Disaster Puts & Nasdaq: Why Hedging Tech Risk is Back in Focus?

Periods of calm in financial markets often mask the risks that lie beneath. With the Nasdaq 100 trading at elevated valuations and implied volatilities back at subdued levels, the cost of buying protection has rarely looked cheaper.

That sets the stage for a discussion around “disaster puts,” those deep out-of-the-money (OTM) put options designed to protect against sudden and severe drawdowns. These hedges, which would otherwise appear unnecessary, become relevant in cases where history repeats itself, reminding investors of how quickly corrections can turn into crashes.

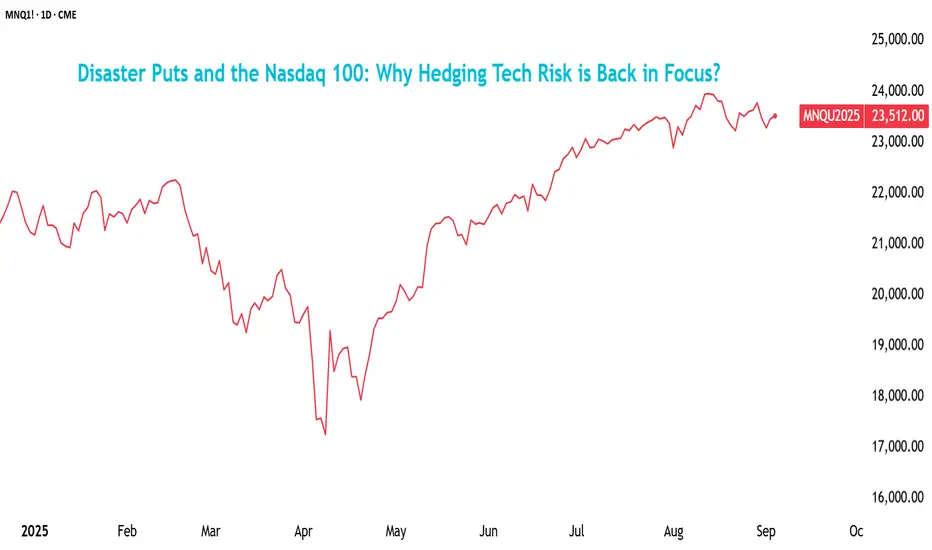

The Nasdaq 100 has surged nearly 40% since its April bottom, powered by the Magnificent 7 rally (+50%). But options traders aren’t buying the calm; they’re piling into disaster puts on QQQ (an ETF tracking the index), driving the 2-month 10-delta to 25-delta put volatility ratio to a three-year high.

Source: Bloomberg

Put skew simply measures how expensive deep OTM crash protection is compared to nearer-the-money downside hedges. Here, a 10-delta put is a very low-probability and a deep OTM option—essentially as insurance against a rare and severe plunge. The 25-delta put is much closer to the current price and represents more standard protection.

The ratio rising toward 1.8x means those deep crash hedges are nearly 80% more expensive than regular downside hedges. Normally, these “disaster puts” always cost more, but the increasing gap shows investors are paying up for tail-risk protection, worried about another sudden April-style selloff rather than just a typical 5–10% correction.

So while the elevated put skew underscores crash hedging demand, it’s only part of the story. To see how the market is weighing downside protection against upside chase in general, we can look at the call/put skew:

Source: CME QuikStrike

Nasdaq 100 (NQ) 10-delta skew also shows deep OTM puts trading at a heavy premium to upside calls. Elevated put skew reflects persistent demand for crash protection, while negative call skew signals little appetite for chasing extreme rallies.

Though not as extreme in magnitude, the preference of calls over puts is clearly reflected in the same chart on the 25-delta skew:

Source: CME QuikStrike

Bearish Tilt in ETF and Futures Positioning

As of 02/Sept, options OI for NQ across all expiries is decisively bearish, with the put-call ratio being 1.45 overall:

Source: CME QuikStrike

Among all expiries through to the end of the year, it is the one expiring on 19/Sept that has the highest OI, followed by the 19/Dec and 17/Oct expiries. The October expiry has the most bearish OI outlook, with a PCR of 1.89.

This QuikStrike table below tracks daily open interest changes for the weekly Nasdaq-100 (NQ) options contract expiring Friday, September 5th.

