Demand Zones – Ideal for Long-Term Investors

Demand zones are crucial areas where buying interest is strong, often due to institutional or big investor activity. Mazagon Dock has two well-marked demand zones:

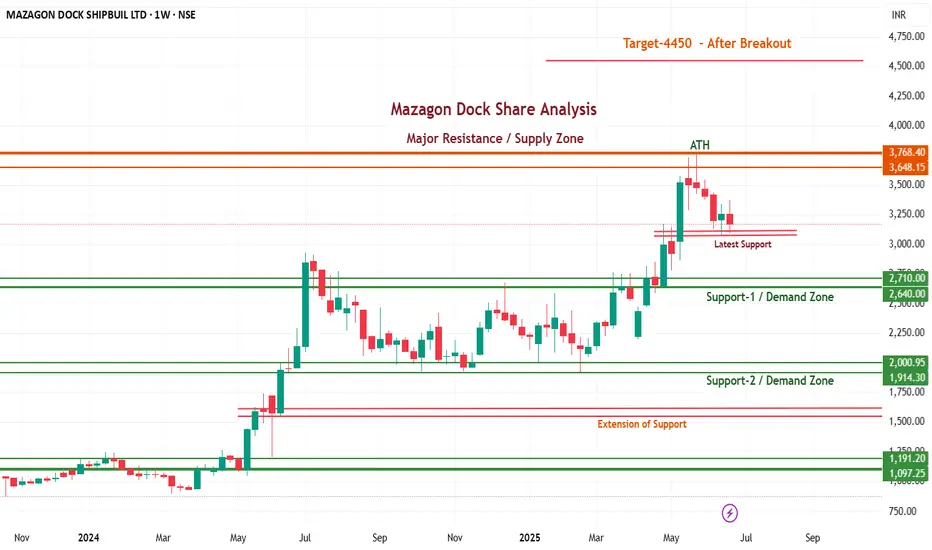

Support-1 / Demand Zone: ₹2,640 – ₹2,710

Support-2 / Demand Zone: ₹1,914 – ₹2,000

Strategy: Long-term investors should look to accumulate or add quantity near these zones, especially if the stock sees a pullback. Historically, the price has shown strong reversal signals from these areas.

Latest Support – Swing Traders’ Focus

Current Swing Support: Around ₹3,100

This zone is crucial for swing traders. If the price holds this level and forms a bullish candle pattern, short-term upward movement may follow. However, a breakdown could lead to testing lower demand zones.

Supply Zone – Major Resistance for Breakout

Major Supply Zone: ₹3,648 – ₹3,768 (also near ATH – All-Time High)

This zone is where profit booking usually happens. Big investors often exit partial holdings near this level, awaiting a strong breakout confirmation. A successful breakout above ₹3,768 can initiate a move toward the next target of ₹4,450.

Extension of Support – Trap or Opportunity?

Levels: ₹1,400 – ₹1,500

In many cases, stocks break demand zones and trap retailers in a false breakdown. This zone is often used by smart money to accumulate quietly. A bounce from this level is a possible re-entry opportunity post-fake breakdown.

What’s the News?

Mazagon Dock has acquired a controlling stake in Colombo Dockyard (Sri Lanka) for ₹452 crore. This marks the company’s first major international acquisition, opening doors for cross-border defense and commercial shipbuilding collaboration.

Mazagon Dock’s strong technical structure and strategic international acquisition position it as a powerful stock for both investors and swing traders.

Stay Ahead in the Market!

If you found this analysis helpful, don’t forget to like, comment, and follow for more such chart updates.

Want regular updates on support/resistance zones, breakouts, and swing trading setups? Save this chart and turn on notifications.- Gift a TradingView Subscription

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.