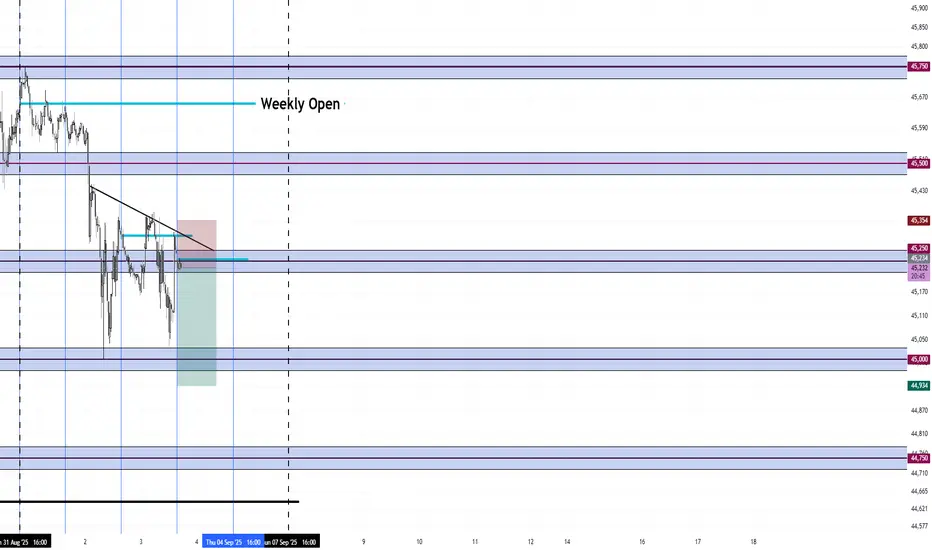

To me, this week is looking like a weekly candle that is going to be a bearish trending cycle.

Sunday, Monday formed the high of the week and immediately sold off. Tuesday and Wednesday was mean reverting around 250 forming a falling wedge consolidation for Thursday/Friday to continue the bearish trend.

I am currently short inside the consolidation.

To me, this wedge consolidation is the middle pause in the trend week and it seems like the goal is to take out August's level.

If bearish trending cycle, then Non Farm Payrolls will be bearish and sell off, closing near the lows.

I am only going for a 2.5 risk to reward. I have been burned too many times swinging for the fences holding on to big trades only to lose money. My system is 2.5 to 1.

Another clue is the consecutive lower openings each day. Sunday opened at the extreme high at 650. Wednesday opened at 320 and now Thursday opened at 250

Sunday, Monday formed the high of the week and immediately sold off. Tuesday and Wednesday was mean reverting around 250 forming a falling wedge consolidation for Thursday/Friday to continue the bearish trend.

I am currently short inside the consolidation.

To me, this wedge consolidation is the middle pause in the trend week and it seems like the goal is to take out August's level.

If bearish trending cycle, then Non Farm Payrolls will be bearish and sell off, closing near the lows.

I am only going for a 2.5 risk to reward. I have been burned too many times swinging for the fences holding on to big trades only to lose money. My system is 2.5 to 1.

Another clue is the consecutive lower openings each day. Sunday opened at the extreme high at 650. Wednesday opened at 320 and now Thursday opened at 250

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.