Source: CME QuikStrike

The build-up of put positions over the past session stands out. On 29/Aug, 90 puts were added for the 23,300 strike; 133 puts were added for the 23,175 strike; and 84 puts were added for the 22,900 strike—a 2.3% decline from the current price.

Source: CME QuikStrike

Going even further deep OTM, we see that strikes as low as 20,950 have also garnered put interest recently:

The additions of 44 puts for that, along with the high concentration of puts above the 22,500 strike, reinforce the hedging demand build-up for the index.

Having said that, near-the-money calls have also seen some interest, with the call interest falling dramatically above the 24,000 strike.

Taken together, the recent OI change mirrors the broader skew dynamics, where investors are paying for tail protection, but there also remains a pocket of bullish positioning near-the-money, reflecting both optimism in the rally’s resilience and nervousness about another outsized swing.

The chart below shows the Commitment of Traders (CoT) report for the Micro Nasdaq 100 (MNQ) contract:

Source: CME QuikStrike

This reflects that retail investors (non-reportable) have already taken note: the positioning has flipped decisively net short starting in July. As of August 26, retail traders held 36,507 longs versus 55,534 shorts, leaving them net short by about 19,000 contracts. This marks a sharp contrast to June, when retail had a strong net long bias.

Source: CME QuikStrike

However, CoT data for asset managers and hedge funds (leveraged) shows that speculators here are still leaning net long. While the latter did add a lot of short positions, it was a 21% week-on-week decline as against the 30% increase in their long positions.

History’s Warning: Valuations and Vulnerability

This renewed appetite for disaster insurance reflects a deeper truth: the Nasdaq 100 has never been a gentle market to own when sentiment turns. Its tech-heavy composition leaves it more exposed than the S&P 500 when valuations come under pressure. Four episodes stand out.

The dot-com bust from March 2000 to October 2002 remains the starkest example. The Nasdaq 100 collapsed by nearly 80%, compared with a 45% decline for the S&P 500. An era of speculative IPOs and unprofitable startups had inflated expectations well beyond what fundamentals could support. When capital dried up, the selling pressure was relentless, and the recovery took more than a decade.

A similar concern about high capex for firms pivoting around AI and their corresponding high valuations worries those who are averse to a call back to post-Y2K events.

A July 2025 report from MIT highlights that 95% of companies investing in GenAI have yet to see financial returns, while Ted Mortonson of Baird flags sky-high valuations in AI stocks with scant earnings as reminiscent of past excess.

The firms are priced to perfection; expectations so high that they are valued with the assumption that everything will go right. In these cases, even a small disappointment can cause the stock to fall sharply because expectations are already maxed out.

OpenAI CEO Sam Altman also cautioned last month that investors are possibly “overexcited,” while Apollo’s Torsten Slok noted that the top-tier S&P names today may be more overvalued than during the 1999 tech apex.

Source: Apollo Academy

The top-10 for both—the S&P 500 and the Nasdaq-100—constitutes the same names, with Berkshire Hathaway replacing Netflix in the former index. Though the chart above pertains to the S&P 500, the situation looks meeker for the Nasdaq 100.

The 2022 bear market brought the focus back to valuations and rates. As the Federal Reserve hiked aggressively to contain inflation, the S&P 500 slipped about 25%. The Nasdaq 100, with its sensitivity to discount rates and long-duration earnings, fell closer to 35%. This reinforced the dot-com lesson: when the cost of capital rises, growth stocks are punished most severely.

Hedging in a Calm Market

Today, the volatility markets tell an interesting story. The Cboe Nasdaq-100 Volatility Index (VXN) shows option premiums to be at near-yearly lows.

Overall, option premiums are subdued, making standard hedges unusually cheap. Tying it back to the disaster puts, the relative cost of crash protection has still spiked with investors crowding into deep OTM puts. In other words, plain insurance is inexpensive, but extreme insurance is at a premium.

Having said that, net ETF flows into QQQ also continue to indicate that investors remain confident in tech, even as concentration risk rises. In August, the inflows netted over $1.8 billion. Assets under management (AUM) have also reached an all-time high, having recovered after the slump in April.

All of this, and especially the subdued IVs, means that hedging is now cheaper; it is also more urgent, given how quickly positioning can flip.

