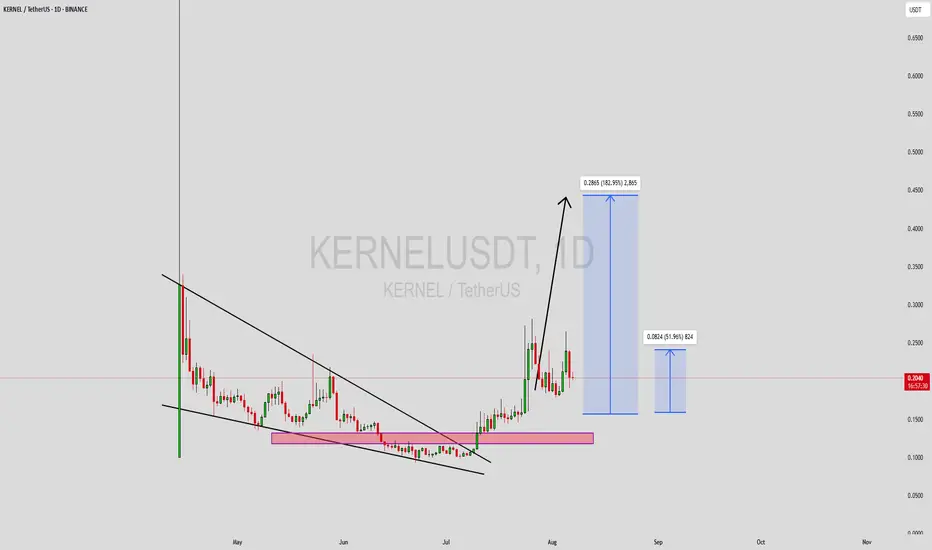

KERNELUSDT is shaping up as a strong breakout candidate, currently trading within a well-defined falling wedge pattern. This technical formation often marks the end of a downtrend and suggests a bullish reversal is near. As the price compresses and approaches the apex of the wedge, we typically see an increase in bullish momentum. In KERNEL's case, the volume is holding steady at promising levels, indicating growing interest and potential accumulation by savvy investors ahead of a breakout.

The falling wedge pattern is widely respected among technical analysts due to its historically high success rate when paired with rising volume and market optimism. KERNELUSDT is offering exactly that setup. With a projected gain of 140% to 150% from the current levels, this crypto pair is attracting traders who are hunting for high-upside opportunities in a consolidating market. Breakouts from such patterns are often sharp and fast, which makes proper timing crucial for maximizing gains.

Market sentiment around the KERNEL project is also improving, with increasing chatter across social platforms and trading communities. This aligns well with the technical structure on the chart and adds further weight to the bullish case. If KERNEL can break above the wedge resistance with volume confirmation, it could quickly surge into price discovery zones not seen in recent weeks.

With all indicators aligning and price tightening within the wedge, KERNELUSDT deserves close attention from technical traders. A well-timed entry here could result in substantial upside if the breakout plays out as expected.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

The falling wedge pattern is widely respected among technical analysts due to its historically high success rate when paired with rising volume and market optimism. KERNELUSDT is offering exactly that setup. With a projected gain of 140% to 150% from the current levels, this crypto pair is attracting traders who are hunting for high-upside opportunities in a consolidating market. Breakouts from such patterns are often sharp and fast, which makes proper timing crucial for maximizing gains.

Market sentiment around the KERNEL project is also improving, with increasing chatter across social platforms and trading communities. This aligns well with the technical structure on the chart and adds further weight to the bullish case. If KERNEL can break above the wedge resistance with volume confirmation, it could quickly surge into price discovery zones not seen in recent weeks.

With all indicators aligning and price tightening within the wedge, KERNELUSDT deserves close attention from technical traders. A well-timed entry here could result in substantial upside if the breakout plays out as expected.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

🟢🟢🟢Join Our Telegram Here to Get Trades With Entry And Exit 🟢🟢🟢

cryptotelegram.bio.link/

🟢🟢🟢

cryptotelegram.bio.link/

🟢🟢🟢

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🟢🟢🟢Join Our Telegram Here to Get Trades With Entry And Exit 🟢🟢🟢

cryptotelegram.bio.link/

🟢🟢🟢

cryptotelegram.bio.link/

🟢🟢🟢

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.