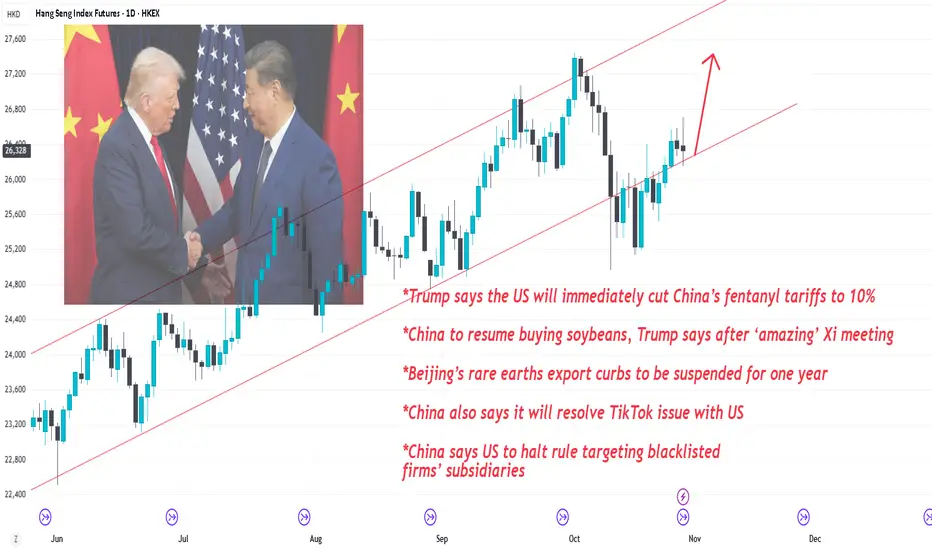

After months of pressure, Chinese equities finally got what they needed: a visible political thaw. The Trump–Xi meeting in Busan marked the first broad trade reset in over two years — with both sides agreeing to suspend or reduce tariffs, reopen commodity flows, and relax export controls on rare earths and semiconductors.

The headline changes are not symbolic. China will halt rare-earth export curbs for one year, the U.S. cuts fentanyl-related tariffs to 10%, and both countries resume agricultural and energy trade — including soybean and oil deals. Beijing also promised to work with Washington on resolving the TikTok issue, while the U.S. temporarily suspends its “50% rule” that targeted Chinese subsidiaries of blacklisted firms.

This combination sends a clear signal: geopolitical pressure is easing, at least for now. The Hang Seng Index has already broken back above the mid-channel trend line, and momentum is building toward the upper resistance zone around 27 000. If the truce holds and follow-through buying continues, a retest of 28 000–29 000 by year-end looks possible.

From a valuation standpoint, Chinese equities remain among the most discounted major markets globally. Industrial, tech-hardware and materials companies trade at forward P/E ratios between 7–10, compared with 20+ for U.S. peers. If rare-earth exports resume and TikTok’s uncertainty is lifted, capital inflows into mainland-linked ETFs could accelerate.

The opportunity lies in the asymmetry: sentiment is still fragile, yet fundamentals are improving. A stable policy backdrop plus renewed U.S. demand for energy and agri-products could set up Chinese indices for an extended relief rally — potentially the strongest since early 2023.

Key levels to watch:

• Hang Seng Index support – 26 000

• Resistance zone – 27 500–28 000

• Break above 28 000 → trend confirmation and rotation toward Chinese cyclicals

Trade logic:

Short-term traders can target a breakout continuation within the rising channel, while longer-term investors may look at selective exposure to resource, industrial and tech-infrastructure names poised to benefit from normalized U.S.–China flows.

If this détente lasts longer than a “subscription diplomacy” cycle, China might be setting up not for a dead-cat bounce — but for the next real rotation story.

The headline changes are not symbolic. China will halt rare-earth export curbs for one year, the U.S. cuts fentanyl-related tariffs to 10%, and both countries resume agricultural and energy trade — including soybean and oil deals. Beijing also promised to work with Washington on resolving the TikTok issue, while the U.S. temporarily suspends its “50% rule” that targeted Chinese subsidiaries of blacklisted firms.

This combination sends a clear signal: geopolitical pressure is easing, at least for now. The Hang Seng Index has already broken back above the mid-channel trend line, and momentum is building toward the upper resistance zone around 27 000. If the truce holds and follow-through buying continues, a retest of 28 000–29 000 by year-end looks possible.

From a valuation standpoint, Chinese equities remain among the most discounted major markets globally. Industrial, tech-hardware and materials companies trade at forward P/E ratios between 7–10, compared with 20+ for U.S. peers. If rare-earth exports resume and TikTok’s uncertainty is lifted, capital inflows into mainland-linked ETFs could accelerate.

The opportunity lies in the asymmetry: sentiment is still fragile, yet fundamentals are improving. A stable policy backdrop plus renewed U.S. demand for energy and agri-products could set up Chinese indices for an extended relief rally — potentially the strongest since early 2023.

Key levels to watch:

• Hang Seng Index support – 26 000

• Resistance zone – 27 500–28 000

• Break above 28 000 → trend confirmation and rotation toward Chinese cyclicals

Trade logic:

Short-term traders can target a breakout continuation within the rising channel, while longer-term investors may look at selective exposure to resource, industrial and tech-infrastructure names poised to benefit from normalized U.S.–China flows.

If this détente lasts longer than a “subscription diplomacy” cycle, China might be setting up not for a dead-cat bounce — but for the next real rotation story.

By CrazyTrader

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

By CrazyTrader

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.