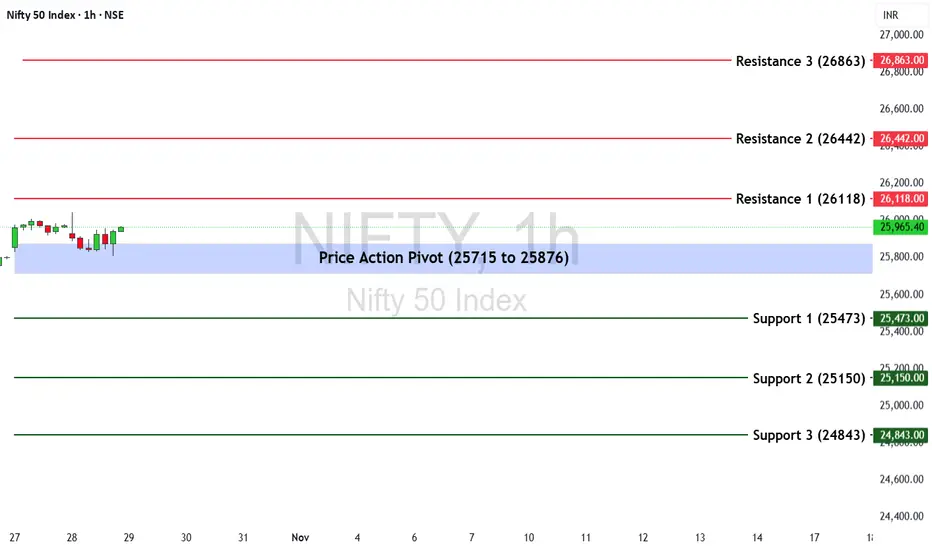

The Nifty 50 Index last week ended at 25,795.15, posting a +0.33% gain. The index continues to consolidate near recent highs, signaling a potential directional move in the upcoming week.

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

25,715 to 25,876 – This blue-shaded zone represents the key decision area. Sustaining above this range may attract fresh buying interest, while a fall below could trigger mild profit booking.

🔻 Support Levels:

S1: 25,473

S2: 25,150

S3: 24,843

🔺 Resistance Levels:

R1: 26,118

R2: 26,442

R3: 26,863

📈 Market Outlook

Bullish Scenario:

If Nifty holds above 25,876, a breakout move could take the index toward R1 (26,118). Sustained strength above this level may open the path to R2 (26,442) and R3 (26,863) in the near term.

Bearish Scenario:

If the index slips below 25,715, short-term weakness could drag it toward S1 (25,473), followed by S2 (25,150) and S3 (24,843).

Disclaimer: aliceblueonline.com/legal-documentation/disclaimer/

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

25,715 to 25,876 – This blue-shaded zone represents the key decision area. Sustaining above this range may attract fresh buying interest, while a fall below could trigger mild profit booking.

🔻 Support Levels:

S1: 25,473

S2: 25,150

S3: 24,843

🔺 Resistance Levels:

R1: 26,118

R2: 26,442

R3: 26,863

📈 Market Outlook

Bullish Scenario:

If Nifty holds above 25,876, a breakout move could take the index toward R1 (26,118). Sustained strength above this level may open the path to R2 (26,442) and R3 (26,863) in the near term.

Bearish Scenario:

If the index slips below 25,715, short-term weakness could drag it toward S1 (25,473), followed by S2 (25,150) and S3 (24,843).

Disclaimer: aliceblueonline.com/legal-documentation/disclaimer/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.