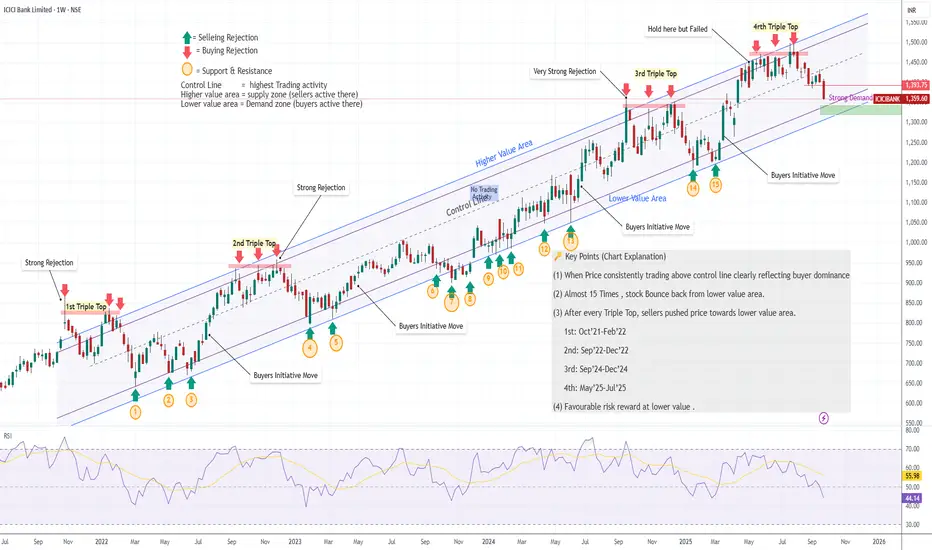

ICICI Bank has been trading inside a long-term uptrend channel for the past 3 years. Within this structure, two clear zones are visible:

Higher Value Area (Supply Zone): Sellers dominate → price faces rejection here.

Lower Value Area (Demand Zone): Buyers dominate → price consistently bounces from here.

👉 Every time price approaches the Lower Value Area around 15 times :

(1) Buyers step in aggressively,

(2) Price reverses strongly,

(3) Risk–Reward becomes highly favorable.

(4) This makes the current setup a good accumulation point.

Now once again, price is testing the Strong Demand Zone (₹1340–1320).

Risk–Reward Setup

Buy Zone: ₹1340–1320

Immediate Resistance: ₹1390–1400

Upside Target: ₹1500–1550 (upper channel boundary)

Risk: Breakdown below ₹1320 may lead to ₹1200.

Fundamental Strength

✔️ Healthy Balance Sheet: Strong capital adequacy, well-managed NPAs.

✔️ Consistent Profit Growth: Strong momentum in NII & PAT over the years.

✔️ Retail & Digital Leadership: Leading share in retail loans + strong digital adoption.

✔️ Sector Tailwind: Indian banking credit growth projected at 14–16%, a positive for ICICI.

✔️ Valuation Comfort: Reasonable PE & PB compared to peers (HDFC Bank, Axis Bank).

Higher Value Area (Supply Zone): Sellers dominate → price faces rejection here.

Lower Value Area (Demand Zone): Buyers dominate → price consistently bounces from here.

👉 Every time price approaches the Lower Value Area around 15 times :

(1) Buyers step in aggressively,

(2) Price reverses strongly,

(3) Risk–Reward becomes highly favorable.

(4) This makes the current setup a good accumulation point.

Now once again, price is testing the Strong Demand Zone (₹1340–1320).

Risk–Reward Setup

Buy Zone: ₹1340–1320

Immediate Resistance: ₹1390–1400

Upside Target: ₹1500–1550 (upper channel boundary)

Risk: Breakdown below ₹1320 may lead to ₹1200.

Fundamental Strength

✔️ Healthy Balance Sheet: Strong capital adequacy, well-managed NPAs.

✔️ Consistent Profit Growth: Strong momentum in NII & PAT over the years.

✔️ Retail & Digital Leadership: Leading share in retail loans + strong digital adoption.

✔️ Sector Tailwind: Indian banking credit growth projected at 14–16%, a positive for ICICI.

✔️ Valuation Comfort: Reasonable PE & PB compared to peers (HDFC Bank, Axis Bank).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.