Gold recorded its largest weekly gain this week, with a cumulative increase of more than $300 since its opening, making it the strongest week of growth during the nine consecutive weekly gains. If the current upward trend continues, gold prices are expected to hit the $4,400 mark. It is expected that the upward trend may slow down on Friday and the price may stabilize within $4,400.

The main drivers of this round of strong gold price rise include rising geopolitical risks and increased risk aversion in the market. The latest retail sales data released by the United States fell short of expectations, further strengthening market expectations that the Federal Reserve may adopt a more aggressive interest rate cut policy. At the same time, geopolitical tensions in the Middle East have escalated significantly, greatly driving the inflow of safe-haven funds into the gold market. Supported by multiple favorable fundamentals, the impact of technical factors has been relatively weakened, the overall market is still dominated by bulls, and bullish sentiment continues to strengthen.

In terms of trading strategy, I had already clearly expressed my bullish view when the gold price was below $4,000, and continued to hold medium- and long-term long positions. For medium- and long-term holdings, the impact of short-term fluctuations is limited, and you can hold on firmly as long as the overall trend remains upward. Recent short-term operations have also adhered to the strategy of buying on dips, achieving relatively impressive returns.

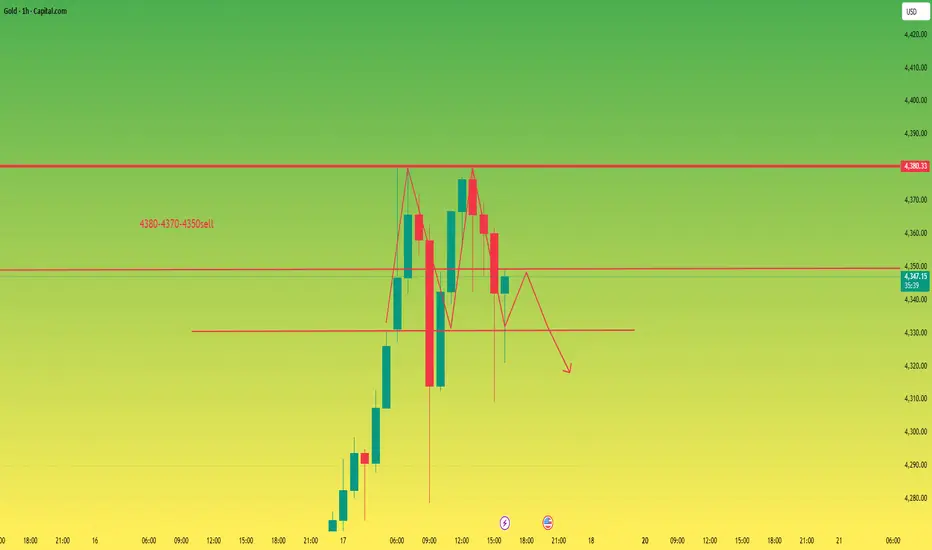

Given that the current gold price continues to rise, some investors may be trapped. Under the overall operating tone of mainly going long, in order to help investors who have difficulty holding positions to reasonably deal with market risks, a counter-trend short position strategy is now provided as a reference: short positions can consider entering the market in the 4370 to 4350 area, and pay attention to the 4330 support level below; if this position is lost, the gold price may further pull back.

The above strategy is my personal opinion and is for reference only. If you haven't yet established an effective profit-making system, please continue to follow my channel. I will regularly share gold trading strategies for your reference. If you agree with the strategy logic, you can copy and implement them to improve your investment performance.

The main drivers of this round of strong gold price rise include rising geopolitical risks and increased risk aversion in the market. The latest retail sales data released by the United States fell short of expectations, further strengthening market expectations that the Federal Reserve may adopt a more aggressive interest rate cut policy. At the same time, geopolitical tensions in the Middle East have escalated significantly, greatly driving the inflow of safe-haven funds into the gold market. Supported by multiple favorable fundamentals, the impact of technical factors has been relatively weakened, the overall market is still dominated by bulls, and bullish sentiment continues to strengthen.

In terms of trading strategy, I had already clearly expressed my bullish view when the gold price was below $4,000, and continued to hold medium- and long-term long positions. For medium- and long-term holdings, the impact of short-term fluctuations is limited, and you can hold on firmly as long as the overall trend remains upward. Recent short-term operations have also adhered to the strategy of buying on dips, achieving relatively impressive returns.

Given that the current gold price continues to rise, some investors may be trapped. Under the overall operating tone of mainly going long, in order to help investors who have difficulty holding positions to reasonably deal with market risks, a counter-trend short position strategy is now provided as a reference: short positions can consider entering the market in the 4370 to 4350 area, and pay attention to the 4330 support level below; if this position is lost, the gold price may further pull back.

The above strategy is my personal opinion and is for reference only. If you haven't yet established an effective profit-making system, please continue to follow my channel. I will regularly share gold trading strategies for your reference. If you agree with the strategy logic, you can copy and implement them to improve your investment performance.

Trade active

Gold pullback is in line with the idea of shorting, and the next focus is on the 4330 support! If it breaks down, there will be further correction!Trade closed: target reached

Gold’s deep correction is in line with the strategy expectations!Patience is the hidden weapon of top traders.🚀

🥇Free Strategy Guidance Channel🥇

t.me/Martin80808

🥇Free Strategy Guidance Channel🥇

t.me/Martin80808

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Patience is the hidden weapon of top traders.🚀

🥇Free Strategy Guidance Channel🥇

t.me/Martin80808

🥇Free Strategy Guidance Channel🥇

t.me/Martin80808

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.