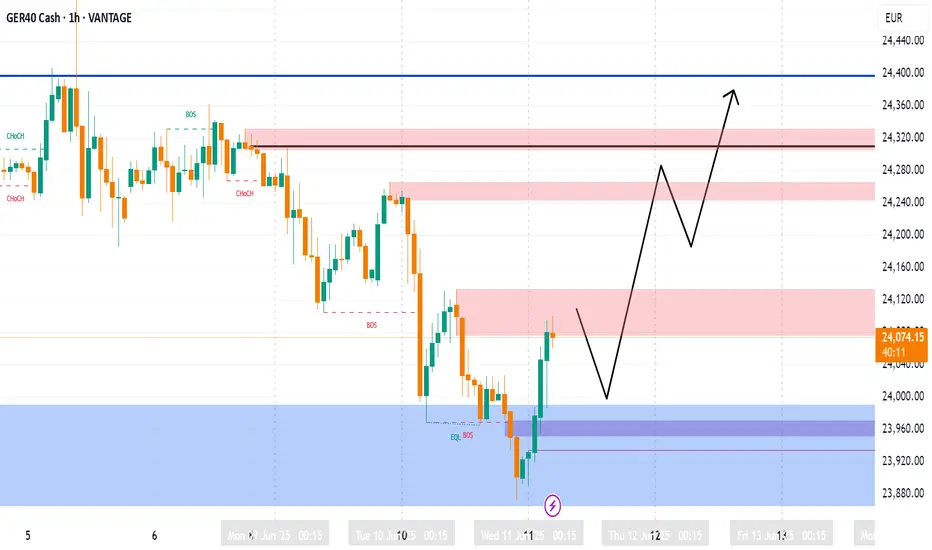

GER40 (DAX) – Long Trade Idea

Timeframes:

Quarterly Bias: Bullish

Entry Execution: 1HR–4HR

Market Narrative:

The Quarterly outlook on GER40 remains bullish, and recent price action has confirmed alignment with this narrative:

Sell-side liquidity has been swept.

A clear bullish market structure shift has occurred.

Price is now likely to retest a Bullish Breaker Block near 23,995—an ideal area to look for long entries.

This setup presents a high-probability continuation move to the upside, targeting premium-side inefficiencies and liquidity.

Entry Zone:

🟢 Buy Zone: 23,995

Retest of the Bullish Breaker Block

Look for:

A bullish FVG or displacement candle on 1HR/4HR

BOS (Break of Structure) confirmation on lower timeframes

Entry after internal liquidity sweep (e.g., stop run below previous low)

Stop Loss:

🔴 SL: 23,900

Below Bullish Breaker and recent structure low

Invalidation point of the bullish thesis

Take Profit Levels:

TP1 – 24,265

🎯 Return to previous structural high & imbalance fill

TP2 – 24,360

🎯 Extended move into premium + likely liquidity draw above highs

Risk Management:

📊 Risk: 1% per trade

Maintain position sizing discipline

Use partial profits at TP1 and trail stop to breakeven or structure for TP2

Confluences:

Quarterly bullish bias remains intact

Sell-side liquidity sweep provides fuel for a bullish move

Market structure shift confirms smart money accumulation

Bullish Breaker Block in discounted territory presents a key entry opportunity

Price likely to seek buy-side liquidity in premium

Execution Plan:

Wait for price to return to 23,995 zone

Watch for confirmation on 15min–1HR:

Internal liquidity sweep

Bullish BOS or FVG

Entry on bullish displacement

Manage trade dynamically based on market behavior at TP1

Timeframes:

Quarterly Bias: Bullish

Entry Execution: 1HR–4HR

Market Narrative:

The Quarterly outlook on GER40 remains bullish, and recent price action has confirmed alignment with this narrative:

Sell-side liquidity has been swept.

A clear bullish market structure shift has occurred.

Price is now likely to retest a Bullish Breaker Block near 23,995—an ideal area to look for long entries.

This setup presents a high-probability continuation move to the upside, targeting premium-side inefficiencies and liquidity.

Entry Zone:

🟢 Buy Zone: 23,995

Retest of the Bullish Breaker Block

Look for:

A bullish FVG or displacement candle on 1HR/4HR

BOS (Break of Structure) confirmation on lower timeframes

Entry after internal liquidity sweep (e.g., stop run below previous low)

Stop Loss:

🔴 SL: 23,900

Below Bullish Breaker and recent structure low

Invalidation point of the bullish thesis

Take Profit Levels:

TP1 – 24,265

🎯 Return to previous structural high & imbalance fill

TP2 – 24,360

🎯 Extended move into premium + likely liquidity draw above highs

Risk Management:

📊 Risk: 1% per trade

Maintain position sizing discipline

Use partial profits at TP1 and trail stop to breakeven or structure for TP2

Confluences:

Quarterly bullish bias remains intact

Sell-side liquidity sweep provides fuel for a bullish move

Market structure shift confirms smart money accumulation

Bullish Breaker Block in discounted territory presents a key entry opportunity

Price likely to seek buy-side liquidity in premium

Execution Plan:

Wait for price to return to 23,995 zone

Watch for confirmation on 15min–1HR:

Internal liquidity sweep

Bullish BOS or FVG

Entry on bullish displacement

Manage trade dynamically based on market behavior at TP1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.