And while protection is unusually inexpensive now, this isn’t as much about predicting the next crash via disaster puts, but more about taking advantage of the market’s calm to lock in cost-efficient insurance. Just as homeowners don’t buy fire insurance because they expect a blaze tomorrow, prudent investors can use puts to guard against shocks.

CME’s weekly Micro E-mini Nasdaq-100 options (and Micro E-mini S&P 500 options) offer a flexible way to manage near-term risks, with contract sizes one-tenth the notional of standard E-minis.

These options allow hedgers to size positions precisely, hedge around specific events like Fed meetings, CPI releases, or major earnings weeks, and do so at a fraction of the capital cost. Protection can be rolled week to week, letting investors adjust to changing conditions without tying up excessive premium budgets.

The Micro weeklies strike the middle ground wherein the long-haul protection of disaster puts can be replaced with more agile and affordable coverage, offering “rolling” caution for the kind of shocks that arrive when least expected.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

That sets the stage for a discussion around “disaster puts,” those deep out-of-the-money (OTM) put options designed to protect against sudden and severe drawdowns. These hedges, which would otherwise appear unnecessary, become relevant in cases where history repeats itself, reminding investors of how quickly corrections can turn into crashes.

The Nasdaq 100 has surged nearly 40% since its April bottom, powered by the Magnificent 7 rally (+50%). But options traders aren’t buying the calm; they’re piling into disaster puts on QQQ (an ETF tracking the index), driving the 2-month 10-delta to 25-delta put volatility ratio to a three-year high.

Source: Bloomberg

Put skew simply measures how expensive deep OTM crash protection is compared to nearer-the-money downside hedges. Here, a 10-delta put is a very low-probability and a deep OTM option—essentially as insurance against a rare and severe plunge. The 25-delta put is much closer to the current price and represents more standard protection.

The ratio rising toward 1.8x means those deep crash hedges are nearly 80% more expensive than regular downside hedges. Normally, these “disaster puts” always cost more, but the increasing gap shows investors are paying up for tail-risk protection, worried about another sudden April-style selloff rather than just a typical 5–10% correction.

So while the elevated put skew underscores crash hedging demand, it’s only part of the story. To see how the market is weighing downside protection against upside chase in general, we can look at the call/put skew:

Source: CME QuikStrike

Nasdaq 100 (NQ) 10-delta skew also shows deep OTM puts trading at a heavy premium to upside calls. Elevated put skew reflects persistent demand for crash protection, while negative call skew signals little appetite for chasing extreme rallies.

Though not as extreme in magnitude, the preference of calls over puts is clearly reflected in the same chart on the 25-delta skew:

Source: CME QuikStrike

Bearish Tilt in ETF and Futures Positioning

As of 02/Sept, options OI for NQ across all expiries is decisively bearish, with the put-call ratio being 1.45 overall:

Source: CME QuikStrike

Among all expiries through to the end of the year, it is the one expiring on 19/Sept that has the highest OI, followed by the 19/Dec and 17/Oct expiries. The October expiry has the most bearish OI outlook, with a PCR of 1.89.

This QuikStrike table below tracks daily open interest changes for the weekly Nasdaq-100 (NQ) options contract expiring Friday, September 5th.

Source: CME QuikStrike

The build-up of put positions over the past session stands out. On 29/Aug, 90 puts were added for the 23,300 strike; 133 puts were added for the 23,175 strike; and 84 puts were added for the 22,900 strike—a 2.3% decline from the current price.

Source: CME QuikStrike

Going even further deep OTM, we see that strikes as low as 20,950 have also garnered put interest recently:

The additions of 44 puts for that, along with the high concentration of puts above the 22,500 strike, reinforce the hedging demand build-up for the index.

Having said that, near-the-money calls have also seen some interest, with the call interest falling dramatically above the 24,000 strike.

Taken together, the recent OI change mirrors the broader skew dynamics, where investors are paying for tail protection, but there also remains a pocket of bullish positioning near-the-money, reflecting both optimism in the rally’s resilience and nervousness about another outsized swing.

