## ideaForge Technology Ltd (IDEAFORGE) Price Analysis

**Current Price and Recent Performance**

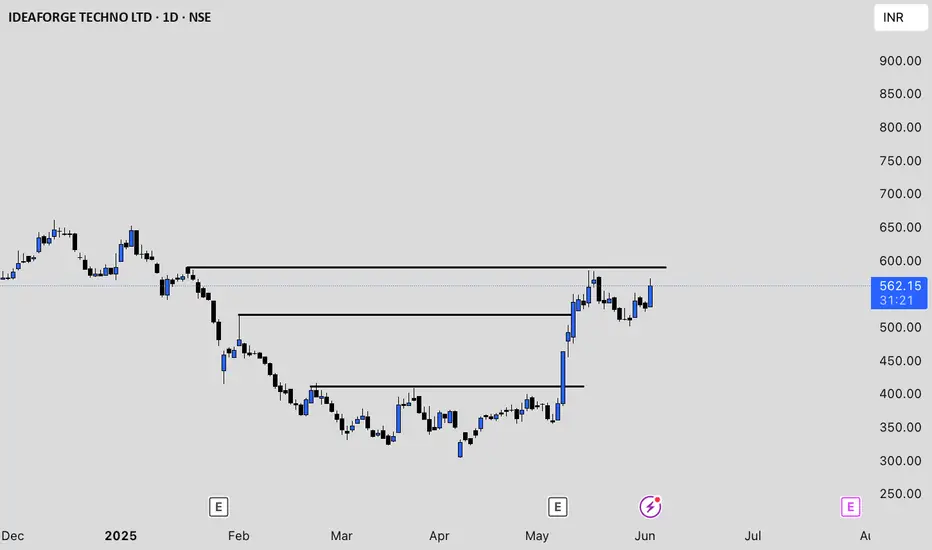

As of June 3, 2025, ideaForge Technology Ltd (IDEAFORGE) is trading at approximately ₹529 on the NSE[7]. The stock has experienced significant volatility in recent months, with a 52-week high of ₹864 and a low of ₹301[2]. Over the past few weeks, the price has rebounded sharply from the ₹360–₹400 range in early May to above ₹520 by the end of May, indicating strong recent momentum[4].

**Valuation and Financials**

- Market capitalization stands at about ₹2,413 crore[2].

- The stock is trading at roughly 3.9 times its book value, which is considered high for its sector[2].

- Return on capital employed (ROCE) is negative at -9.36%, and return on equity (ROE) is also negative at -9.81% for the latest period, reflecting operational challenges or recent losses[2].

- The company is almost debt-free, which is a positive factor for financial stability[2].

- No dividends have been declared, and the company’s interest coverage ratio is low, suggesting limited ability to cover interest expenses from profits[2].

**Operational Highlights and Risks**

- ideaForge operates in the unmanned aircraft systems (UAS) segment, a high-growth and innovative sector[2].

- Promoter holding is relatively low at 29.2%, which may affect investor confidence[2].

- The company’s debtor days and working capital days have increased significantly, indicating potential challenges in cash flow management[2].

- Over the last three years, ROE has averaged just 0.86%, highlighting weak profitability[2].

**Recent Price Action**

- After a sharp rally from ₹360 in early May to over ₹530 by the end of the month, the stock has stabilized in the ₹528–₹559 range in early June[4].

- Trading volumes have been high during this period, suggesting increased investor interest and possible speculative activity[4].

**Summary**

ideaForge Technology Ltd has shown strong recent price momentum but faces fundamental challenges, including negative returns, high valuation relative to book value, and growing working capital requirements. The company’s debt-free status and position in a high-potential industry are positives, but weak profitability and low promoter holding are key risks. Investors should monitor operational improvements and cash flow management before considering long-term positions[2][4][7].

**Current Price and Recent Performance**

As of June 3, 2025, ideaForge Technology Ltd (IDEAFORGE) is trading at approximately ₹529 on the NSE[7]. The stock has experienced significant volatility in recent months, with a 52-week high of ₹864 and a low of ₹301[2]. Over the past few weeks, the price has rebounded sharply from the ₹360–₹400 range in early May to above ₹520 by the end of May, indicating strong recent momentum[4].

**Valuation and Financials**

- Market capitalization stands at about ₹2,413 crore[2].

- The stock is trading at roughly 3.9 times its book value, which is considered high for its sector[2].

- Return on capital employed (ROCE) is negative at -9.36%, and return on equity (ROE) is also negative at -9.81% for the latest period, reflecting operational challenges or recent losses[2].

- The company is almost debt-free, which is a positive factor for financial stability[2].

- No dividends have been declared, and the company’s interest coverage ratio is low, suggesting limited ability to cover interest expenses from profits[2].

**Operational Highlights and Risks**

- ideaForge operates in the unmanned aircraft systems (UAS) segment, a high-growth and innovative sector[2].

- Promoter holding is relatively low at 29.2%, which may affect investor confidence[2].

- The company’s debtor days and working capital days have increased significantly, indicating potential challenges in cash flow management[2].

- Over the last three years, ROE has averaged just 0.86%, highlighting weak profitability[2].

**Recent Price Action**

- After a sharp rally from ₹360 in early May to over ₹530 by the end of the month, the stock has stabilized in the ₹528–₹559 range in early June[4].

- Trading volumes have been high during this period, suggesting increased investor interest and possible speculative activity[4].

**Summary**

ideaForge Technology Ltd has shown strong recent price momentum but faces fundamental challenges, including negative returns, high valuation relative to book value, and growing working capital requirements. The company’s debt-free status and position in a high-potential industry are positives, but weak profitability and low promoter holding are key risks. Investors should monitor operational improvements and cash flow management before considering long-term positions[2][4][7].

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.