Hello traders, stepping into a fresh week with a clear head sets the tone, so here’s a warm dive into what gold is whispering on the weekly chart.

Gold opens the week sitting inside a crucial balance pocket on the W1 map. Momentum is easing, candle bodies are shrinking, and the structure is quietly storing energy for a decisive breakout. This outlook stays loyal to pure Weekly flow — no lower-timeframe noise, just the five-day roadmap drawn by W1 structure itself.

Macro & News Context

The USD steps into a heavy data line-up this week: Retail Sales, GDP, PCE, and Durable Goods.

Any one of these can tilt momentum and sculpt the shape of the weekly candle, so stay alert — the macro winds are active.

WEEKLY — Neutral-Bullish but Losing Momentum

The weekly chart remains bullish in structure but fragile in strength.

Upper wicks = hesitation. Buyers control trend, but conviction is fading.

Key Weekly Zones

🟥 Supply Above

4170–4270 → Rejection shelf. Repeated sell absorption.

4330–4460 → Major distribution ceiling.

4570–4700 → Extreme premium, exhaustion zone.

🟦 Demand Below

3980–3880 → Primary weekly support keeping HLs alive.

3830–3700 → Mid-range accumulation.

3600–3450 → Deep structural foundation.

⚪ Weekly Balance Point: 4040–4140

This is the pivot of the week.

Above → continuation possible.

Below → correction opens.

Weekly Scenarios

Bullish: Hold above 4040–4140 → targets 4170 → 4270 → 4330.

Bearish: Lose 4040 → drop toward 3980 → 3880 → 3830.

Weekly view: A data-driven coin toss — USD strength will decide the winner.

DAILY — Compression Between Supply & Demand

Price is trapped between EMA21 and EMA50, RSI rolling over → indecision.

Daily Supply

4235–4330 → The final battlefield. Every test = heavy rejection.

4140–4210 → Active distribution. Sellers defend aggressively.

Daily Demand

3980–3880 → Key bullish defense.

3720–3580 → Discount base of the October rally.

3450–3300 → Long-term accumulation.

Daily Decision Zone: 4055–4115

Stuck here — no direction until a breakout.

Daily Scenarios

Bullish: D1 close above 4120 → aim for 4210 → 4330.

Bearish: Break & close below 3980 → opens 3880 → 3720.

Daily view: Market is coiling — the next D1 close decides the week.

H4 — Pressure Building Inside a Tight Box

H4 is in a compression pocket 4060–4090.

H4 Supply

4135–4165 → Nearest premium selling.

4210–4240 → Heavy distribution cap.

4320–4350 → Deep premium reversal zone.

H4 Demand

4020–3990 → Nearest support.

3935–3905 → Continuation demand.

3840–3810 → Major accumulation.

H4 Scenarios

Bullish: Reclaim 4090 → 4135–4165 → 4210–4240.

Bearish: Lose 4020 → 3990 → 3935–3905.

H4 view: Expect a violent expansion once it escapes the box.

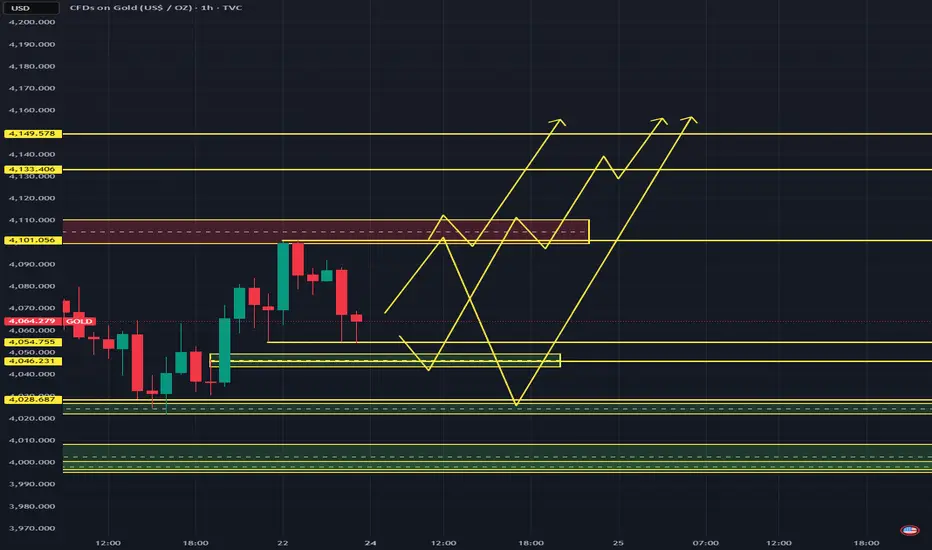

H1 — Liquidity Games Underway

Bias: Neutral–Bullish, liquidity-driven.

4140 = weak high, perfect sweep candidate.

EMAs flat → compression.

RSI mid-50s → room on upside if impulse forms.

H1 Supply

4170–4185 → Extreme premium reversal.

4118–4135 → Weak high liquidity.

4088–4100 → Breaker supply.

H1 Demand

4025–4040 → Key intraday floor.

3988–4005 → Deep H1/H4 confluence.

4055–4065 → Micro accumulation.

H1 Pivot: 4075–4085

Above → bullish continuation.

