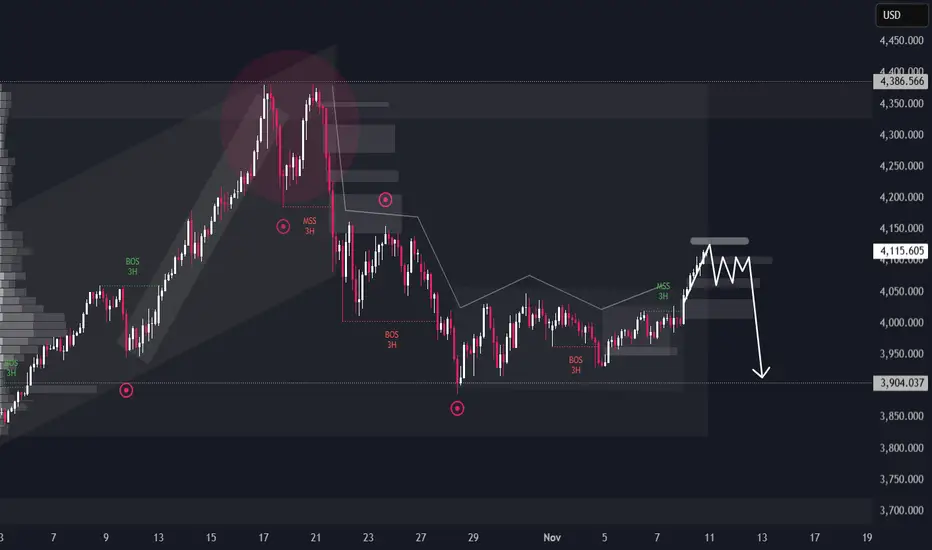

Gold is showing signs of exhaustion after the recent corrective bounce. The 3H market structure highlights a clear distribution pattern, as price continues to reject from the 4,135–4,250 supply zone. Repeated Break of Structure (BOS) signals that bearish momentum remains dominant.

Institutional activity suggests that liquidity is being built above local highs, preparing for another downside leg. The current market sentiment stays bearish as long as price trades below the key premium area. A confirmed rejection from this zone could trigger a decline toward the 3,904 liquidity pool.

Only a breakout and hold above 4,250 would invalidate this scenario and shift bias back to bullish accumulation.

Institutional activity suggests that liquidity is being built above local highs, preparing for another downside leg. The current market sentiment stays bearish as long as price trades below the key premium area. A confirmed rejection from this zone could trigger a decline toward the 3,904 liquidity pool.

Only a breakout and hold above 4,250 would invalidate this scenario and shift bias back to bullish accumulation.

(Services:✔️ JOIN Telegram channel

t.me/+fI0WyqjCgiEyN2Zk

Gold trading signals 🚀 99%

t.me/+fI0WyqjCgiEyN2Zk

t.me/+fI0WyqjCgiEyN2Zk

Gold trading signals 🚀 99%

t.me/+fI0WyqjCgiEyN2Zk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

(Services:✔️ JOIN Telegram channel

t.me/+fI0WyqjCgiEyN2Zk

Gold trading signals 🚀 99%

t.me/+fI0WyqjCgiEyN2Zk

t.me/+fI0WyqjCgiEyN2Zk

Gold trading signals 🚀 99%

t.me/+fI0WyqjCgiEyN2Zk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.