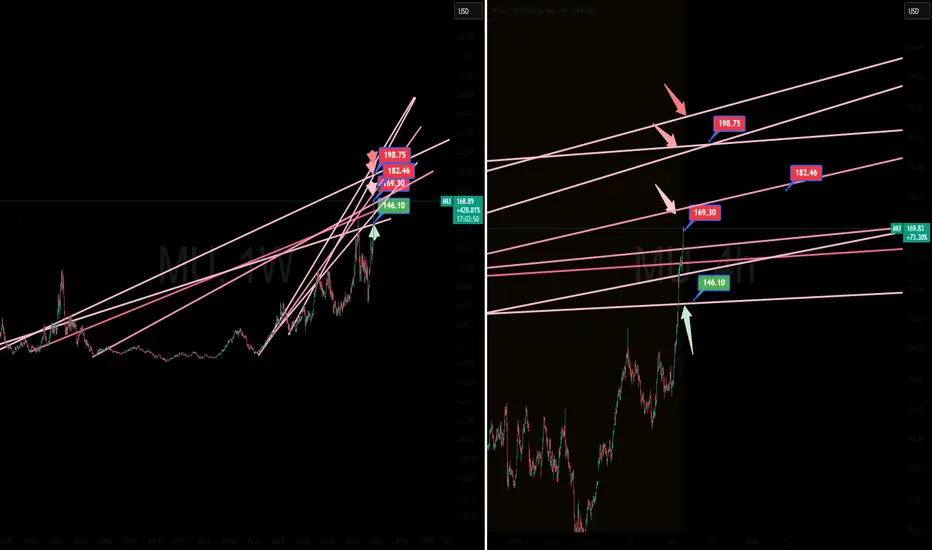

This trade is a strategic short on Micron Technology (MU), grounded in a technical analysis thesis of price rejection at a significant trendline resistance. The core premise is that the strong upward momentum has exhausted itself as the price has encountered a formidable ceiling, signaling an imminent corrective move. The trade is designed to capitalize on the anticipated retracement to a key underlying support level.

The price of MU has been on a strong ascent, but this rally has recently culminated in a critical inflection point. As shown by the red arrow on the chart, the price has failed to convincingly break above a major resistance trendline, which has been respected over a long-term horizon. This rejection is a high-probability bearish signal, indicating a shift in market control from buyers to sellers.

Trade Idea:

Entry Signal: The short position is initiated at the point of rejection, precisely where the red arrow is located.

Exit Strategy: The primary profit target is set at the strong support level, marked by the green support line.

The price of MU has been on a strong ascent, but this rally has recently culminated in a critical inflection point. As shown by the red arrow on the chart, the price has failed to convincingly break above a major resistance trendline, which has been respected over a long-term horizon. This rejection is a high-probability bearish signal, indicating a shift in market control from buyers to sellers.

Trade Idea:

Entry Signal: The short position is initiated at the point of rejection, precisely where the red arrow is located.

Exit Strategy: The primary profit target is set at the strong support level, marked by the green support line.

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.