The chart below shows the Commitment of Traders (CoT) report for the Micro Nasdaq 100 (MNQ) contract:

Source: CME QuikStrike

This reflects that retail investors (non-reportable) have already taken note: the positioning has flipped decisively net short starting in July. As of August 26, retail traders held 36,507 longs versus 55,534 shorts, leaving them net short by about 19,000 contracts. This marks a sharp contrast to June, when retail had a strong net long bias.

Source: CME QuikStrike

However, CoT data for asset managers and hedge funds (leveraged) shows that speculators here are still leaning net long. While the latter did add a lot of short positions, it was a 21% week-on-week decline as against the 30% increase in their long positions.

History’s Warning: Valuations and Vulnerability

This renewed appetite for disaster insurance reflects a deeper truth: the Nasdaq 100 has never been a gentle market to own when sentiment turns. Its tech-heavy composition leaves it more exposed than the S&P 500 when valuations come under pressure. Four episodes stand out.

The dot-com bust from March 2000 to October 2002 remains the starkest example. The Nasdaq 100 collapsed by nearly 80%, compared with a 45% decline for the S&P 500. An era of speculative IPOs and unprofitable startups had inflated expectations well beyond what fundamentals could support. When capital dried up, the selling pressure was relentless, and the recovery took more than a decade.

A similar concern about high capex for firms pivoting around AI and their corresponding high valuations worries those who are averse to a call back to post-Y2K events.

A July 2025 report from MIT highlights that 95% of companies investing in GenAI have yet to see financial returns, while Ted Mortonson of Baird flags sky-high valuations in AI stocks with scant earnings as reminiscent of past excess.

The firms are priced to perfection; expectations so high that they are valued with the assumption that everything will go right. In these cases, even a small disappointment can cause the stock to fall sharply because expectations are already maxed out.

OpenAI CEO Sam Altman also cautioned last month that investors are possibly “overexcited,” while Apollo’s Torsten Slok noted that the top-tier S&P names today may be more overvalued than during the 1999 tech apex.

Source: Apollo Academy

The top-10 for both—the S&P 500 and the Nasdaq-100—constitutes the same names, with Berkshire Hathaway replacing Netflix in the former index. Though the chart above pertains to the S&P 500, the situation looks meeker for the Nasdaq 100.

The 2022 bear market brought the focus back to valuations and rates. As the Federal Reserve hiked aggressively to contain inflation, the S&P 500 slipped about 25%. The Nasdaq 100, with its sensitivity to discount rates and long-duration earnings, fell closer to 35%. This reinforced the dot-com lesson: when the cost of capital rises, growth stocks are punished most severely.

Hedging in a Calm Market

Today, the volatility markets tell an interesting story. The Cboe Nasdaq-100 Volatility Index (VXN) shows option premiums to be at near-yearly lows.

Overall, option premiums are subdued, making standard hedges unusually cheap. Tying it back to the disaster puts, the relative cost of crash protection has still spiked with investors crowding into deep OTM puts. In other words, plain insurance is inexpensive, but extreme insurance is at a premium.

Having said that, net ETF flows into QQQ also continue to indicate that investors remain confident in tech, even as concentration risk rises. In August, the inflows netted over $1.8 billion. Assets under management (AUM) have also reached an all-time high, having recovered after the slump in April.

All of this, and especially the subdued IVs, means that hedging is now cheaper; it is also more urgent, given how quickly positioning can flip.

And while protection is unusually inexpensive now, this isn’t as much about predicting the next crash via disaster puts, but more about taking advantage of the market’s calm to lock in cost-efficient insurance. Just as homeowners don’t buy fire insurance because they expect a blaze tomorrow, prudent investors can use puts to guard against shocks.

CME’s weekly Micro E-mini Nasdaq-100 options (and Micro E-mini S&P 500 options) offer a flexible way to manage near-term risks, with contract sizes one-tenth the notional of standard E-minis.

These options allow hedgers to size positions precisely, hedge around specific events like Fed meetings, CPI releases, or major earnings weeks, and do so at a fraction of the capital cost. Protection can be rolled week to week, letting investors adjust to changing conditions without tying up excessive premium budgets.

The Micro weeklies strike the middle ground wherein the long-haul protection of disaster puts can be replaced with more agile and affordable coverage, offering “rolling” caution for the kind of shocks that arrive when least expected.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Full Disclaimer - linktr.ee/mintfinance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Full Disclaimer - linktr.ee/mintfinance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.