The Nifty 50 opened with a gap-up of 97.5 points (0.41%) and ended the week at 24,039.35 (0.79%)

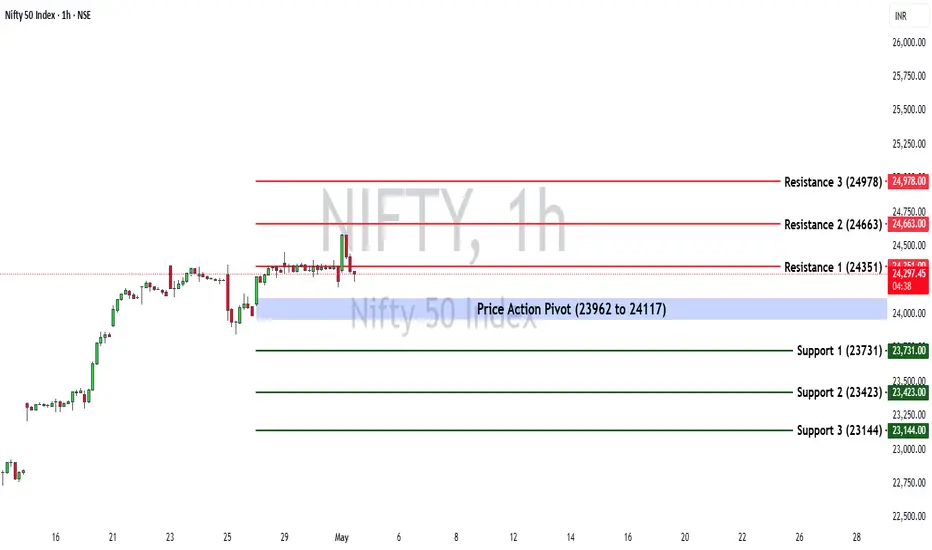

If Nifty sustains below 23,962, selling pressure may increase. However, a move above 24,117 could restore bullish momentum.

Key Levels for the Upcoming Week

🔹 Price Action Pivot Zone:

The crucial range to watch for potential trend reversals or continuation is 23,962-24,117.

🔹 Support & Resistance Levels:

Support:

Resistance:

Market Outlook

✅ Bullish Scenario: A sustained breakout above 24,117 could attract buying momentum, driving Nifty towards R1 (24,663) and beyond.

❌ Bearish Scenario: A drop below 23,962 may trigger selling pressure, pushing Nifty towards S1 (23,731) or lower.

If Nifty sustains below 23,962, selling pressure may increase. However, a move above 24,117 could restore bullish momentum.

Key Levels for the Upcoming Week

🔹 Price Action Pivot Zone:

The crucial range to watch for potential trend reversals or continuation is 23,962-24,117.

🔹 Support & Resistance Levels:

Support:

- S1: 23,731

- S2: 23,423

- S3: 23,144

Resistance:

- R1: 24,351

- R2: 24,663

- R3: 24,978

Market Outlook

✅ Bullish Scenario: A sustained breakout above 24,117 could attract buying momentum, driving Nifty towards R1 (24,663) and beyond.

❌ Bearish Scenario: A drop below 23,962 may trigger selling pressure, pushing Nifty towards S1 (23,731) or lower.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.