Below → bearish intraday flow.

Intraday Scenarios

Bullish Liquidity Sweep:

Reclaim 4085 → aim for: 4110 → 4135/40 → 4170/85.

Bearish Retrace:

Reject 4135–4140 → drop toward 4075 → 4053 → 4025–4005.

💡 THE REAL TAKEAWAY — MASTER SUMMARY

📌 Gold is coiled inside multi-timeframe compression.

All major biases depend on a breakout from 4055–4115 (D1) and 4060–4090 (H4).

Upside Bias:

Only valid above 4120 (D1) / 4090 (H4) → targets 4135 → 4170 → 4210+.

Downside Bias:

Confirmed only below 4020 (H4) / 3980 (D1) → targets 3900 → 3830.

Intraday Edge:

Expect a sweep of 4140 before any decisive move.

Most probable play:

↗️ Sweep 4140 → fade

or

↘️ Dip into 4050–4020 → reload upward.

Gold opens the week sitting inside a crucial balance pocket on the W1 map. Momentum is easing, candle bodies are shrinking, and the structure is quietly storing energy for a decisive breakout. This outlook stays loyal to pure Weekly flow — no lower-timeframe noise, just the five-day roadmap drawn by W1 structure itself.

Macro & News Context

The USD steps into a heavy data line-up this week: Retail Sales, GDP, PCE, and Durable Goods.

Any one of these can tilt momentum and sculpt the shape of the weekly candle, so stay alert — the macro winds are active.

WEEKLY — Neutral-Bullish but Losing Momentum

The weekly chart remains bullish in structure but fragile in strength.

Upper wicks = hesitation. Buyers control trend, but conviction is fading.

Key Weekly Zones

🟥 Supply Above

4170–4270 → Rejection shelf. Repeated sell absorption.

4330–4460 → Major distribution ceiling.

4570–4700 → Extreme premium, exhaustion zone.

🟦 Demand Below

3980–3880 → Primary weekly support keeping HLs alive.

3830–3700 → Mid-range accumulation.

3600–3450 → Deep structural foundation.

⚪ Weekly Balance Point: 4040–4140

This is the pivot of the week.

Above → continuation possible.

Below → correction opens.

Weekly Scenarios

Bullish: Hold above 4040–4140 → targets 4170 → 4270 → 4330.

Bearish: Lose 4040 → drop toward 3980 → 3880 → 3830.

Weekly view: A data-driven coin toss — USD strength will decide the winner.

DAILY — Compression Between Supply & Demand

Price is trapped between EMA21 and EMA50, RSI rolling over → indecision.

Daily Supply

4235–4330 → The final battlefield. Every test = heavy rejection.

4140–4210 → Active distribution. Sellers defend aggressively.

Daily Demand

3980–3880 → Key bullish defense.

3720–3580 → Discount base of the October rally.

3450–3300 → Long-term accumulation.

Daily Decision Zone: 4055–4115

Stuck here — no direction until a breakout.

Daily Scenarios

Bullish: D1 close above 4120 → aim for 4210 → 4330.

Bearish: Break & close below 3980 → opens 3880 → 3720.

Daily view: Market is coiling — the next D1 close decides the week.

H4 — Pressure Building Inside a Tight Box

H4 is in a compression pocket 4060–4090.

H4 Supply

4135–4165 → Nearest premium selling.

4210–4240 → Heavy distribution cap.

4320–4350 → Deep premium reversal zone.

H4 Demand

4020–3990 → Nearest support.

3935–3905 → Continuation demand.

3840–3810 → Major accumulation.

H4 Scenarios

Bullish: Reclaim 4090 → 4135–4165 → 4210–4240.

Bearish: Lose 4020 → 3990 → 3935–3905.

H4 view: Expect a violent expansion once it escapes the box.

H1 — Liquidity Games Underway

Bias: Neutral–Bullish, liquidity-driven.

4140 = weak high, perfect sweep candidate.

EMAs flat → compression.

RSI mid-50s → room on upside if impulse forms.

H1 Supply

4170–4185 → Extreme premium reversal.

4118–4135 → Weak high liquidity.

4088–4100 → Breaker supply.

H1 Demand

4025–4040 → Key intraday floor.

3988–4005 → Deep H1/H4 confluence.

4055–4065 → Micro accumulation.

H1 Pivot: 4075–4085

Above → bullish continuation.

Below → bearish intraday flow.

Intraday Scenarios

Bullish Liquidity Sweep:

Reclaim 4085 → aim for: 4110 → 4135/40 → 4170/85.

Bearish Retrace:

Reject 4135–4140 → drop toward 4075 → 4053 → 4025–4005.

💡 THE REAL TAKEAWAY — MASTER SUMMARY

📌 Gold is coiled inside multi-timeframe compression.

All major biases depend on a breakout from 4055–4115 (D1) and 4060–4090 (H4).

Upside Bias:

Only valid above 4120 (D1) / 4090 (H4) → targets 4135 → 4170 → 4210+.

Downside Bias:

Confirmed only below 4020 (H4) / 3980 (D1) → targets 3900 → 3830.

Intraday Edge:

Expect a sweep of 4140 before any decisive move.

Most probable play:

↗️ Sweep 4140 → fade

or

↘️ Dip into 4050–4020 → reload upward.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.