What is Cup & Handle (brief recap) - A cup & handle is a bullish continuation pattern.

It consists of two parts:

1. Cup: a rounding bottom (U‑shaped), where price declines from a peak, finds support, then recovers back toward the earlier high.

2. Handle: after reaching (or nearing) the former high level, the price pulls back a little (a shallow consolidation / retracement) before attempting to break out.

Key characteristics / rules (not all must be perfect, but stronger when these hold):

• The cup depth should not be too deep (ideally less than ~50% retracement of the prior rise)

• The bottom of the cup should be rounded (not a sharp “V”)

• The handle must not retrace too far. Often the retracement is around 30–50% (or less) of the cup’s rise.

• Volume behavior: volume tends to fall (or remain muted) during the formation of the cup and handle, then ramp up (spike) on the breakout above the “neckline” (resistance line at the top of the cup)

• The breakout (close above the neckline) ideally confirms with stronger volume.

• The target (projected move) is often estimated by measuring the vertical distance from the bottom of the cup to the neckline, and projecting that upward from the breakout point.

• The handle should occur in the upper half of the cup (i.e. the pullback should not drop too low)

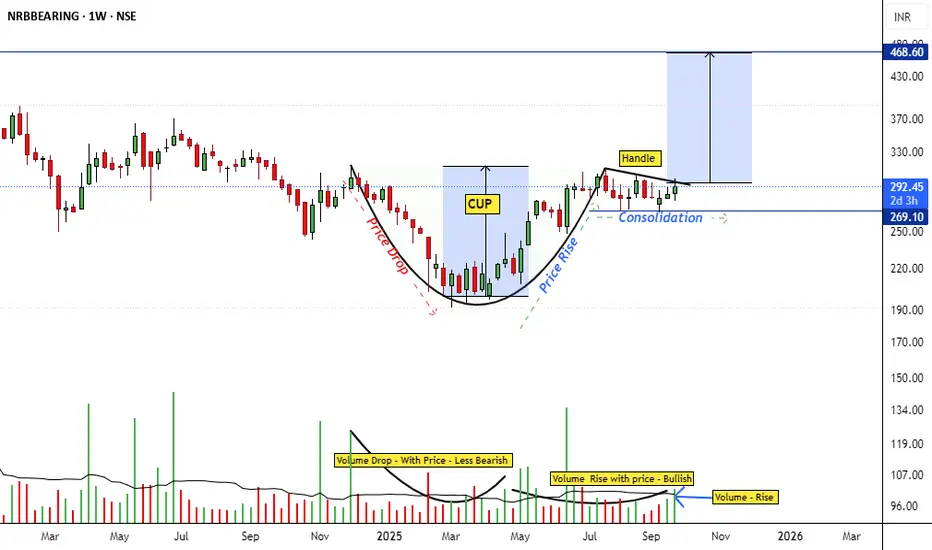

How to Apply / Annotate It on NRB Bearing

Identify the left peak / prior high - Mark the earlier high from which the stock declined to start forming the cup.

Mark the bottom / rounding area - Find the support zone where price found a floor and started to rebound. The base should be somewhat rounded rather than extremely sharp.

Plot the right side of the cup - The rebound should approach (or test) the same resistance (or close to it) as the left peak.

Draw the “neckline” / resistance line - This is typically drawn horizontally (or slightly slanted) at the level of the peak of the left side (or where both sides of the cup top out).

Spot the handle - After the right side nears the neckline, price should pull back somewhat (a smaller retracement) forming the handle. Usually this happens near the upper region of the cup, not down at the bottom.

Volume check - Annotate / highlight volume: should decline during the cup formation, stay lighter during the handle, then pick up strongly when price tries to break out above the neckline.

Confirm the breakout - The pattern becomes more credible when price closes above the neckline, ideally with volume support. You can draw an arrow or flag at the breakout point.

Set target & risk zones - Target (take profit estimate): measure the distance from bottom of the cup to the neckline, then add that to the breakout point for a target.

Stop loss / invalidation point: often placed slightly below the bottom of the handle (or support area in the handle) in case breakout fails.

It consists of two parts:

1. Cup: a rounding bottom (U‑shaped), where price declines from a peak, finds support, then recovers back toward the earlier high.

2. Handle: after reaching (or nearing) the former high level, the price pulls back a little (a shallow consolidation / retracement) before attempting to break out.

Key characteristics / rules (not all must be perfect, but stronger when these hold):

• The cup depth should not be too deep (ideally less than ~50% retracement of the prior rise)

• The bottom of the cup should be rounded (not a sharp “V”)

• The handle must not retrace too far. Often the retracement is around 30–50% (or less) of the cup’s rise.

• Volume behavior: volume tends to fall (or remain muted) during the formation of the cup and handle, then ramp up (spike) on the breakout above the “neckline” (resistance line at the top of the cup)

• The breakout (close above the neckline) ideally confirms with stronger volume.

• The target (projected move) is often estimated by measuring the vertical distance from the bottom of the cup to the neckline, and projecting that upward from the breakout point.

• The handle should occur in the upper half of the cup (i.e. the pullback should not drop too low)

How to Apply / Annotate It on NRB Bearing

Identify the left peak / prior high - Mark the earlier high from which the stock declined to start forming the cup.

Mark the bottom / rounding area - Find the support zone where price found a floor and started to rebound. The base should be somewhat rounded rather than extremely sharp.

Plot the right side of the cup - The rebound should approach (or test) the same resistance (or close to it) as the left peak.

Draw the “neckline” / resistance line - This is typically drawn horizontally (or slightly slanted) at the level of the peak of the left side (or where both sides of the cup top out).

Spot the handle - After the right side nears the neckline, price should pull back somewhat (a smaller retracement) forming the handle. Usually this happens near the upper region of the cup, not down at the bottom.

Volume check - Annotate / highlight volume: should decline during the cup formation, stay lighter during the handle, then pick up strongly when price tries to break out above the neckline.

Confirm the breakout - The pattern becomes more credible when price closes above the neckline, ideally with volume support. You can draw an arrow or flag at the breakout point.

Set target & risk zones - Target (take profit estimate): measure the distance from bottom of the cup to the neckline, then add that to the breakout point for a target.

Stop loss / invalidation point: often placed slightly below the bottom of the handle (or support area in the handle) in case breakout fails.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.